US Durable Goods and Q3 GDP (2nd estimate) surprise to the upside

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

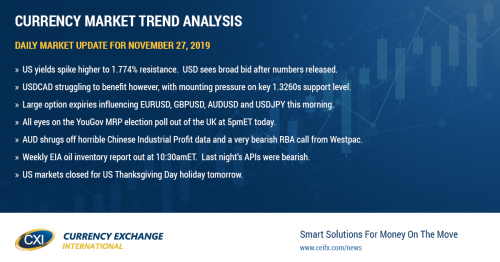

SUMMARY

ANALYSIS

USDCAD

Dollar/CAD began this holiday shortened week with a bid tone after Friday’s strong NY close, and it has kept this upward tone for the most part despite some better than expected Canadian Wholesale Trade data from yesterday. Crude oil prices appear to be the driver so far this week, and it feels like USDCAD might want to re-test 1.3290-1.3300 during NY trade today with the January futures now inching back above $58. The leveraged funds at CME reduced their net short USDCAD position for the 2nd week in a row during the week ending Nov 19th, by covering shorts and adding new longs. While we think USDCAD may fall victim to some consolidation heading into the US Thanksgiving holiday later this week, we think the market’s new uptrend remains intact so long as prices can stay above the 1.3260s.

USDCAD DAILY

USDCAD HOURLY

JAN CRUDE OIL DAILY

EURUSD

Euro/dollar came under pressure to start the week after a lackluster read on German IFO Expectations for November (92.1 vs 95.5 exp) kept traders focused on trend-line support in the 1.1010s. That being said, the market is trying to inch back above this support level now as US 10yr yields continue to back off the 1.78-1.79% resistance they ran into yesterday. We’re reading headlines this morning about a phone call between China’s Liu and the US’ Lighthizer where both negotiators “reached consensus on properly resolving relevant issues” and agreed to stay in contact on the remaining points/core concerns for the phase one trade deal. More here from Bloomberg. Markets don’t seem all that convinced in our opinion, which is why we think US yields continue to back up here. We think the longer EURUSD stays above the 1.1010s support level, the more likely it is we may see some short covering. The funds at CME increased their net short EURUSD position during the week ending Nov 19th by primarily liquidating long positions.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Sterling has fallen victim to some negative developments for the Tories in the election polls since mid-day yesterday. After rallying all the way back up to 1.2910-20 chart resistance early yesterday on the release of the Conservative Party manifesto, we’ve since seen GBPUSD retreat as a number of polls now show the Tory lead slipping over the Labour Party. Today the market appears focused on the latest Kantar poll, which shows the Tories now just 11pts ahead vs 18pts last time around. With the market now falling back below the 1.2870s support level, we think the market might be vulnerable to further weakness here. The funds started re-building their net short GBPUSD position ever so slightly during the week ending Nov 19th, by liquidating longs and adding new shorts.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar successfully held chart support in the 0.6770s to start the week yesterday and the market appears to be getting some more help this morning from the RBA’s Lowe. In a speech before the Annual ABE Dinner, the Australian central bank governor pushed back on quantitative easing and negative interest rate policy. More here from the Financial Post. With AUDUSD now inching back above 0.6780, we think the market could drift a little higher here but we’d want to see EURUSD rally as well before getting more optimistic. The funds added to their net short AUDUSD position for the 2nd week in a row during the week ending Nov 19th. The RBA is still expected to keep interest rates on hold at their next meeting on Dec 3rd.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen spiked higher above the 109 level in Asian trade last night after Xinhua reported the headline about the US and China “reaching consensus on properly resolving relevant issues”, but it has since fallen back with US yields as traders effectively say “talk is cheap…show us real evidence of progress on trade negotiations”. The Fed’s Powell spoke last night, but didn’t provide much in the way of new substance for markets. More here from CNBC. The funds added ever so slightly to their new, net long, USDJPY position for the 5th week in a row during the week ending Nov 19th.

USDJPY DAILY

USDJPY HOURLY

GERMAN 10YR BUND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com