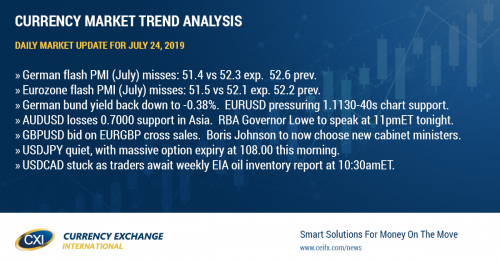

Germany's flash PMI for July surprises to the downside again

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

USDCAD

Overnight trading was relatively subdued for USDCAD today, despite a multitude of headlines that could have arguably knocked the market around a little bit. First off, we got a much bigger than expected draw in the weekly API inventory report last night (-10.96M barrels vs -4M exp). September crude oil prices knee jerked higher in response above trend-line resistance at 57.25, but immediately pulled back and therefore had very little impact on USDCAD. Then in European trade today we got the weaker than expected July flash PMI surveys out of Germany and the broader Eurozone. This knocked EURUSD down through chart support in the 1.1140s but the effect on the broader USD was relatively muted, with USDCAD rallying a measly 10pts. China has given the go-ahead this morning for five companies to purchase up to 3 million tons of US soybeans without import tariffs, as part of a goodwill gesture towards the United States, according to Bloomberg. This is now seeing a mild bid come in for commodity currencies in general, but USDCAD continues to hold chart support in the 1.3120s with a range-bound tone. Today’s North American calendar should be lacking in terms of excitement as traders will only have the US Markit PMI survey for July to chew on (which is not normally market moving). The EIA will release its weekly oil inventory report at 10:30amET as usual, and the expectation is now for a draw of 4-6M barrels following last night’s API report. USDCAD chart support today comes in at 1.3125 while resistance lies at yesterday’s highs in the 1.3150s.

USDCAD DAILY

USDCAD HOURLY

SEP CRUDE OIL DAILY

EURUSD

Euro/dollar is hanging on for dear life this morning after yesterday’s swift decline and today’s dismal German flash PMI for July puts a lot of pressure on trend-line support in the 1.1130-40 area. The German 10yr bund has collapsed back down to -0.38% in response to the weak German data and the odds of the ECB cutting rates by 10bp tomorrow have shot up above 40%. The ECB will announce its latest update on Eurozone monetary policy at 7:45amET tomorrow morning and we think this meeting could be a doozy. Traders are very much expecting the European Central Bank to make some sort of dovish adjustment to their outlook, but we’re not quite sure markets are prepared for further interest rate cuts or a re-initiation of quantitative easing just yet.

EURUSD DAILY

EURUSD HOURLY

AUG GOLD DAILY

GBPUSD

Sterling is bouncing nicely this morning and this appears to be EURGBP sell-driven more than anything else following today’s weak flash PMI data out of Germany and the Eurozone. The cross lost chart support in the 0.8960s right after the release and it has made a bee-line for the next trend-line support level in the 0.8910s. GBPUSD is benefitting from the relative GBP demand and has shot back above the 1.2450-60 level it struggled with yesterday. We think this is simply a short covering bounce in an otherwise pronounced downtrend for GBPUSD. UK politics will feature some pomp and circumstance today as Theresa May resigns to the Queen and Boris Johnson is formally asked by her majesty to form a new government. Next up for GBP traders will be Boris Johnson’s new cabinet minister selections.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The disappointment for AUD bulls continues today as the fall in EURUSD continues to lead this market lower. Chart support at the 0.7000 level gave way in Asian trade last night, and similar to what’s going on in EURUSD this morning, traders are trying to cling to the next support level right now, which lies in the 0.6980s. RBA Governor Lowe will be speaking tonight at 11pmET and we think this will be the next catalyst for AUDUSD price action.

AUDUSD DAILY

AUDUSD HOURLY

SEP COPPER DAILY

USDJPY

Dollar/yen is struggling a bit this morning, but we’re still holding within yesterday’s price range. Trend-line chart resistance in the 108.20s is capping while trend-line support just north of the 108.00 is supporting. Today’s NY session features a massive option expiry at the 108.00 strike this morning (4.3blnUSD), so odds are we’re going nowhere fast. Reuters was out with a report this morning saying BOJ officials are “divided” on the need to ease monetary policy further when they meet next Monday night. More here.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com