Nancy Pelosi announces impeachment "inquiry" against Trump

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

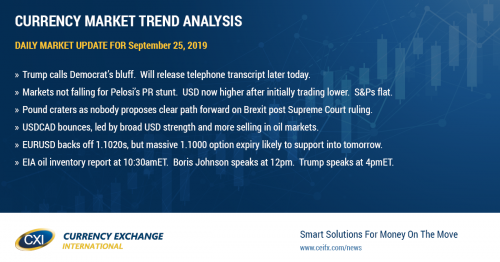

SUMMARY

ANALYSIS

USDCAD

Dollar/CAD is rallying higher with the broader USD this morning, but if we look at overnight price action across markets we think this has more to do with declining oil prices and growing Brexit angst in the UK as lawmakers were forced back to work today with no clear path forward, as opposed to “risk-off” flows from Nancy Pelosi’s impeachment PR stunt against President Trump late yesterday. To be clear, an official vote to commence impeachment proceedings HAS NOT yet occurred on the floor of the House of Representatives. According to Fox News, neither the Democrats nor the alleged whistleblower are even privy to the contents of Trump’s phone call with President Zelensky of Ukraine. President Trump, in calling Pelosi’s bluff, has now agreed to release the transcript of his call with Zelensky later today insisting he’s done nothing wrong…and so this could all blow up in Democrat faces very soon. We honestly think markets aren’t too bothered by all this impeachment banter for the moment. The USD has now bounced considerably higher from its lows after the Pelosi headlines late yesterday. This sounds like another desperate attempt by Democrats (think Russia-gate) to get Trump out of office because they don’t have a compelling message with which to beat him at the ballot box come 2020. We think the sad state of the Brexit crisis and October crude oil’s mission to fill its Sep 15th chart gap are far more important things for traders to be watching right now. The weekly API report came out last night with an unexpected build in inventories (bearish) and we’ve also seen headlines from Reuters that suggest Saudi Arabia is ahead of schedule with bringing its oil production capacity fully back online. The weekly EIA oil inventory report will be released this morning at 10:30amET, with traders expecting a draw of 0.249M barrels. President Trump is expected to speak at 4pmET today.

USDCAD DAILY

USDCAD HOURLY

OCT CRUDE OIL DAILY

EURUSD

Euro/dollar has fallen back from its post-Pelosi highs at trend-line resistance in the 1.1020s as the sellers didn’t ultimately fall for the Speaker of the House’s impeachment speech (that’s all it was), and with no European economic or central bank headlines to chew on this morning, we think traders have been content to simply follow GBPUSD lower for the time being. We think bids will re-emerge however at familiar support in the 1.0980s as tomorrow’s massive option expiry at the 1.1000 strike continues to grow in size (now almost 6blnEUR according to Reuters).

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Sterling is plunging over 100pts lower this morning as it appears neither the UK parliament nor the Prime Minister know what to do next regarding Brexit. The Supreme Court has ruled them back to work (or let’s be realistic…back to arguing), but there appears to be no clear path forward. A UK government spokesperson said Boris Johnson will not request a Brexit deadline extension when he meets with the EU in mid-October, but UK attorney general Geoffrey Cox says the government will comply with last week’s new no-deal Brexit legislation if negotiations are unsuccessful (Benn Act). UK Liberal Democrat leader, Jo Swinson, said today “We simply cannot afford to wait until the 19th of October to see whether the prime minister will refuse to obey the law again”. We need to “find a way to remove that threat of a no-deal Brexit more quickly.” Will the government attempt another election motion after AG Cox declared parliament “dead” a “disgrace” this morning?

According to Luke McGee from CNN, Brexit is frozen. "Both sides want an election, but can’t agree on when it should happen. Johnson asked Parliament twice for an early election, but the opposition said no. What we might be seeing is the starting point of a brand-new government tactic: To goad the opposition into holding a vote of confidence and triggering a general election. It would be just as much of a risk for Labour as it would be for the Conservatives. But right now, it’s hard to see how Brexit moves on without someone, anyone, taking a leap into the unknown. The problem is, both sides want the other to take that leap.”

With GBPUSD now trading all the way back below chart support in the low 1.24s, we think this further emboldens Friday’s bearish NY closing pattern on the charts and we think the sellers clearly have momentum on their side now. Boris Johnson is expected to address the UK House of Commons at 12pmET today.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

We had a feeling yesterday’s RBA Lowe driven bounce in the Aussie wouldn’t last, and here we are trading 50pts lower as AUDUSD succumbs to broad USD buying. Support at the 0.6780s has been lost once again on the charts. Traders are now testing chart support level in the 0.6740-50s. We think the selling might stop here for the time being though, especially if EURUSD finds option-related bids heading into tomorrow.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen is shaking off Pelosi’s impeachment speech as well, with the market now trying to regain Monday and Tuesday’s key chart support level at 107.50. We think some looming option expiries above the market for tomorrow’s session could be helping with that (1.1blnUSD at 107.50 and 2blnUSD at 107.90-108.00). US 10yr yields aren’t bouncing this morning however (still stuck at chart support at 1.65%) and we posit this is because repo is once again back in focus. The overnight GC repo rate opened at 2.15% this morning and the just completed $75bln repo operation from the NY Fed today was oversubscribed yet again (this time by $17bln!). Who keeps needing all this liquidity?

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com