US headline GDP figures for Q1 2019 beat expectations, but inflation readings disappoint

Summary

-

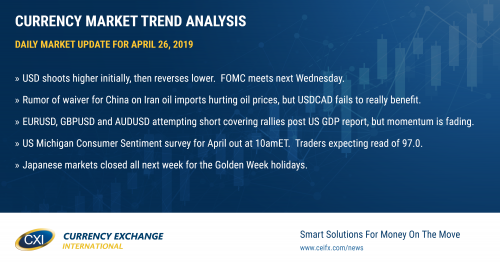

USDCAD: The preliminary look at US GDP for Q1 2019 was just released and the numbers blew away expectations on the headline (+3.2% YoY growth vs +2.3%). However, the inflation components within the report missed expectations (GDP price index +0.6% QoQ vs +1.3%, core Personal Consumption Expenditures +1.3% QoQ vs +1.6%). The USD broadly shot higher in the minutes following the release but has now reversed lower as the weak inflation figures seem to steal the limelight as traders start to think about how the FOMC will respond to this when it meets next Wednesday. June crude oil prices are dumping another 2% lower this morning after dropping 1% into the NYMEX close yesterday, and rumor has it that the US will give China a waiver on Iranian oil imports (Iran exports about half of its oil to China). This combination of mixed US data and bearish oil market news is keeping USDCAD stuck around the high 1.34s as NY trading gets underway today. We think the market may be vulnerable to some profit taking here as the longs have still not gotten their breakout higher above the post Bank of Canada highs at 1.3520. Chart support today comes in at the 1.3440s.

-

EURUSD: Euro/dollar spiked lower to trend-line chart support in the 1.1110s following the release of the US Q1 GDP figures, but has since shot higher as traders appear to dwell on the fact that inflation did not pick up as much as expected. We think we may have now sown the seeds for a short covering rally in EURUSD. Chart resistance today comes in at the 1.1170s, then the 1.1190s-1.1210s.

-

GBPUSD: Sterling spiked lower as well following the headline beat on US GDP, but the market’s brief foray below chart support in the 1.2890s has been completely reversed. We think the GBPUSD market could stage a bit of a rally here should we stay above the 1.2910s and should EURUSD continue higher.

-

AUDUSD: The Aussie is showing the same post US GDP price response as EURUSD and GBPUSD this morning, but with less upside vigor as chart resistance abounds at 0.7050-75. May copper prices are bouncing 0.6% higher this morning, which is supportive. We think AUDUSD might lag any corrective bounces higher in EURUSD and GBPUSD as its chart technicals are a little more negative at this hour.

-

USDJPY: Dollar/yen is following the broader USD’s response to the US Q1 GDP report this morning: higher on the headline, but now lower after everybody gets a good look at the softer than expected inflation readings. Key chart support in the 111.60-80s was regained in overnight trade today, but the failed breakout back above this zone following the GDP report is not making the hourly chart look good in our opinion. The US 10yr bond yield has fallen back down to 2.50% following the release, while the S&P futures still appear focused on the positives out of the report. We think USDJPY likely chops around for the rest of the day. Japanese markets will be closed for all of next week in observance of the extra-long Golden Week holidays this year. Liquidity will be lower than normal during the Asian time zone next week, which is leading some market participants to speculate about potentially erratic moves in the USDJPY market should some players want to take advantage of these market conditions.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

June Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

May Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com