Silver selloff briefly helps USD, but Fed meeting looms

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- Spot silver rallies another 6% in Asia, then crashes 15% into Europe.

- Broader USD bounces, but dovish Fed bets not folding just yet.

- Fed extends emergency lending programs though to end of year.

- Risk sentiment takes a knock, lifting USD once again into NY trade.

- GBPUSD appears to trip buy stop orders above the 1.2900 figure.

- USDJPY following global bond yields lower since the European open.

ANALYSIS

USDCAD

Dollar/CAD was under pressure for most of yesterday’s trade as the rally in precious metals didn’t show serious signs of abating and as September WTI oil prices recovered into the NYMEX close. An afternoon rally for US tech stocks seemed to help the latter, along with chatter that Mexico had not yet started executing trades connecting to its annual oil hedge (after Reuters reported they were asking banks for quotes late last week). All this saw USDCAD slip below the 1.3380-90s support into the NY close.

It was all about precious metals again in Asia last night as spot silver surged another 6% higher onto a $26 handle and as spot gold extended its record breaking run by another 2% to trade at $1980…but all this unraveled spectacularly around the midnight ET hour with silver prices crashing 15% from their session highs! There wasn’t a particular headline behind the position liquidation but we noted a reluctance on the part of USD bears to push the market lower during the 7pm-11pmET precious metals ramp (1st warning) and yesterday’s lingering thought of silver’s run, in particular, potentially coming to end going into Wednesday’s futures contract expiry for July (2nd warning). See here. When all was said and done, European traders were looking at a blow-off top for silver, and a broadly stronger USD as a result, when they walked in this morning.

There wasn't much follow-through momentum behind the USD's bounce in Europe as it appeared traders weren't willing to completely abandon dovish bets ahead of tomorrow’s FOMC meeting, but some of it is returning now following the broader market's negative reaction to the Fed extending its lending programs (more below). Dollar/CAD is now trying to hold the 1.3380-90s level; the familiar chart support it lost yesterday but regained overnight.

USDCAD DAILY

USDCAD HOURLY

SEP CRUDE OIL DAILY

EURUSD

Euro/dollar’s struggle with the 1.1760s resistance level yesterday was a negative precursor going into last night’s silver-driven pullback, but it appeared traders in Europe didn't want to get rid of their bearish USD bets this morning as the FOMC looms large for tomorrow.

The Fed just surprised markets after the NY open however with an extension of its emergency lending programs through to the end of the year, and we think the fact that they couldn’t wait until tomorrow’s meeting to make the announcement is what's hitting risk sentiment at this hour. See here. Is the Fed trying to bolster risk sentiment ahead of negative soundbites tomorrow?

EURUSD DAILY

EURUSD HOURLY

SPOT SILVER DAILY

GBPUSD

Sterling also saw some selling when silver prices crashed last night, but traders have completely shaken off the move and are now reacting (perhaps overreacting) to the Fed’s announcement to extend its lending facilities. Yes this is dovish news when it comes to US monetary policy, but broad risk sentiment (+ the other risk currencies CAD & AUD) have down-ticked since the news broke and so we wonder if some buy stops simply got triggered above the 1.2900 figure or if there's positive Brexit chatter making the rounds .

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

It’s been a choppy 24hrs of trade for the Australian dollar. Yesterday’s drift higher continued into Asia when silver prices surged another 6% higher; this turned into a 50pts selloff for AUDUSD when silver crashed 15%, and while some pre-FOMC meeting dovishness stalled the USD’s bounce in Europe, this morning’s Fed announcement has now dampening broad risk sentiment. Again, why did they have to announce this today, when they meet tomorrow? Traders are expecting -2.0% QoQ and -0.4% YoY for tonight’s Q2 CPI report out of Australia at 9:30pmET.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

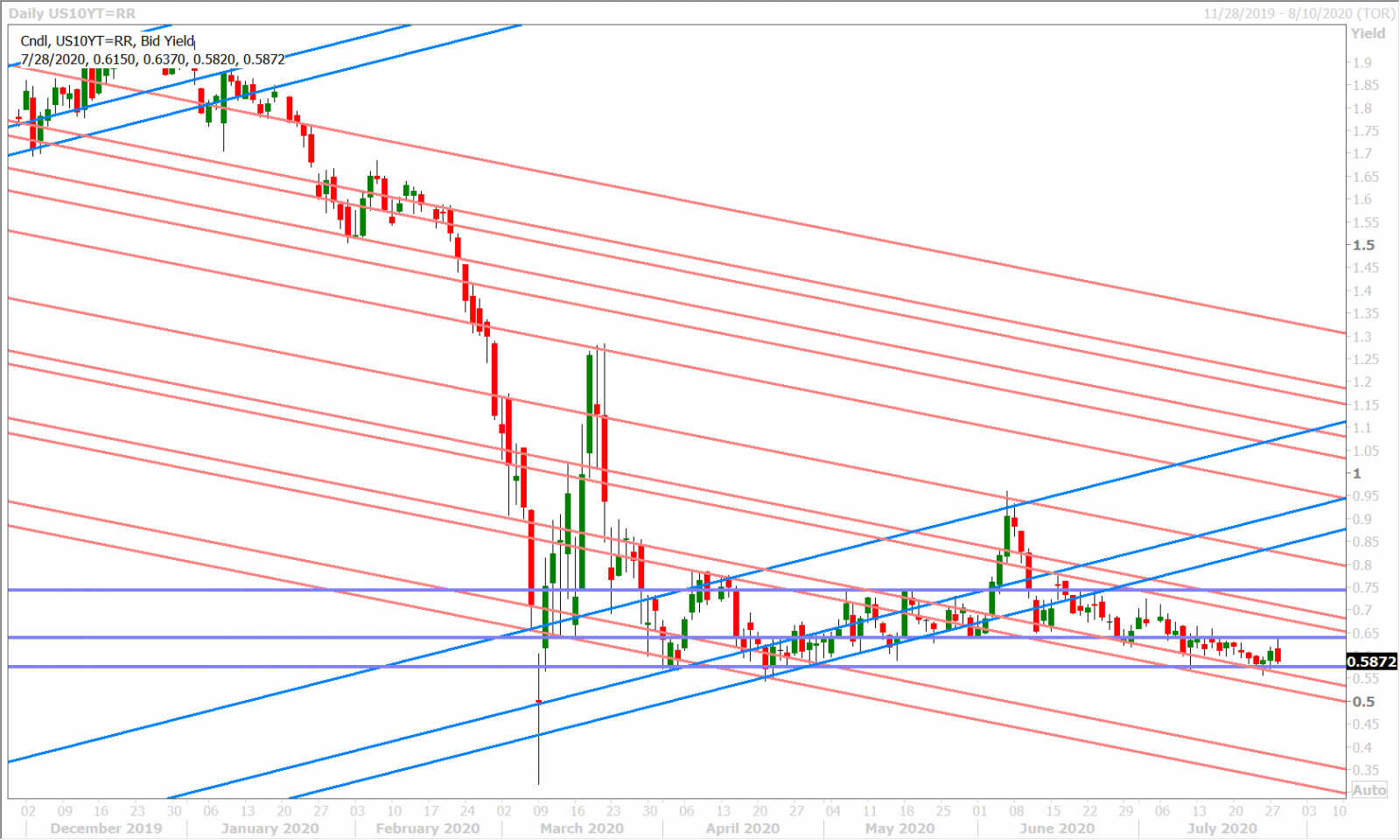

Dollar/yen traded higher with the broader USD during late NY/Asian trade yesterday, but we’ve noticed an increased positive correlation with global bond yields ever since the European open today. German bund and US treasury yields have moved swiftly lower and this has coincided with strong USDJPY selling right after the pair stalled at former support turned resistance in the 105.60s. What’s the bond market trying to tell us here? Perhaps we will get a dovish surprise from the Fed tomorrow?

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com