Jackson Hole symposium in focus this week

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- Will Powell unveil conclusions from Fed’s Review of Monetary Policy Strategy?

- Markets still hoping for move to average inflation targeting/yield curve control.

- USD could rally again if Powell’s speech is light on details/leaves traders hanging.

- Big EUR, AUD, CAD option expiries could help USD into Powell’s speech.

- Leveraged funds ill-time flip to net long GBPUSD position, add to USDCAD longs.

- Speculators reduce short USDJPY bets for a third week in a row.

ANALYSIS

USDCAD

There’s a mild risk-on tone to global markets this morning as traders point to the FDA’s approval of convalescent plasma as a COVID-19 treatment and as reports circulate about the Trump administration possibly fast-tracking an experimental coronavirus vaccine for use before the US election. The S&P and Nasdaq both opened cash trading +1% to new all-time highs but the safe-haven dollar is now recouping its overnight losses as this optimism evaporates. US yields are trading unchanged as bond traders express their usual skepticism, and WTI oil prices seem to be gyrating with the S&P and developments regarding the two hurricanes set to hit the Gulf of Mexico. Another technically disappointing day of price action on Friday (1.3230s rejected and 1.3190-1.3200s lost) added to the woes for dollar/CAD in Europe this morning, but this has all been erased following a strong bounce off familiar trend-line support in the 1.3130s.

The CFTC’s latest Commitment of Traders Report showed the leveraged funds adding to their net long USDCAD position for the second week in a row during the week ending August 18. The fact that the size of this net position (33,587 contracts) is now almost as large as it was in May, when speculators were looking for a break above 1.42, is yet another negative development for the market in our opinion. These bets continue to bleed money and could ignite a flush lower in USDCAD should these traders decide to throw in the towel below the 1.3130s.

This week’s key event will be Jerome Powell’s speech at the Kansas City Fed’s annual Jackson Hole Symposium on Thursday morning at 9:10amET, where everybody’s going to be looking to see if the Fed chairman unveils conclusions from its year-long Review of Monetary Policy Strategy, which has been focused on a new approach towards inflation. The North American calendar will otherwise be quiet in terms of key economic data points (just US Durable Goods for July, the second estimate of US GDP for Q2 and Canada’s GDP figure for June). They’ll be an abundance of options expiring above the market later this week ($2bln between 1.3200 and 1.3250 over Wednesday/Thursday), and below the market in EURUSD and AUDUSD on Thursday (see below)…which could help the broader USD and USDCAD if Powell decides to leave traders hanging.

USDCAD DAILY

USDCAD HOURLY

OCT CRUDE OIL DAILY

EURUSD

Euro/dollar is enjoying a bid back up to the familiar 1.1830s this morning as vaccine/COVID-treatment optimism helps lift broader risk sentiment, but we think the market is going to have a tough time going anywhere ahead of Jackson Hole later this week. The litany of option expiries between 1.1750 and 1.1850 (over 7blnEUR) going into Thursday’s session could be a near-term volatility killer in our opinion, and we’d note the largest of them all (1.7blnEUR) at 1.1750 as a potential downside magnet for spot EURUSD prices should Powell fail to offer the doves what they're looking for.

Germany releases its Q2 GDP and August IFO survey tomorrow morning, although neither should command much market attention. The ECB’s Phillip Lane is set to speak at Jackson Hole a few hours after Jerome Powell on Thursday, which could be interesting. The leveraged funds pared back their record net long EURUSD position during the week ending August 18 as longs took profit. This was contrary to what we were expecting and takes the focus off stretched EUR bullishness once again in our opinion.

EURUSD DAILY

EURUSD HOURLY

SPOT GOLD DAILY

GBPUSD

Sterling followed the euro higher earlier this morning, but the pivotal 1.3120-30s (last week’s battleground area) acted as chart resistance after this level was lost once again going into Friday’s NY close..and GBPUSD has now spiraled quickly back lower again. Euro/sterling also appears to be gathering steam for another push higher after negative Brexit headlines snapped it back onto the 0.90 handle late last week, which is GBP-negative.

The leveraged funds finally flipped their positioning to net long GBPUSD during the week ending August 18 (first time since April), although we have to say that the timing of this development looks bad in light of Friday’s bearish price action and so we think this could hurt sterling here. The Bank of England’s Any Haldane will speak on Wednesday and Governor Andrew Bailey will deliver a speech at the Jackson Hole Symposium on Thursday (right around the time that Jerome Powell will be speaking).

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The stock market’s love affair with Apple helped boost risk sentiment and the Aussie late Friday and while last night’s vaccine optimism brought about more selling of the safe-haven dollar, this has quickly and rightly begun to unravel in NY trade this morning. This week’s Australian calendar doesn’t feature anything notable from an economic/central bank perspective, and so we think the market will continue to follow the broader USD tone. Similar to EURUSD, they’ll be a large option expiry going off below the market on Thursday morning right after Jerome Powell begins speaking (935M at 0.7120), which could create uncomfortable interest in AUDUSD downside should the Fed chairman not offer up any hints towards monetary policy that will allow inflation to overshoot. We think a decisive NY close below the 0.7120s could bring about an end to the Aussie’s uptrend against the dollar.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

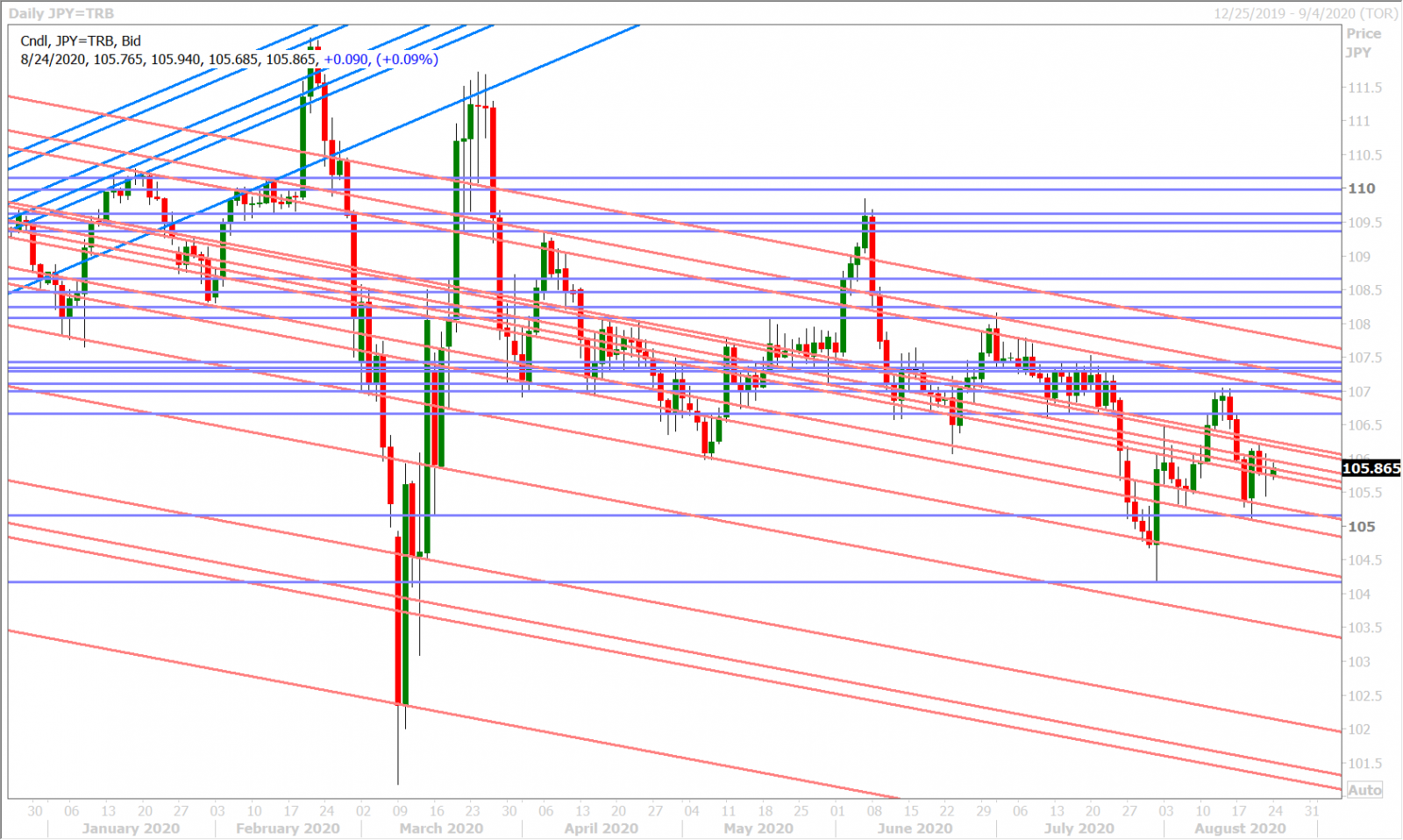

The leveraged funds continued to liquidate short USDJPY positions for the third week in a row during the week ending August 18; and we find this to be a notable development in light of the market’s (and the BOJ’s) recent unwillingness to see dollar/yen trade below the 105 level for very long. The market is clinging to the 105.70-90 support zone as the week gets started and we’re starting to wonder if Thursday’s Jackson Hole event could provide the catalyst for another broad USD rally. The market might have to deal with huge $3.2bln option expiry at the 105.00 strike beforehand on Wednesday though.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com