Traders continue to buy USD broadly as fears mount about Brexit deadlock and Turkish money markets

Summary

-

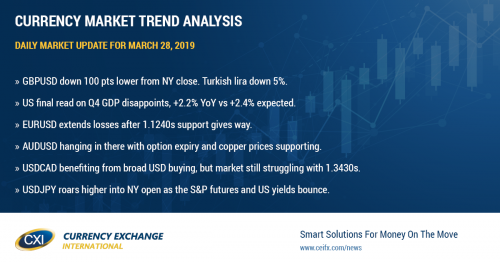

USDCAD: Dollar/CAD traders failed to breach trend-line resistance in the 1.3430s yesterdays, but they’re giving it another kick at the can this morning as the broader USD rallies. This broad demand for dollars appears to be USDCNH and USDTRY led today, as the former continues its breakout above 6.7250 and the ladder explodes 5% higher in response to the latest chapter of economic turmoil in Turkey. More here. Emerging market currencies like the MXN, ZAR and RUB are getting hit as proxy hedges for the TRY decline, pound sterling is falling again this morning after the UK parliament couldn’t agree on any sort of Brexit alternatives through indicative votes, and April gold prices continue to fall after failing to regain the 1317 level yesterday. When we combine all this with May crude oil prices falling back below the 58.90 support level today, it’s not surprising to see USDCAD trading higher here, but we must say we’re getting a bit concerned about the market’s inability to break above the 1.3430s with all these positive headwinds. The US reported its third and final read on Q4 2018 GDP just now and it came in at +2.2% YoY vs +2.4% expected and +2.6% on the 2nd reading.

-

EURUSD: The leveraged funds shorts in EUR are smiling this morning as the broader markets fret about Brexit and Turkey. Downward sloping trend-line support at the 1.1240s has given way, and this has allowed for further selling down to the next chart support level in the 1.1210s. Some buyers are trying to step in, despite Germany reporting weaker than expected inflation numbers for March just now (+1.3% YoY vs +1.6%), but we think the path of least resistance is still lower for EURUSD right now.

-

GBPUSD: Sterling is having a rough time this morning the UK’s parliament can seem to make any meaningful progress since taking over Brexit negotiations from Theresa May earlier this week. Yesterday’s indicative votes failed garner any consensus on alternatives to Theresa May’s deal. The DUP party hasn’t changed its position and won’t vote for the deal. Not even Theresa May’s pledge to resign post Brexit is helping to break the deadlock. GBPUSD’s NY close was nasty yesterday, and this gave traders the confidence to resell an upside test of the 1.3200 level in overnight trade. Chart support in the 1.3130-50s has now given way in early NY trade, and this opens a downside test of the 1.3070-1.3110 area in our opinion.

-

AUDUSD: The Aussie is consolidating yesterday losses this morning after trend-line support at the 0.7070s held into the NY close and during Asian trade overnight. A bounce in copper prices during London trade today and over 1blnAUD in options expiring at the 0.7100 strike also appears to be offsetting the downside pressure from a broadly higher USD today. We think AUDUSD drips lower after today’s option expiry at 10amET.

-

USDJPY: Dollar/yen is roaring higher here as the S&P futures and US yields uptick into the cash open for stocks. The Fed’s Clarida is on the wires reiterating the FOMC’s patience on monetary policy because of a whole host of global risks, but we don’t think these headlines are bullish. The broad USD buying we’ve witnessed today really hasn’t abated yet, and so we think this is a bit of “USDJPY being late to the party” going on now, combined with some relief that US yields aren’t making new lows. We think the USDJPY technicals once again look in good shape since we’re trading back above the 110.30s.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

May Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

May Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

June S&P 500 Daily

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com