German court hands ECB three-month ultimatum to justify bond purchases

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- Pompeo says “significant amount of evidence” exists COVID-19 came from Wuhan lab.

- Trump says China “made a horrible mistake and didn’t want to admit it”.

- China “intentionally concealed the severity” of the coronavirus pandemic (leaked DHS document).

- Markets go “risk-off” to start illiquid Asian trade last night, but recover in European AM.

- Risk sentiment shaky ahead of quiet US calendar, just US March Factory Orders on deck at 10amET.

- RBA meets tonight at 12:30amET. China returns from holiday on Wed, Japan returns on Thursday.

ANALYSIS

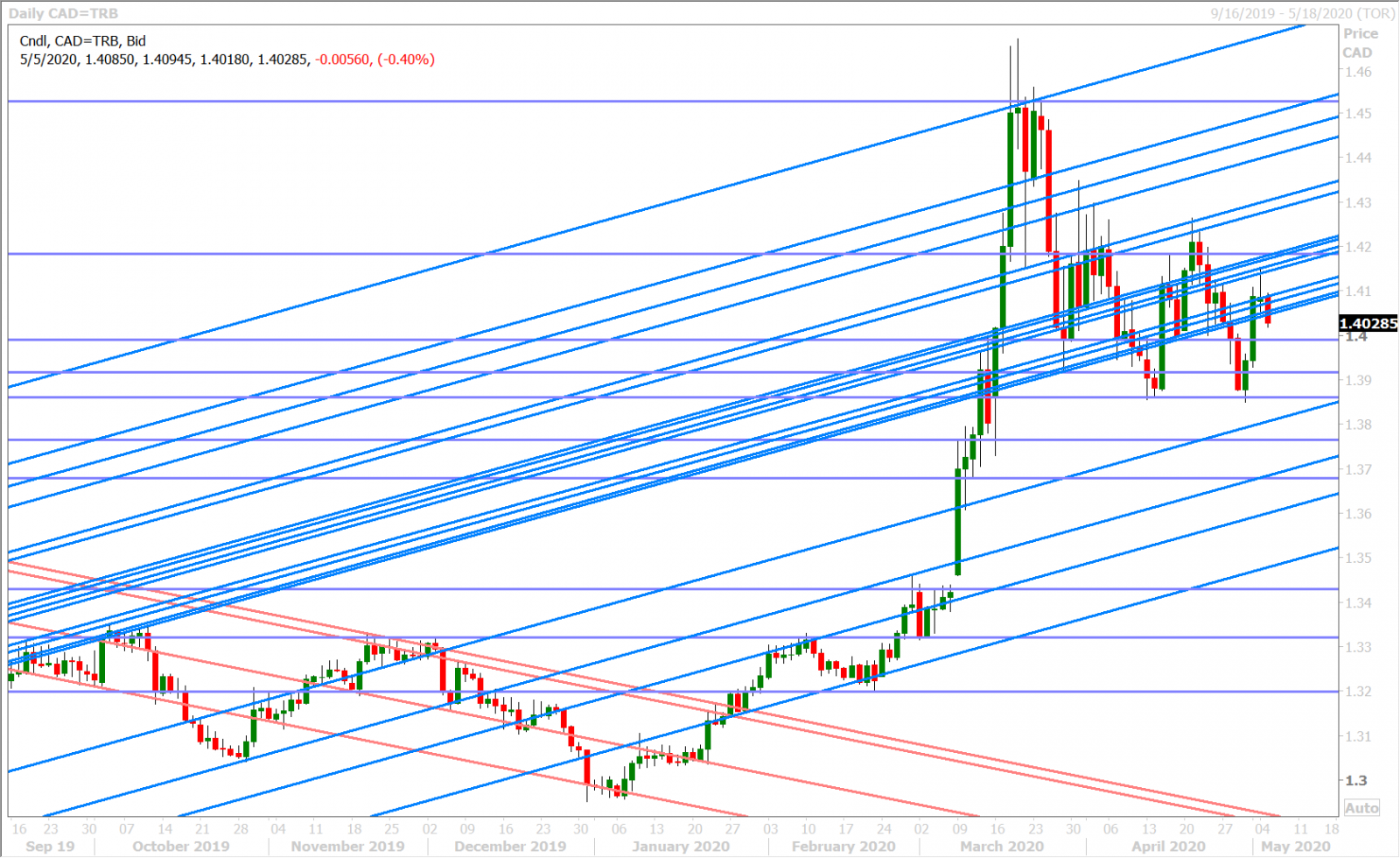

USDCAD

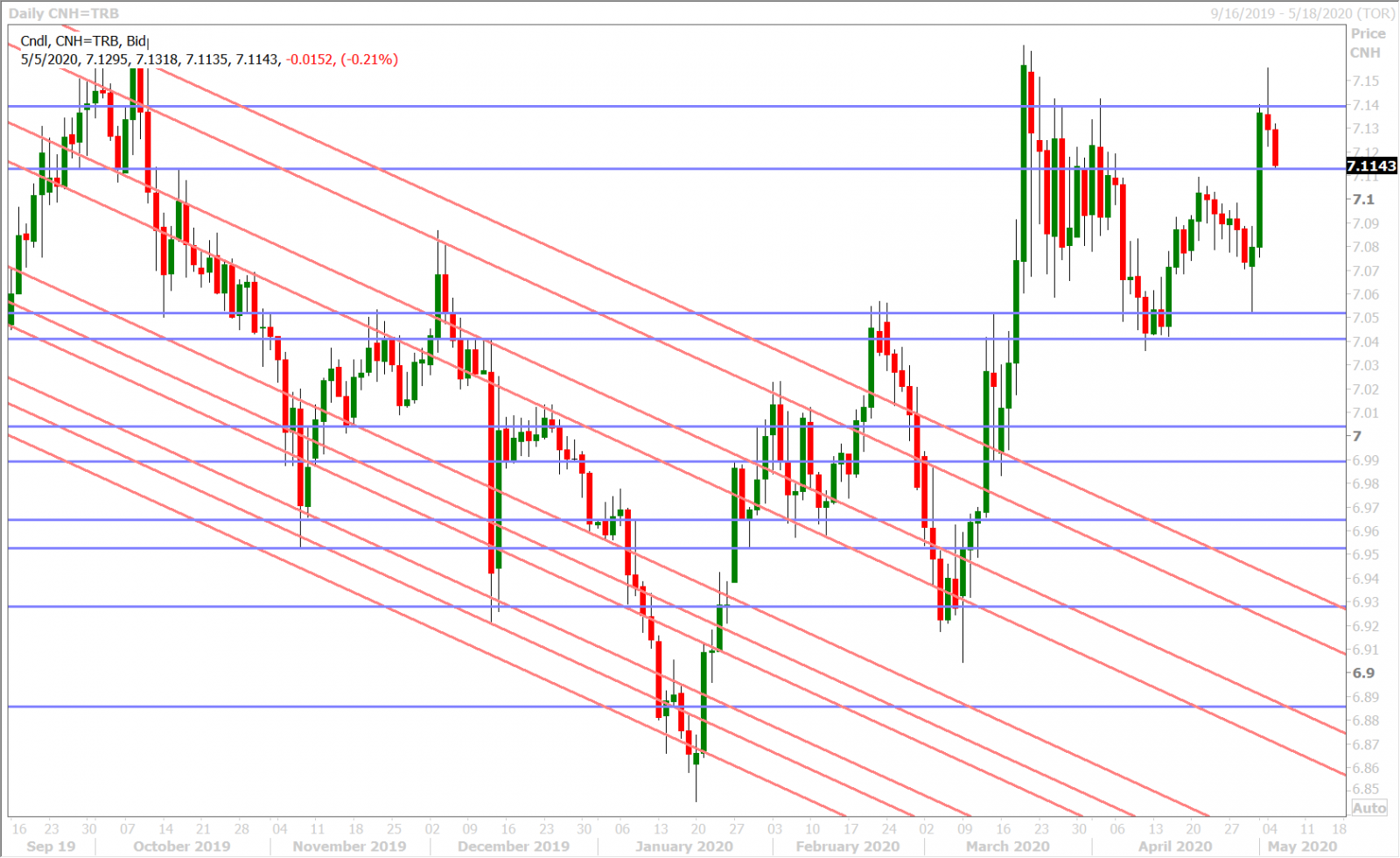

Global risk sentiment took at a hit at the start of Asian trade last night after US Secretary of State Mike Pompeo told ABC News on Saturday that “there is a significant amount of evidence that this [COVID-19] came from that laboratory in Wuhan”. The Associated Press reported on a leaked Department of Homeland Security document on Sunday which said US officials believe China “intentionally concealed the severity” of the coronavirus pandemic to stock up on the medical supplies needed to respond to it. President Trump added a little more fuel to the “risk-off” fire when he said last night that he believed China made a mistake. “I think they made a horrible mistake and didn’t want to admit it”, Trump said at a Fox News town hall. Offshore dollar/yuan punched through the 7.1400 resistance level and the S&P futures fell 3% lower, while the USD and the JPY competed for safe-haven flows in holiday thinned trade. Dollar/CAD extended its recent bounce to the 1.4140-50s.

Some cooler heads seemed to have prevailed when liquidity returned in Europe this morning, but we would be prepared for more US/China headlines, especially considering this week's relatively light data calendar until Friday. The US reports its March Factory Orders data at 10amET this morning (-9.7% MoM expected) and we'll get the US April Non-Manufacturing PMI tomorrow. The US weekly Jobless Claims figures come out on Thursday and the official US & Canadian April Employment will feature on Friday.

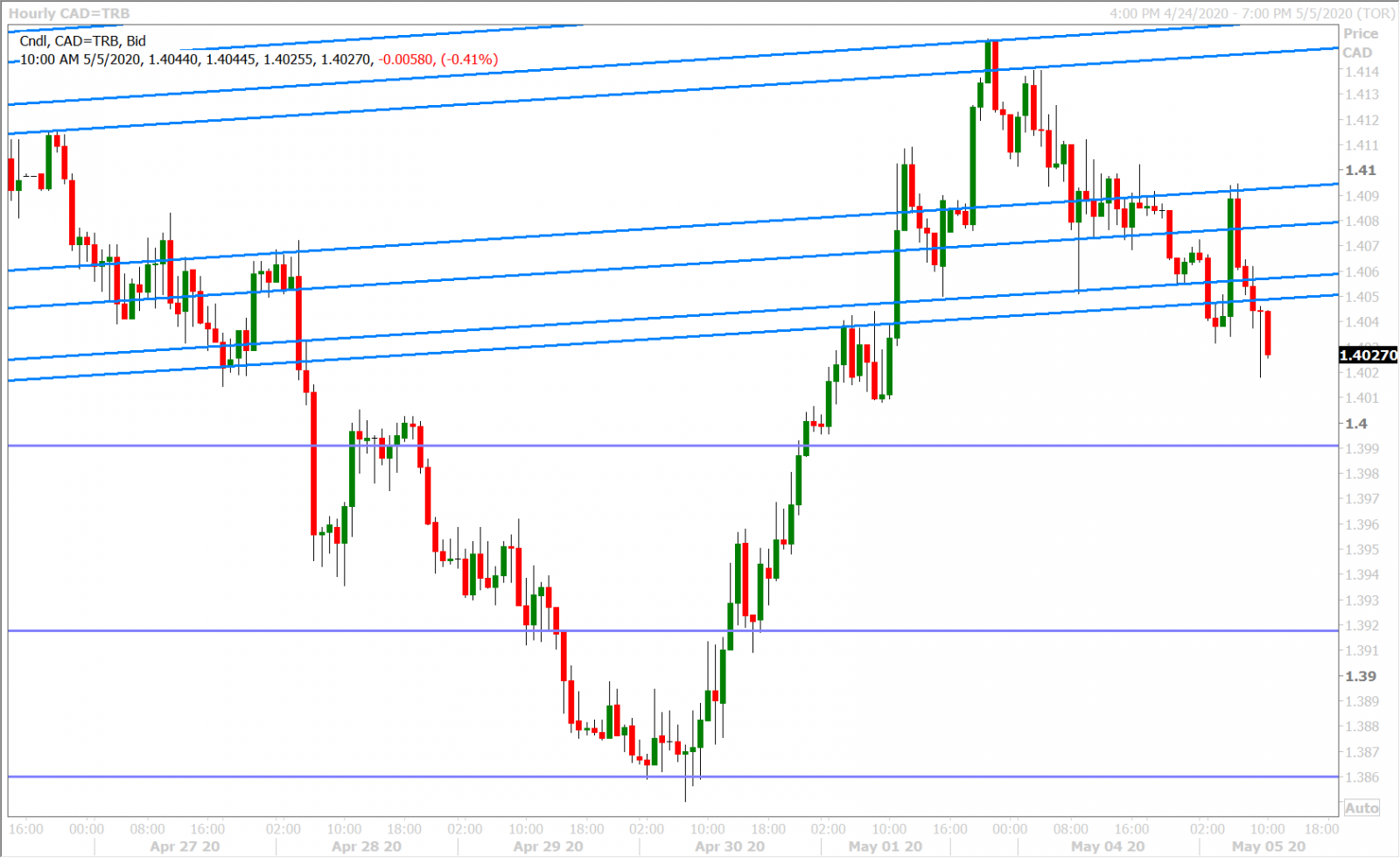

The latest Commitment of Traders report from the CFTC showed the leveraged funds increasing their net long USDCAD position marginally during the week ending April 28 but we believe that market’s neutral chart structure is still intact, as evidenced by last week’s confident bounce off the 1.3850-1.3920 support zone. Last night’s pullback off the 1.4140-50s is not surprising either, as this is just another demonstration of what range-bound activity looks like. All this being said though, we are becoming increasingly acute to signs of a US/China Trade War 2.0 and the possibility for another US dollar funding squeeze; factors that could very well see USDCAD’s price range resolved with a break out to the upside. Pompeo and Trump turned up the dial a bit over the weekend and the benchmark 3-month EURUSD cross currency basis swap now trades back below zero (-0.50bp).

USDCAD DAILY

USDCAD HOURLY

JUNE CRUDE OIL DAILY

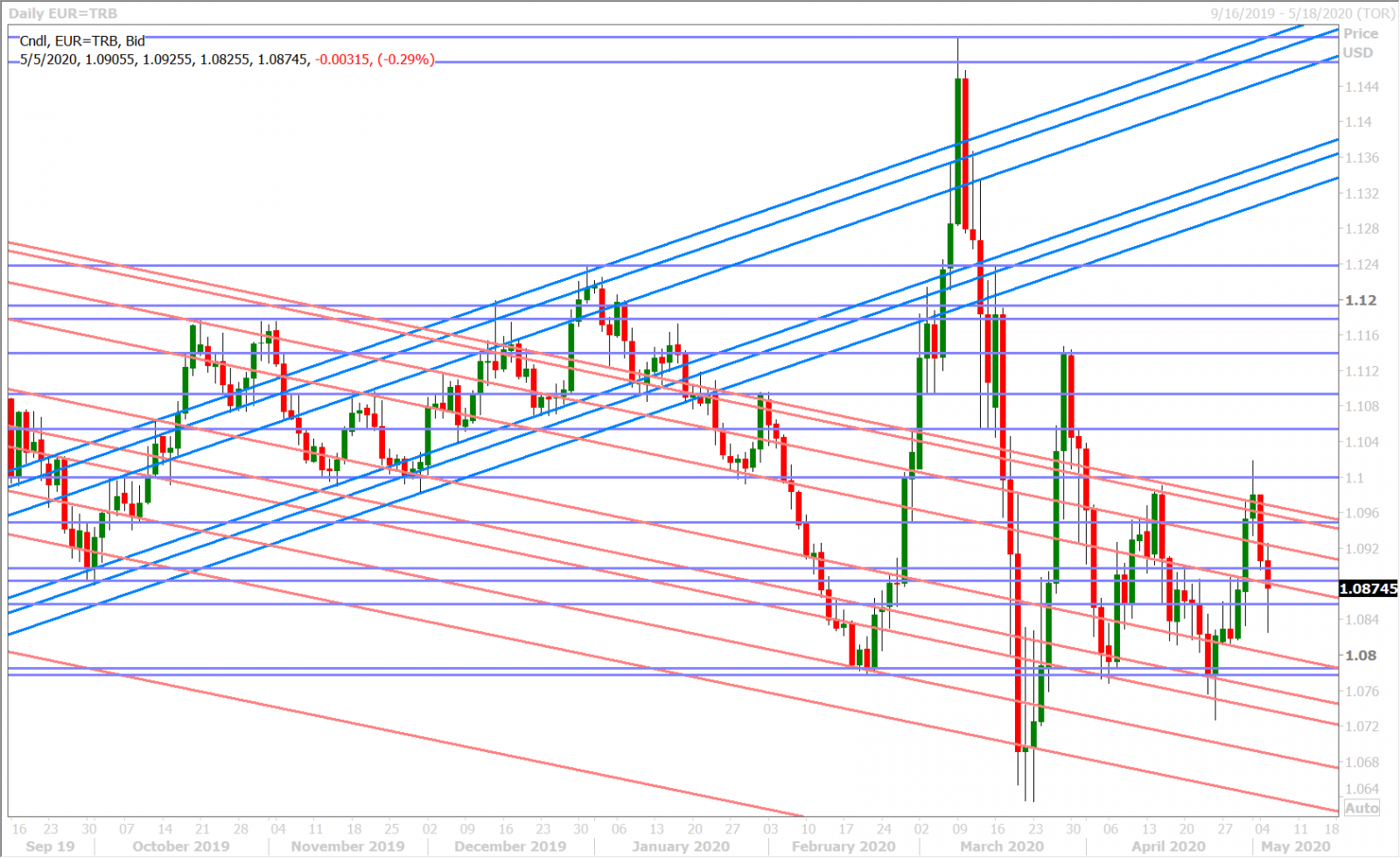

EURUSD

Euro/dollar has slumped back to Thursday’s intra-day support in the 1.0920s this morning as traders re-establish the market’s positive correlation with risk sentiment. Friday’s “odd bid”, as we called it, is now being blamed on lingering month-end USD sales and one-off flows from the London fix, which sounds good in retrospect. We’re just not so sure yet that EURUSD is done with it’s push to the upside. The pullback of the 1.1000 level has been rather measured in our opinion and we think today’s topside option expiries could attract buying interest. The leveraged funds largely left their net long EURUSD position unchanged during the week ending April 28.

The German and Eurozone final April Manufacturing PMIs were reported this morning with a few tenths of a point from their flash readings a couple weeks ago (so no surprises here). The final Services and Composite reads for April will come out on Wednesday, which should be non-events as well. We’ll get some “hard” German economic figures on Wednesday/Thursday though, in the form of the March Industrial Orders and Industrial Output dataset.

EURUSD DAILY

EURUSD HOURLY

BTP/BUND YIELD SPREAD DAILY

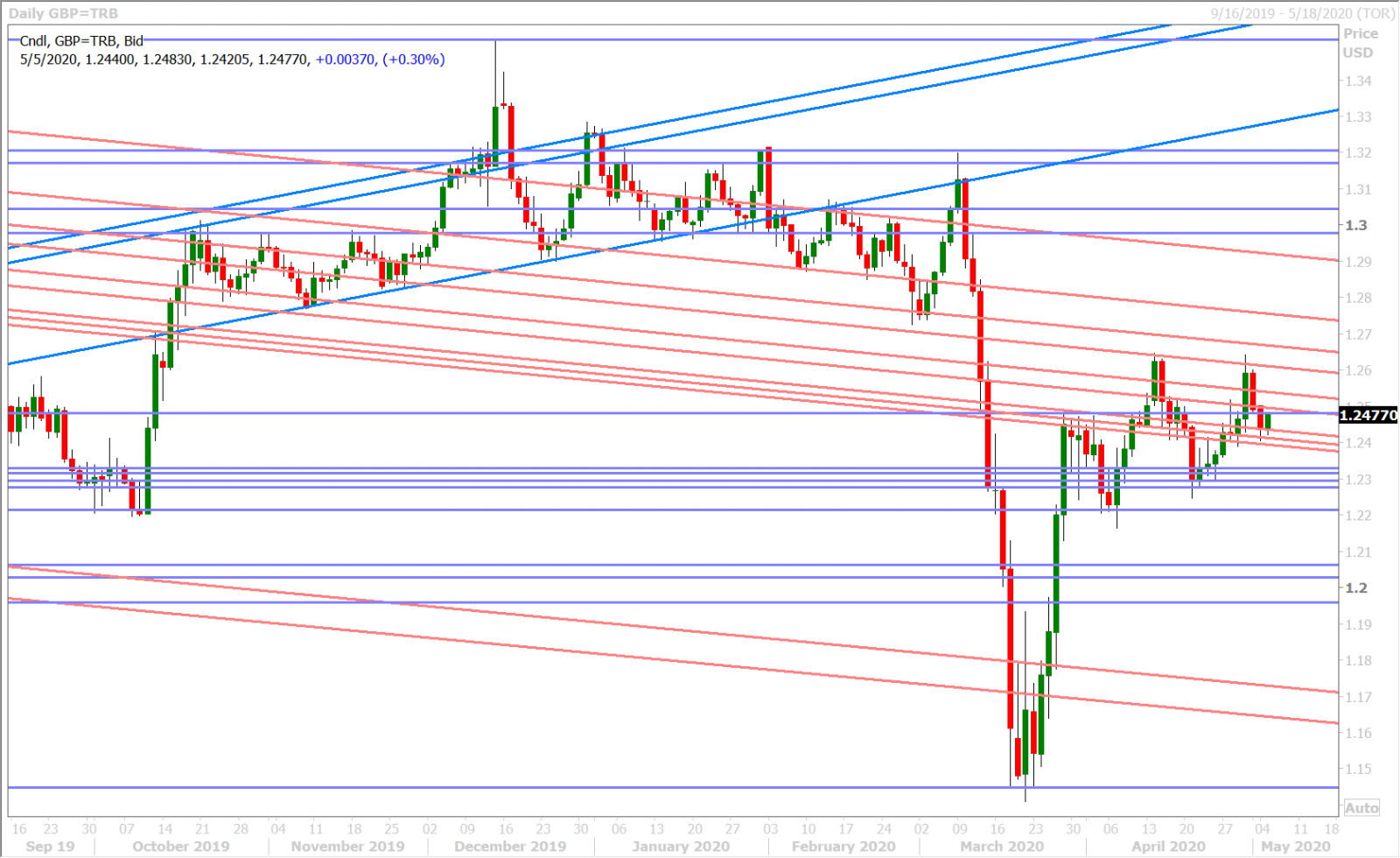

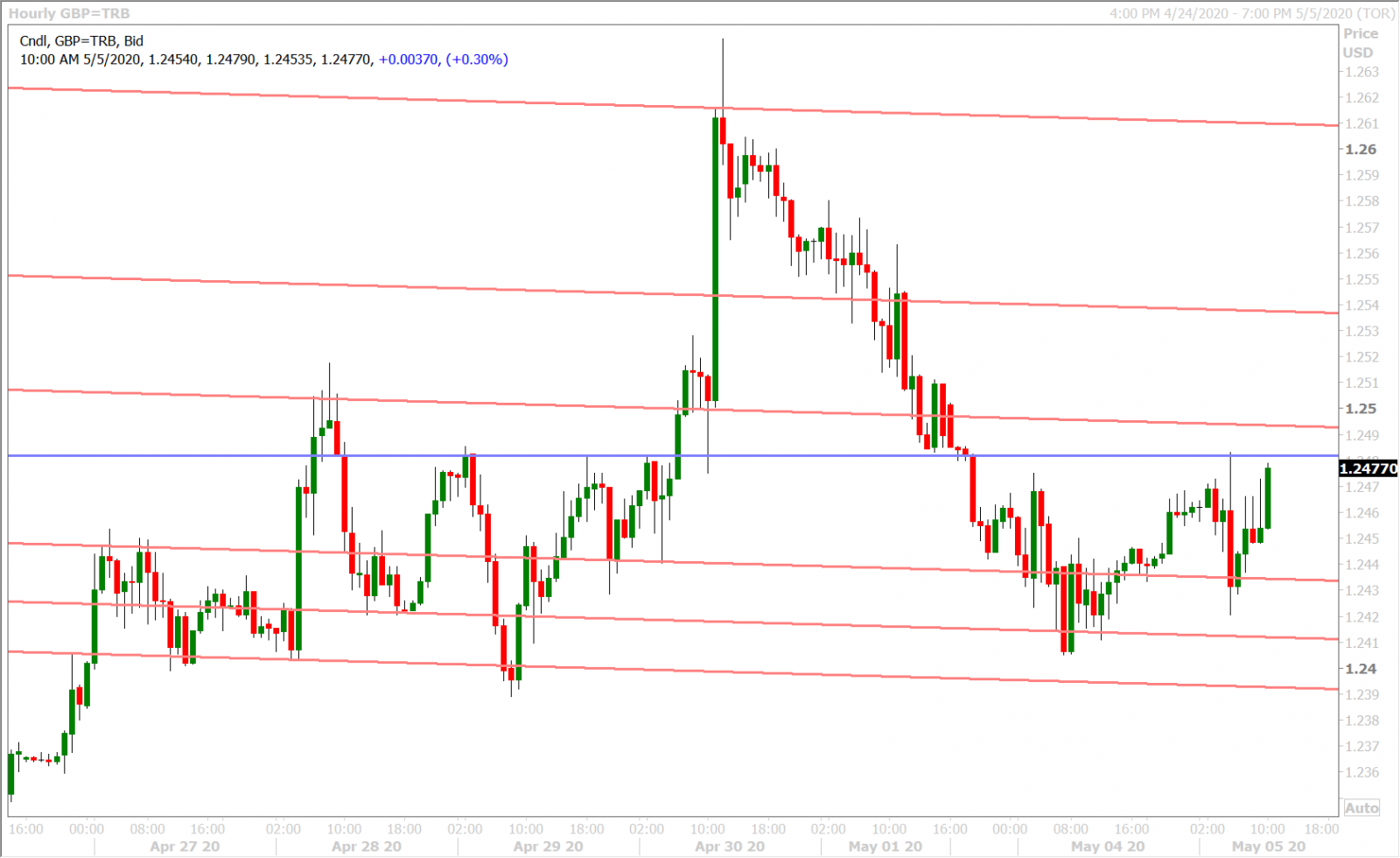

GBPUSD

The sterling disappointment continues this morning after the 1.2480-1.2500 support area gave way at the start of Asian trade last night. The continued pressure on GBPUSD during the rest of Friday’s trade was a pre-cursor to this, following buyer failure above the 1.2540s into the London fix, and the weekend’s increased US/China tension was the ultimate trigger for further sales. The European/early NY session has been very choppy so far, but we have seen buyers step up twice in the 1.2410s. With the 1.2480-1.2500 now gone however, we’re starting to refocus on the bearish head & shoulders pattern that never confirmed itself last Tuesday. The right shoulder is a little taller and more pronounced now and we’d would get another confirmation of the negative pattern with a NY close below the 1.2390s. The leveraged funds increased their new net short position to 7k contracts during the week ending April 28.

The Bank of England will be announcing its latest decision on monetary policy this Thursday and, while no changes to interest rates and the asset purchase program are expected, some traders think a big announcement is coming because the meeting time has been moved back 5 hours to 2amET (vs the normal 7amET), to coincide with the central bank’s detailed economic forecasts in its Financial Stability Report. UK markets will be closed on Friday for the May Bank Holiday.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

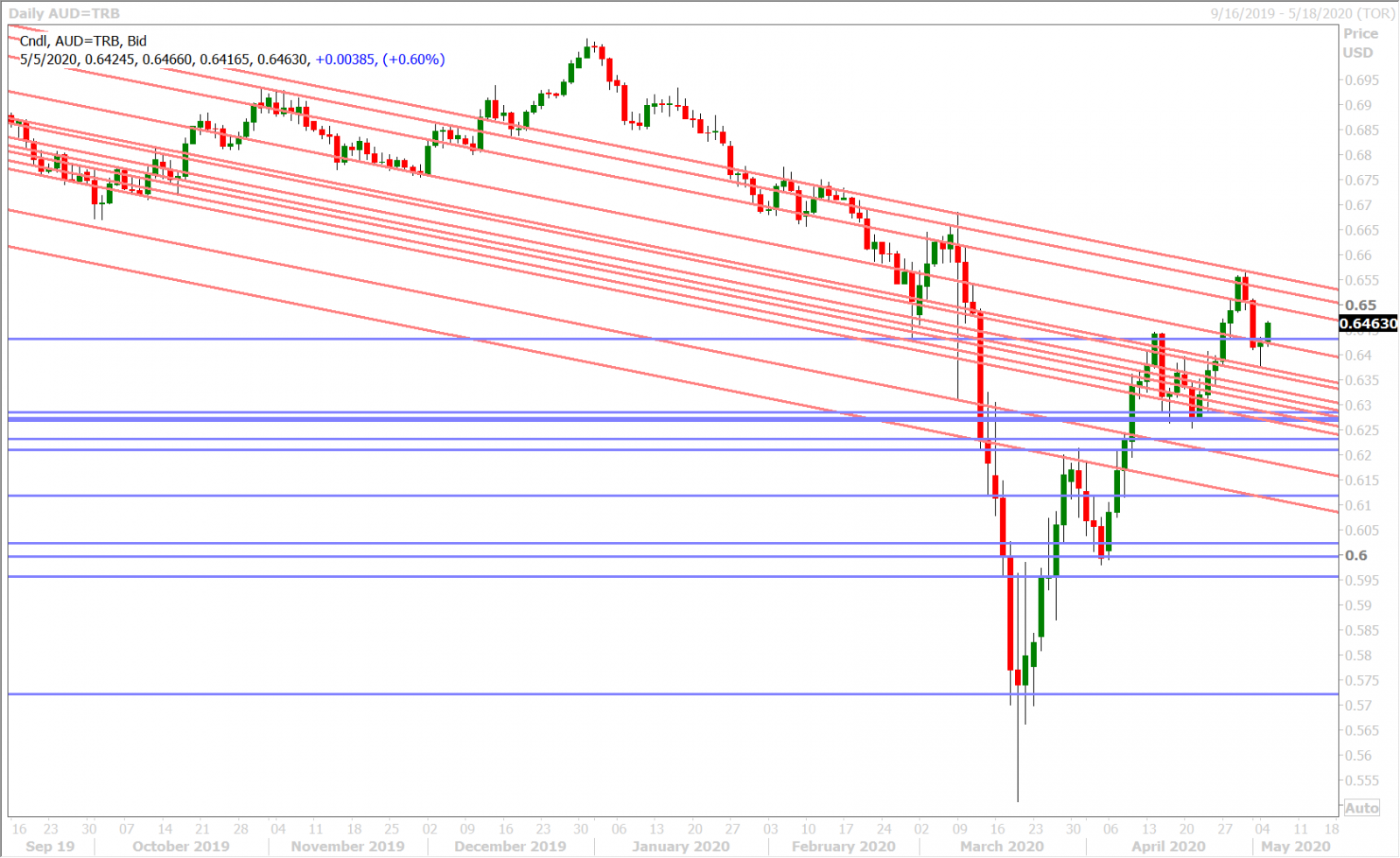

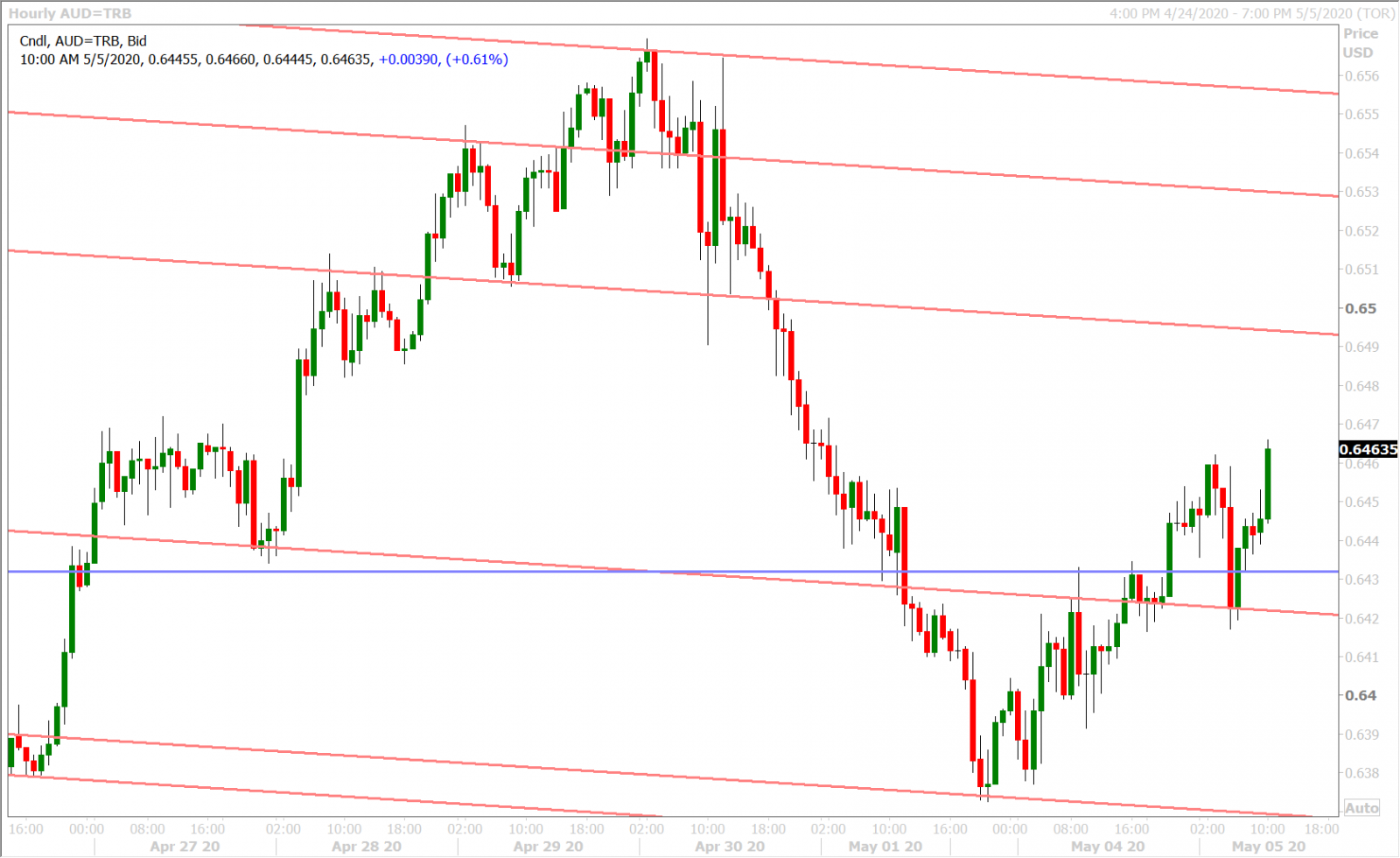

The Australian dollar bounced off chart support in the 0.6370s at the height of last’s risk-off moves, but it’s struggling now to regain the 0.6430s level that was lost in Friday’s trade. Resurgent US/China tensions have very much turned this market around since last Wednesday, and we think more negative headlines could be coming. The Reserve Bank of Australia is expected to keep interest rates on hold and keep its 3yr bond yield target (0.25%) in place tonight when it announces its latest decision on monetary policy at 12:30amET. We wonder though if the press release might be light on detail (and therefore a non-event) given the RBA’s quarterly Statement on Monetary Policy, which is scheduled to be released on Thursday night ET.

Australia reported better than expected Building Approvals data for March last night (-4.0% MoM vs -15.0% expected), but this is a notoriously volatile data set. Aussie Retail Sales for March/Q1 will be reported on Wednesday night ET. The latest Commitment of Traders report from the CFTC showed the leveraged funds increasing their net short AUDUSD position marginally to 38k contracts during the week ending April 28.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

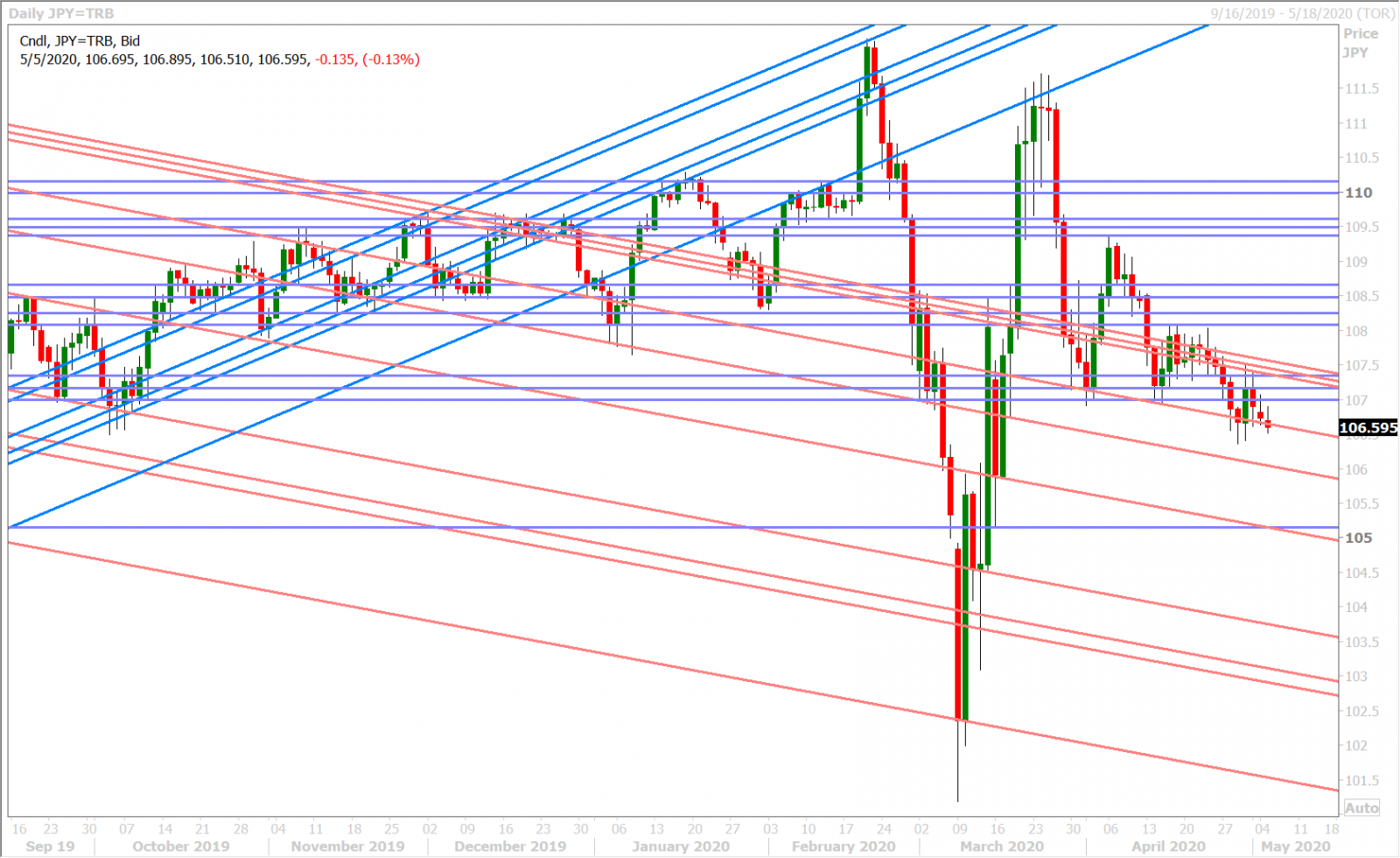

The yen has seen some more competition for safe haven flows today, as the USD rallies across the board following this weekend’s escalation of US/China tensions. Friday’s familiar trend-line support level in the 106.60s has held once again as a result, and we think this could make for some choppy trade until China returns from its Labor Day holiday on Wednesday and Japan returns from its Golden Week holiday on Thursday.

The leveraged funds increased their net short USDJPY position back to their early April highs during the week ending April 28; which turned out to be a good move following the BOJ-inspired fall back below the 107.30s.

USDJPY DAILY

USDJPY HOURLY

US 10YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com