Sunak unveils 30blnGBP plan to protect UK jobs

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- Sterling continues bounce off 1.2520s as UK Finance Minister delivers speech.

- Optimism now fading though, causing some USD buying into 9amET hour.

- Large EURUSD & USDJPY option expiries in play this morning at 10amET.

- Canada’s Bill Morneau to deliver “economic and fiscal snapshot” at 1:30pmET.

- “No real change” noted after Frost/Barnier dinner at No.10 Downing (Reuters).

- China’s Shanghai Composite rallied another 1.7% last night, pressures USDCNH.

ANALYSIS

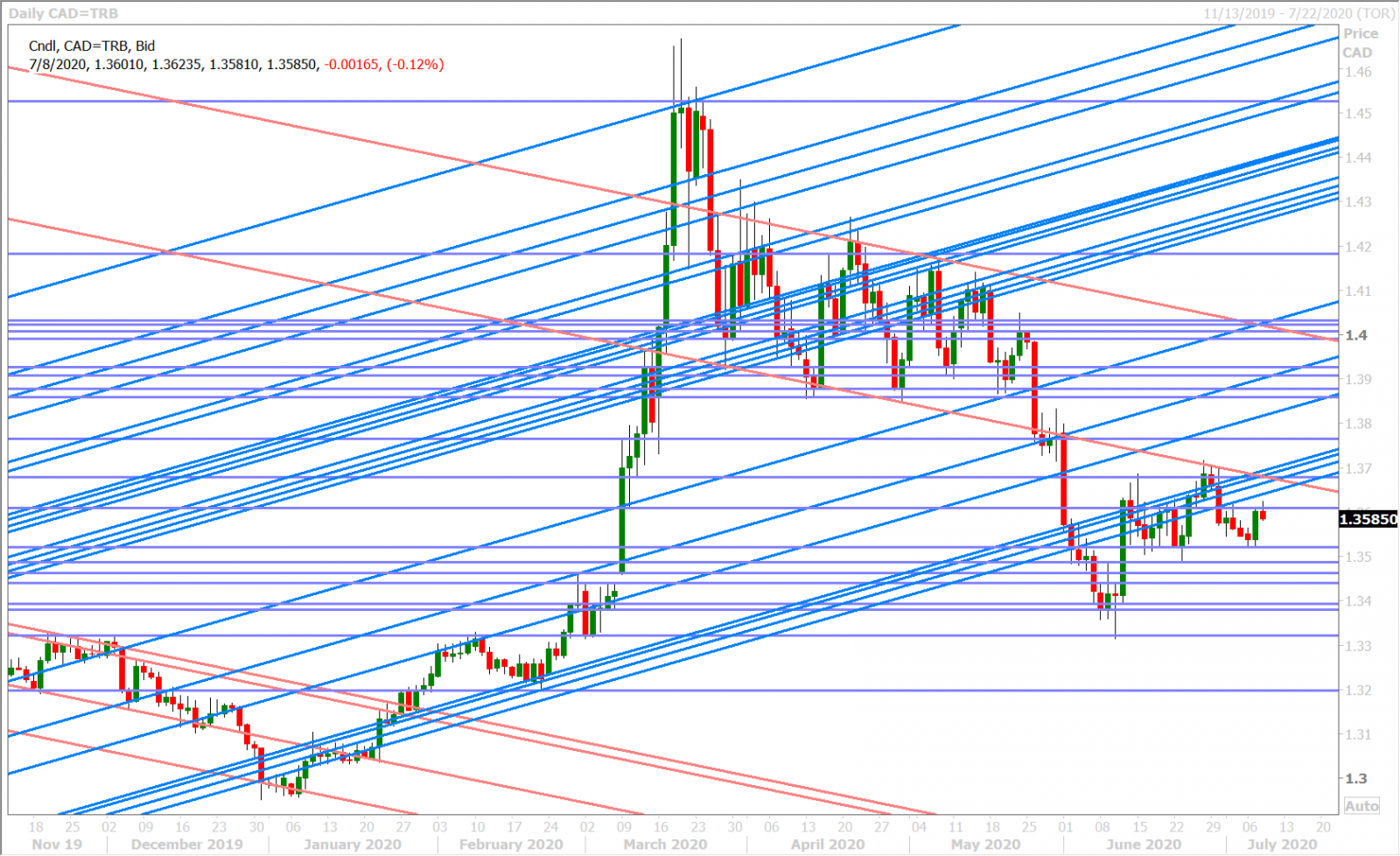

USDCAD

The removal of some bearish Brexit bets seemed to drive sterling higher, and the USD broadly lower, during NY trade yesterday. However, “no real change” was noted by Reuters after last night’s dinner between the UK’s Frost and the EU’s Barnier at Number 10 Downing Street and so we saw GBPUSD retreat, and USDCAD recover, into the NY close. Dollar/CAD traders peaked their heads above the 1.3610s during the European AM this morning but this move unraveled when GBPUSD buyers defended yesterday’s chart resistance (turned support) in the 1.2520s.

Traders bid up sterling some more at the NY open after British Finance Minister Rishi Sunak unveiled an ambitious 30blnGBP plan to protect the UK job market, but the initial optimism is now fading…which is mildly helping USDCAD from inching lower. Up next is Canada’s Bill Morneau, who is set to present an “economic and fiscal snapshot” at 1:30pmET that will “provide information on the current state of the economy and the government of Canada’s response to support Canadians during the COVID-19 pandemic”.

USDCAD DAILY

USDCAD HOURLY

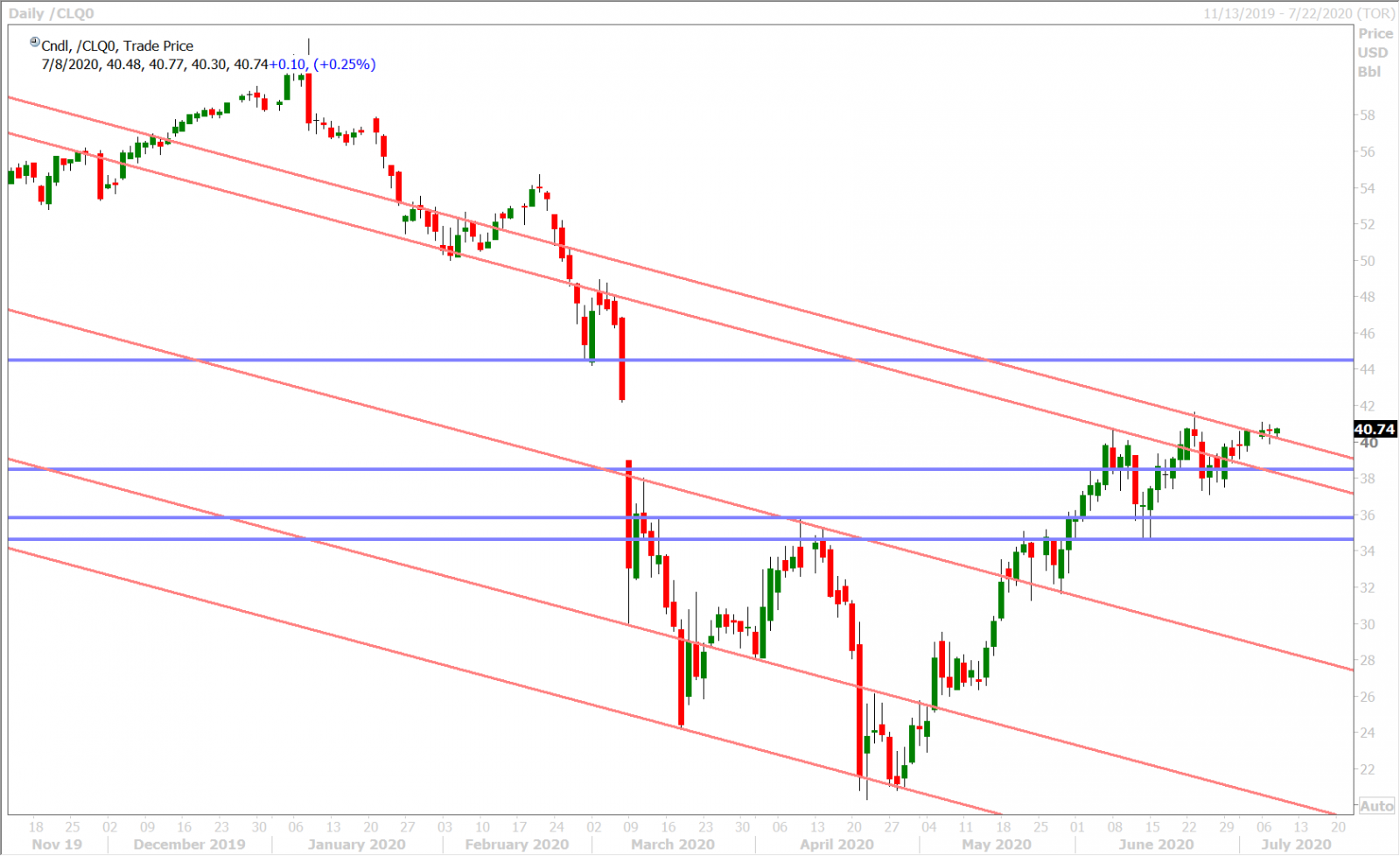

AUGUST CRUDE OIL DAILY

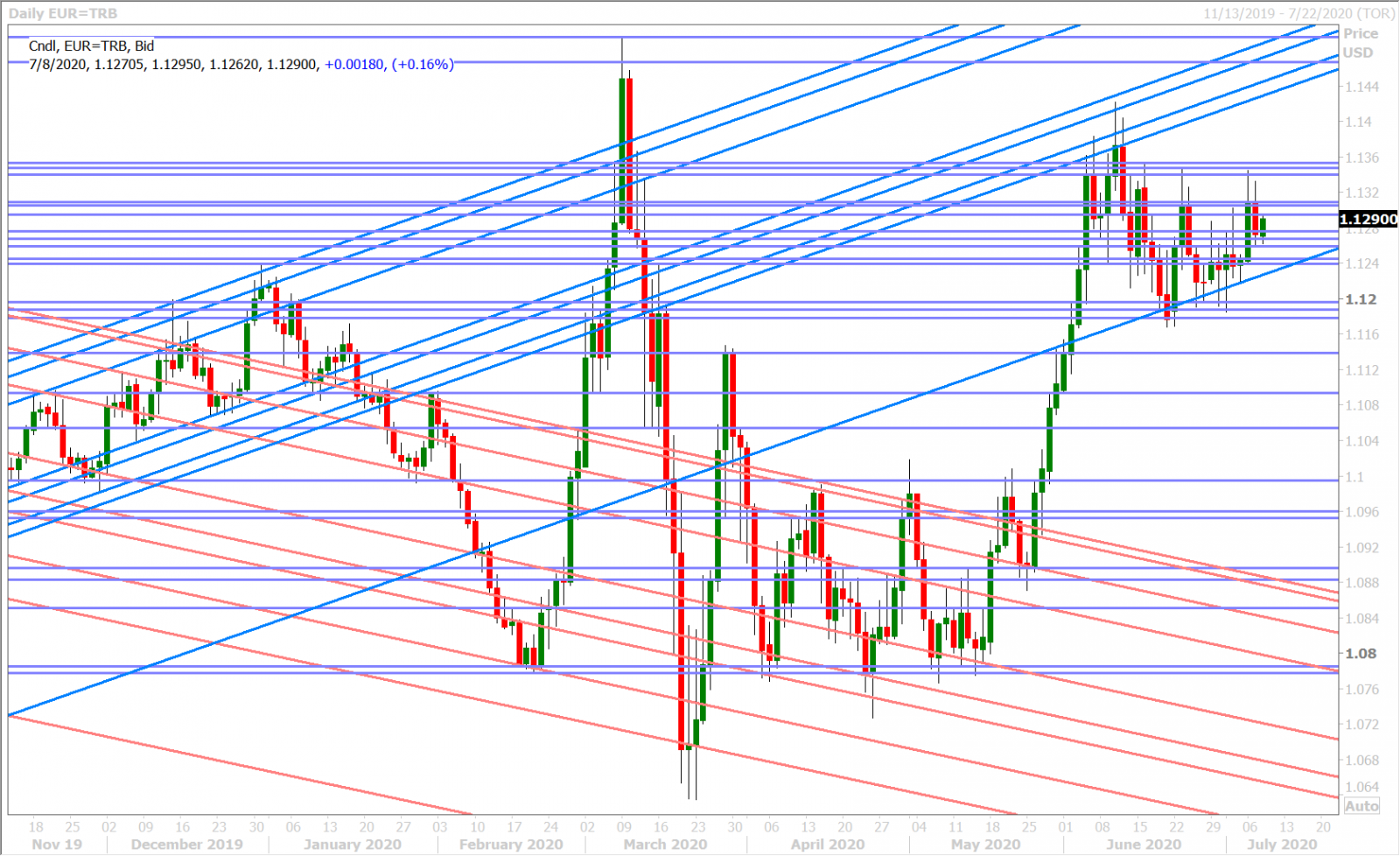

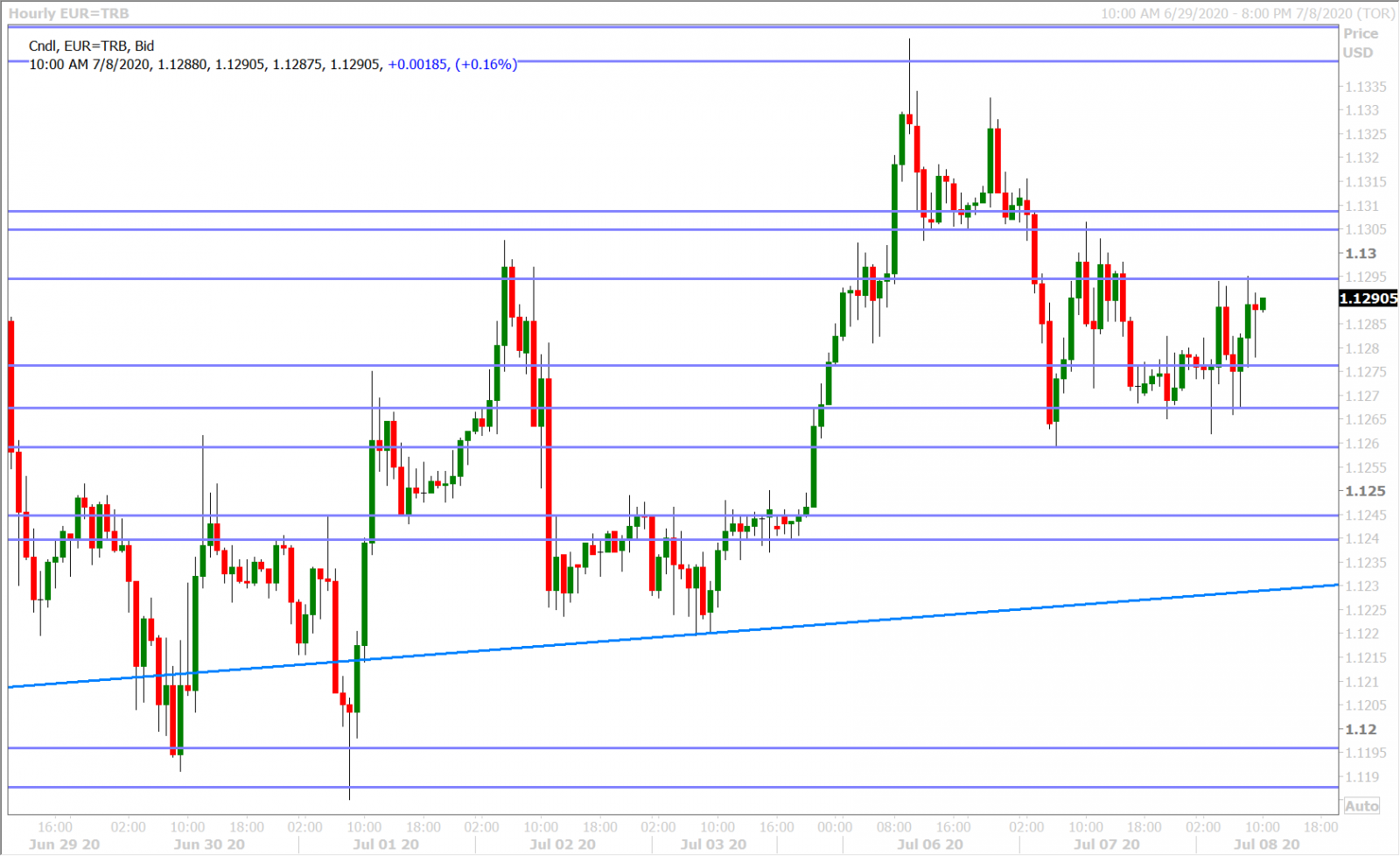

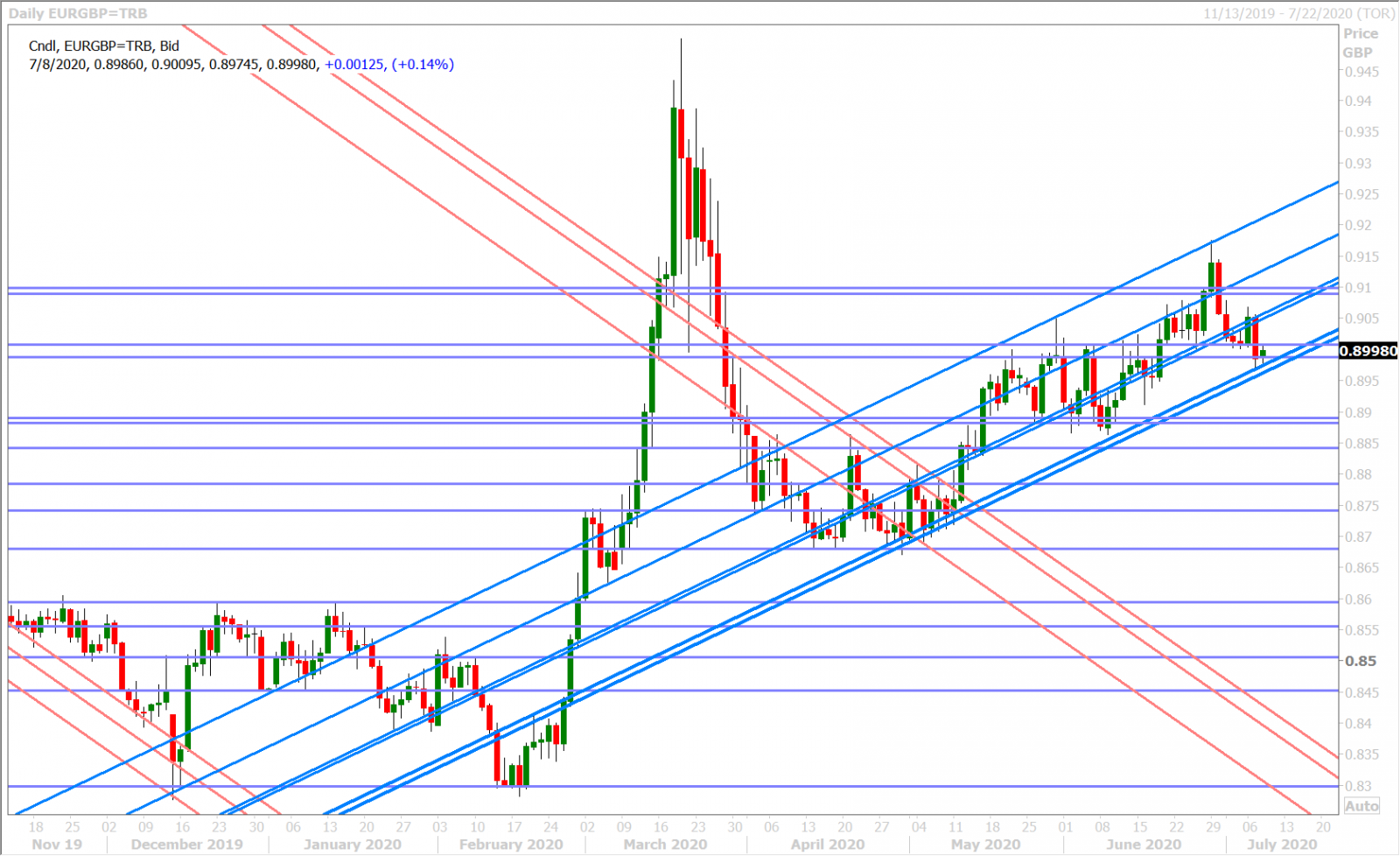

EURUSD

Euro/dollar didn’t look too hot going into the NY close yesterday after the steam came out of GBPUSD, but the market seemed to find support in Asia after another Chinese equity rally put renewed downside pressure on USDCNH. We’ve noticed steady EURUSD dip buying in the 1.1260s during London trade this morning as GBPUSD defended chart resistance turned support in the 1.2520s and we think today’s massive option expiries (2.7blnEUR) up around 1.1300-1.1310 level could help to keep the EUR bid.

EURUSD DAILY

EURUSD HOURLY

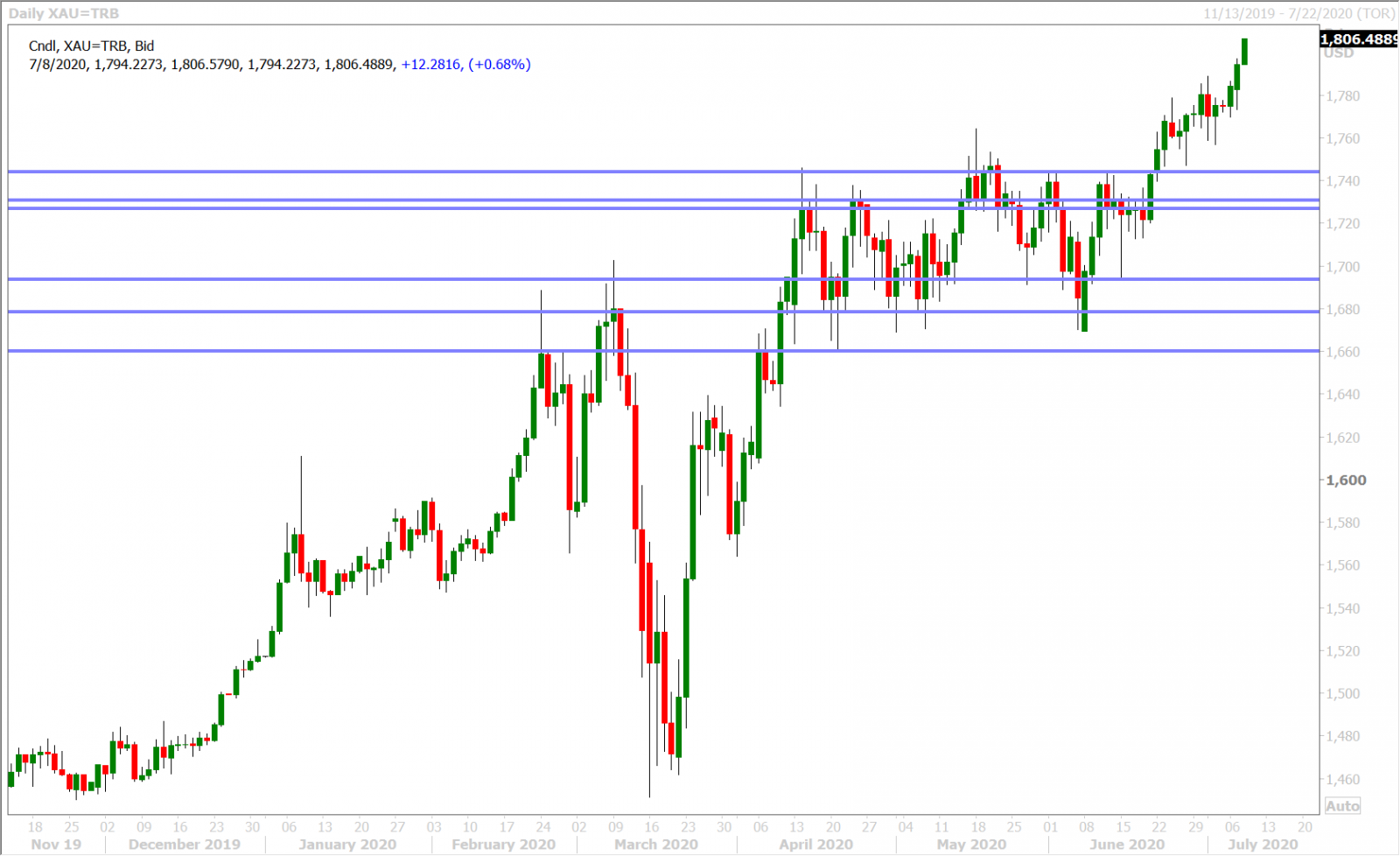

SPOT GOLD DAILY

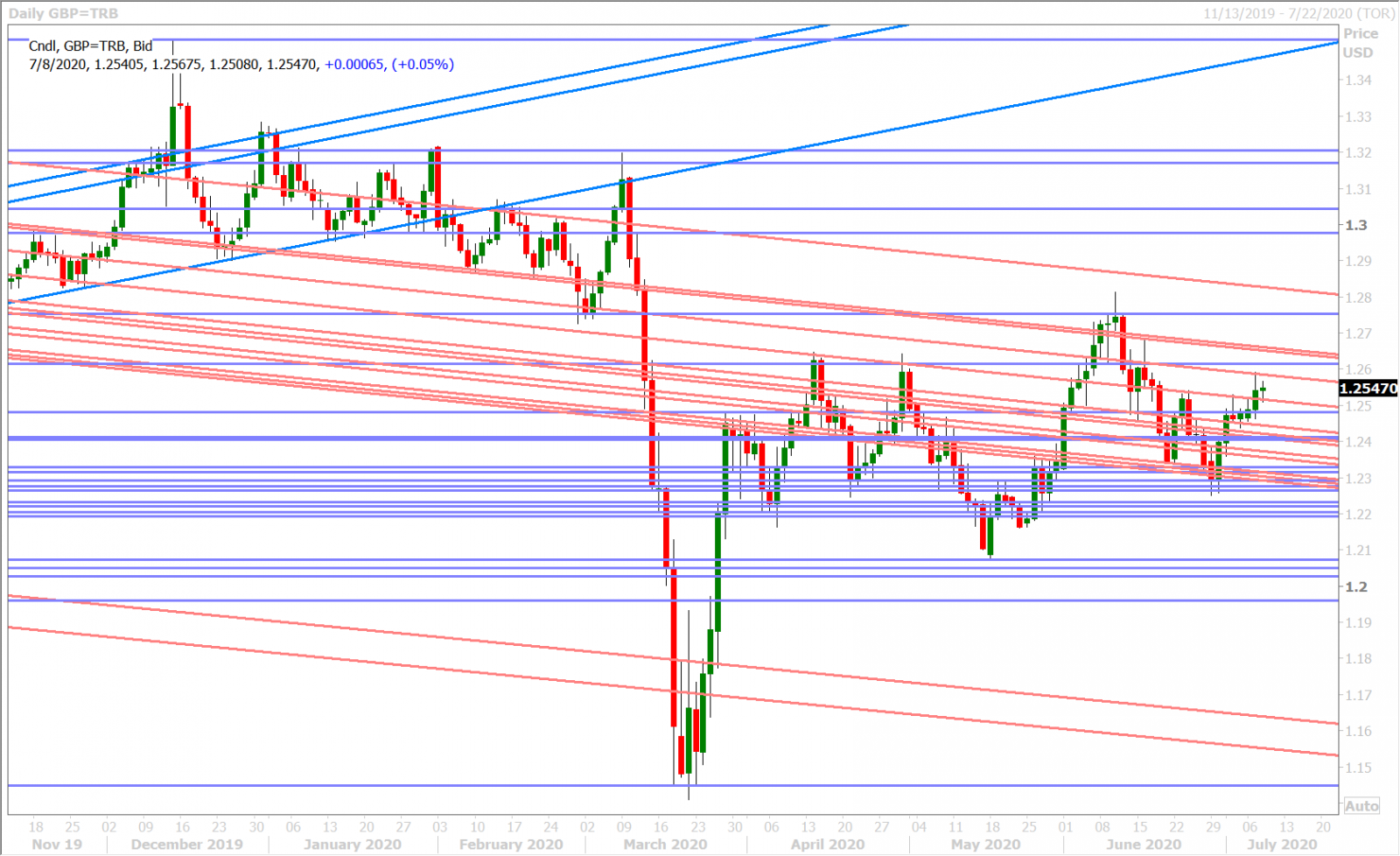

GBPUSD

All eyes were on British Finance Minister Rishi Sunak at the NY open today as he unveiled the UK government’s latest plans to help the economy steer through the coronavirus crisis…and sterling traders initially liked the sound of a 30blnGBP plan to protect jobs and businesses. Highlights here from Reuters via US News. GBPUSD re-tested it London session highs in the 1.2560s while Sunak was speaking, but the optimism is now beginning to fade.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

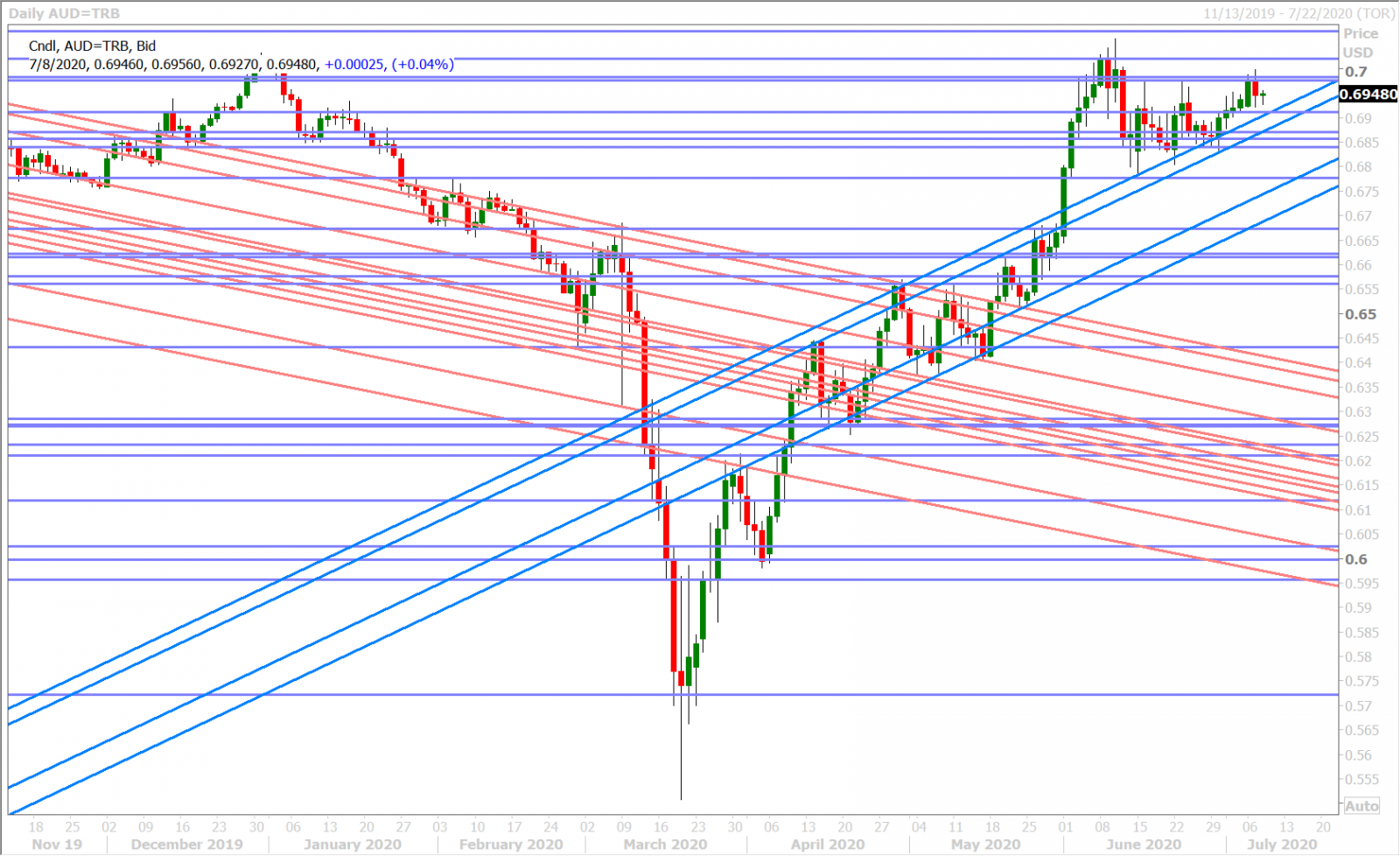

AUDUSD

It was quite amazing how some pre-Brexit negotiation/pre-Sunak speech repositioning in GBPUSD made Aussie traders forget about the Melbourne lock-down in NY trade yesterday, but the AUDUSD bounce ultimately disintegrated into the NY close as word leaked of “no real change” coming out of Frost’s and Barnier’s wine-and-dine.

We felt another 1.7% rally in the Shanghai Composite, and the upside pressure it put on the Chinese yuan, helped the Australian dollar find a floor in Asia last night and we’d note this morning’s EURUSD bid (topside option expiry driven) and GBPUSD strength (Sunak driven) as mildly supportive for AUDUSD around the NY open. Australia’s state of Victoria reported 134 new COVID infections over the past 24hrs, versus the previous day’s record 191.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

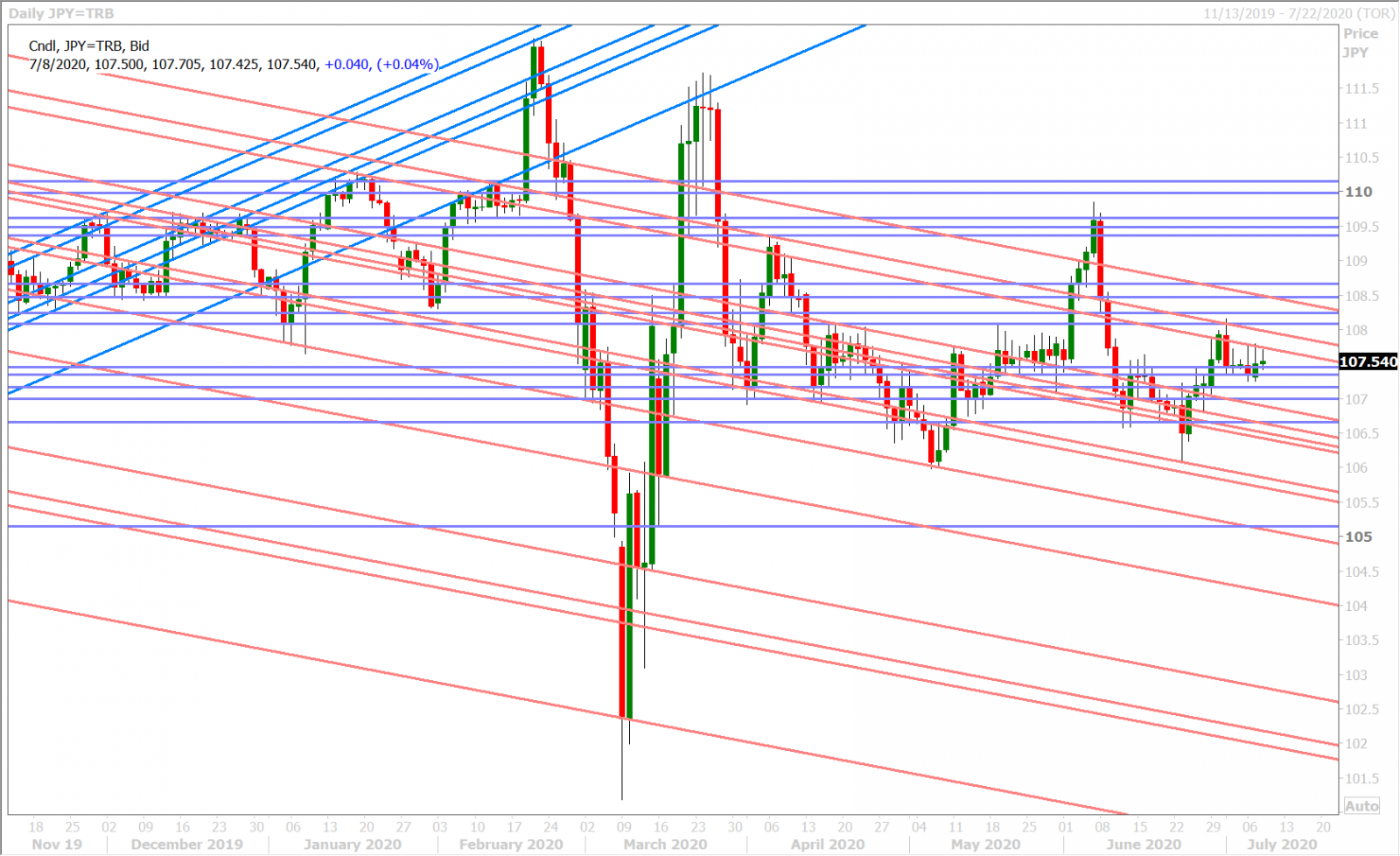

Dollar/yen remains glued to the 107.50 area this morning as over $3bln worth of options are set to expire around there at 10amET. Another $1blnUSD goes off the board at 107.50 tomorrow as well, which should keep the market anchored to current levels.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com