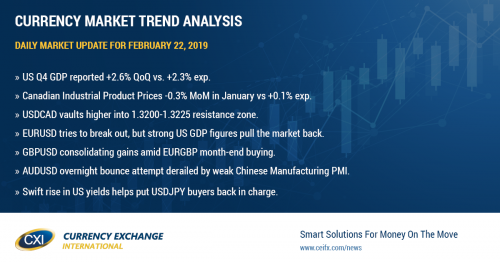

Significant beat on US Q4 GDP propels USD higher into NY trade

Summary

-

USDCAD: Dollar/CAD is trading bid this morning as the S&P futures and crude oil prices drift lower. China’s weaker than expected Manufacturing PMI for February made the rounds in overnight trade, with another print below 50 now further spreading concerns about Chinese growth. This is creating a mild “risk-off” mood this morning that is depressing commodity currencies like AUD and CAD. The US has just reported Q4 GDP this morning at +2.6% QoQ vs expectations of +2.3% and Canada just reported Industrial Product Prices for January at -0.3% vs +0.1%. This combination of better than expected US and weaker than expected Canadian data is now seeing USDCAD vault higher into a key trend-line resistance zone (1.3200-1.3225).

-

EURUSD: Euro/dollar is breaking higher this morning; something we alluded to yesterday as being a possibility should the 1.1370s hold. While we can’t point to a specific headline for the overnight move higher today, we would note a number of positive influences. First, and probably more importantly, trend-line resistance at the 1.1400 level has given way. Second, the BTP/Bund yield spread has resumed its contraction today, falling down to +260bp (Italian bonds are rallying). The EURGBP cross has reclaimed chart support in the 0.8550s on demand which is now commonly seen at month end. Both Italy and Germany reported in-line MoM CPI figures for the month of February this morning and while they weren’t great numbers, they weren’t bad either. Lastly, with the Fed’s semi-annual testimony before Congress now out of the way and confirmation that we’re going to have “patient” monetary policy out of the US for the foreseeable future, we think the market is starting to test the resolve of entrenched fund short positions here. We think the 1.1400 level will act as today’s pivot for price action. Should buyers hold the level after a downside test, we think EURUSD could make a run for 1.1450 at some point heading into next week’s ECB meeting. The stronger than expected US Q4 GDP figures just released however is now forcing a test of the 1.1400 level rather quickly and it’s not going well.

-

GBPUSD: Sterling is trading quietly offered this morning as the Brexit headlines slow down a bit and EURGBP finds its usual month-end buyers. Chart support today lies in the 1.3270s. Futures traders added another 5,486 contracts in new positions during yesterday’s rally.

-

AUDUSD: The Aussie had a rough session yesterday, falling all the way back down to chart support in the 0.7140s after EURUSD rejected the 1.1400 level for a second time. An attempt was made to bounce the market higher in Asian trade overnight, but the weaker than expected Chinese Manufacturing PMI derailed this, and the stronger than expected US GDP figures for Q4 are now adding insult to injury this morning. The next support level comes in at 0.7100-0.7115 today.

-

USDJPY: Dollar/yen buyers are all of a sudden back in charge following yesterday’s dramatic reversal higher. Some swift selling in the US bond market (sharp rise in US yields) appeared to be driver, and helped USDJPY quickly reclaim the 110.60-70 level it lost the day before. Overnight price action saw traders test this level again (this time as support) and buyers showed up. The stronger than expected US Q4 GDP figures is now leading to some broad USD buying, which is helping USDJPY target Monday’s highs once again. We think a daily close above the 111.10s will invite further buyers and a chase for the 112 level.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

April Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

May Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

US 10 Year Bond Yield Chart

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com