Explosive silver rally leads USD lower over last 24hrs

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- Spot breaks above 19.40s on Monday and surges 7% higher yesterday.

- Over 70Moz of physical silver demanded by longs into July futures expiry.

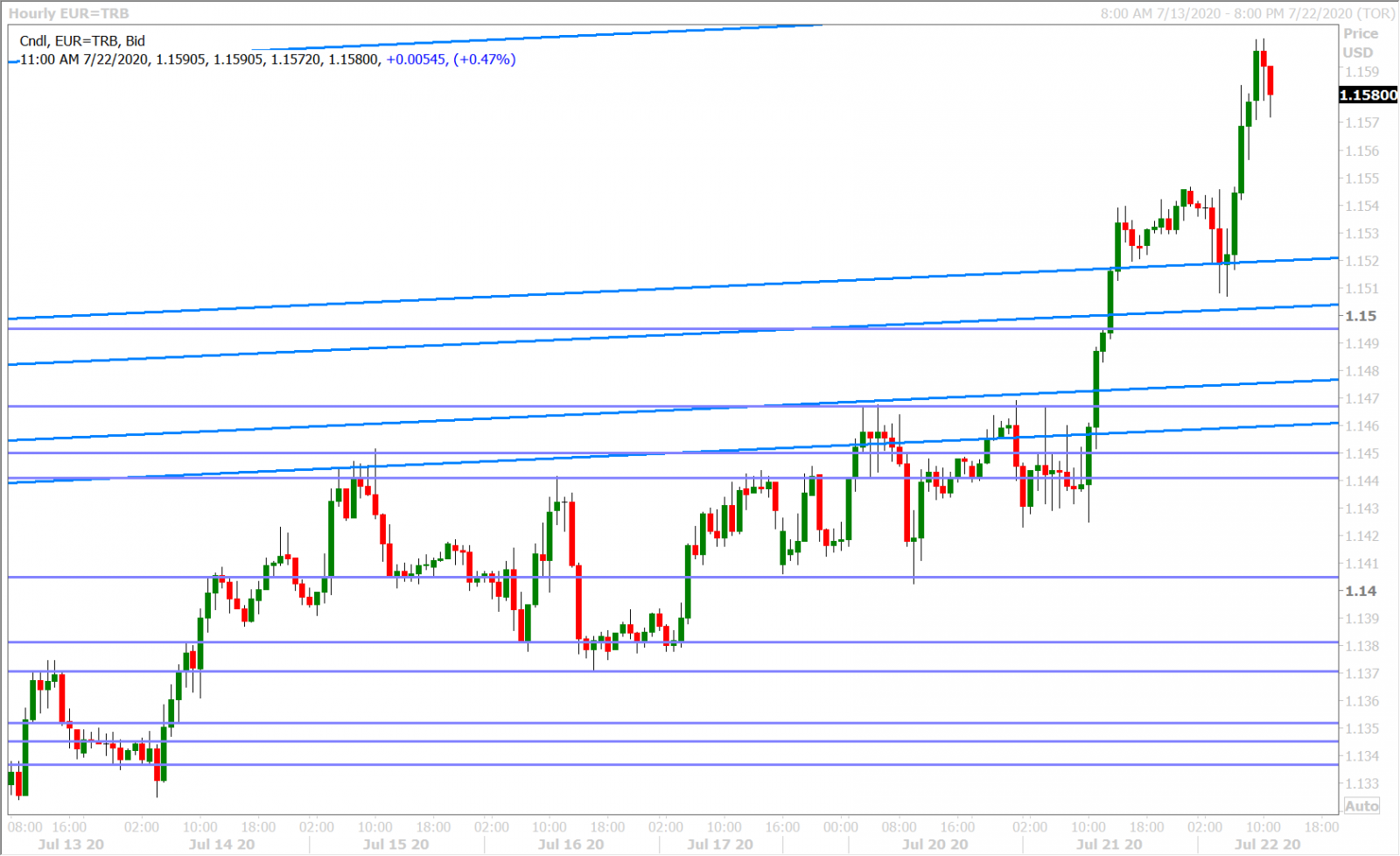

- EURUSD gives up post-EU Summit fade, surges into the 1.15 handle.

- US orders closure of China’s Houston consulate over spying concerns.

- Resulting risk-off helps USD recover, but silver rally recovers into NY open.

- All eyes now on silver prices, off +8% session highs, but still +4% on day.

ANALYSIS

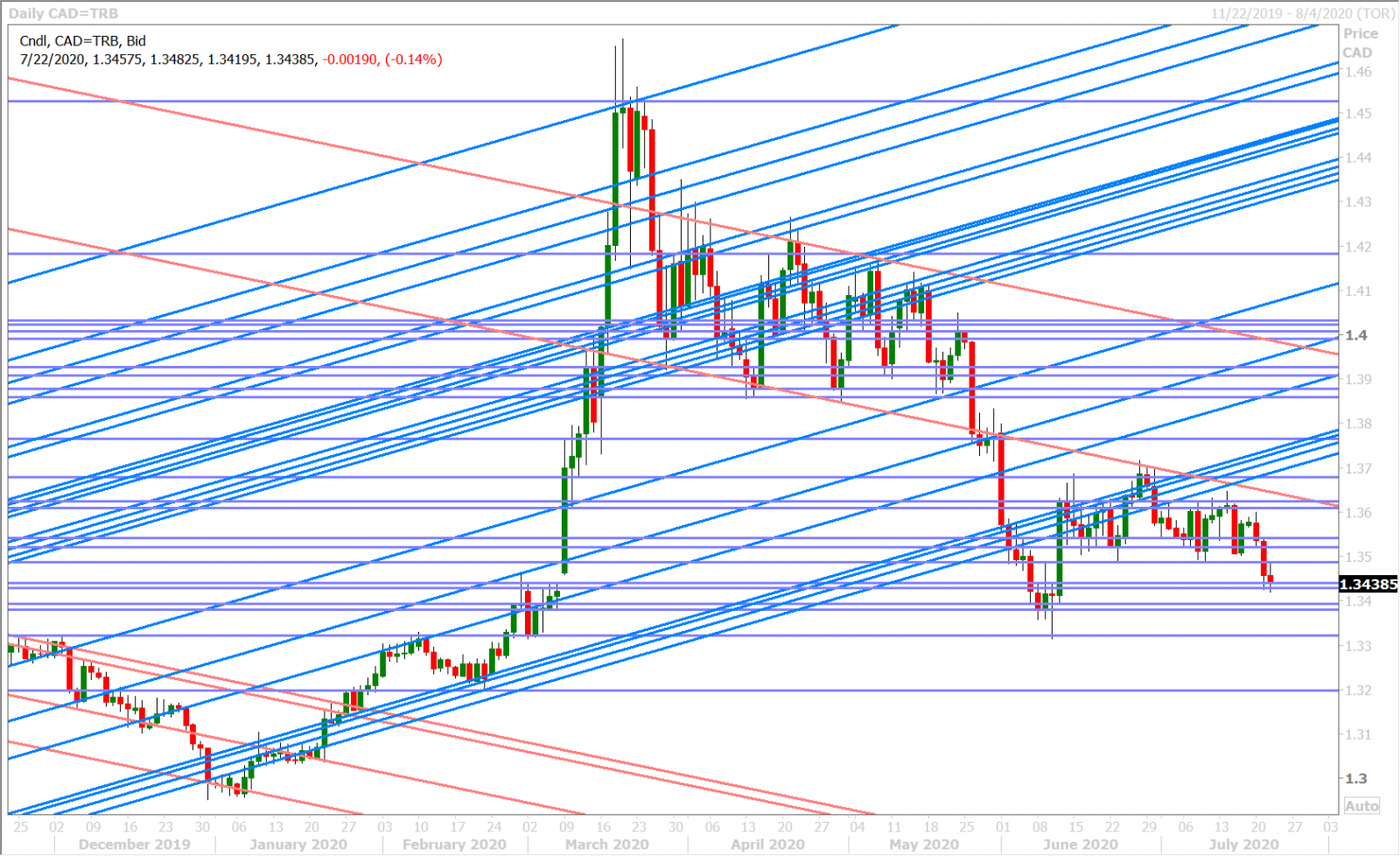

USDCAD

The broader USD attempted to bounce in early NY trade yesterday as EURUSD traders continued to fade 1.1450-70s resistance in the aftermath of an overhyped EU recovery fund deal, but technical breakdowns for the USD against the risk currencies (AUD, CAD, GBP), which were already underway in overnight trade, proved the more dominant force going into the 9amET hour. Spot silver prices then absolutely exploded higher over the next 60mins in a panicky move that saw the EURUSD faders throw in the towel and join the sell-USD party. We can’t say there was a specific headline which sparked the 7% surge higher in the precious metal yesterday, but we would note spot silver’s breakout above 19.40s resistance on Monday and increasing market chatter about the astronomical amount of physical silver (70M ounces) that has been demanded by long futures holders going into next week’s July contract expiry, if we look at the latest COMEX delivery notices report. We’ve witnessed an increased number of instances over the last few months where extreme price movement in the precious metals complex has led broader USD price action on a short-term basis, and so we think this dynamic warrants even closer attention now considering that gold and silver prices are breaking out to multi-year highs.

Spot silver prices continued their surge in Asia last night; corrected lower in Europe this morning amid some broad risk-off flows from the US’ decision to shut China’s consulate in Houston, completely reversed their losses to trade another 8% higher into NY trade, but are now correcting lower once again. The broader USD is now trying to finding a bottom as a result, which has seen the USDCAD selling stall at 1.3430-40s chart support for the time being.

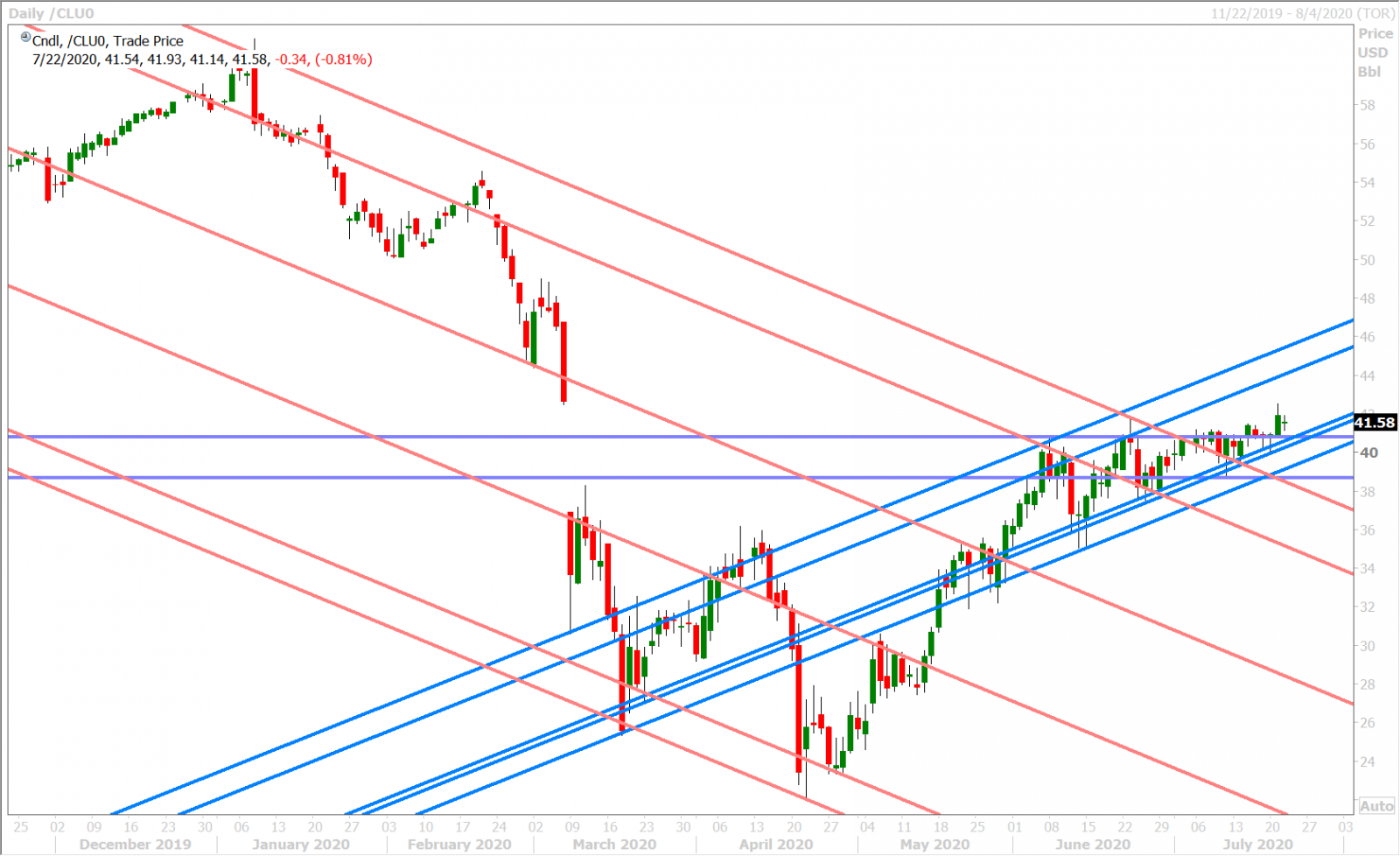

This morning’s higher than expected Canadian CPI figures for June (+0.8% MoM vs +0.4%) were a non-event, as has been the case with most economic data lately. Watch silver prices today and the oil market’s reaction to this morning’s weekly EIA oil inventory report at 10:30amET, after last night’s APIs revealed an unexpected 7.54mln build and pressured September WTI to give up half of yesterday’s breakout gains in overnight trade.

USDCAD DAILY

USDCAD HOURLY

SEP CRUDE OIL DAILY

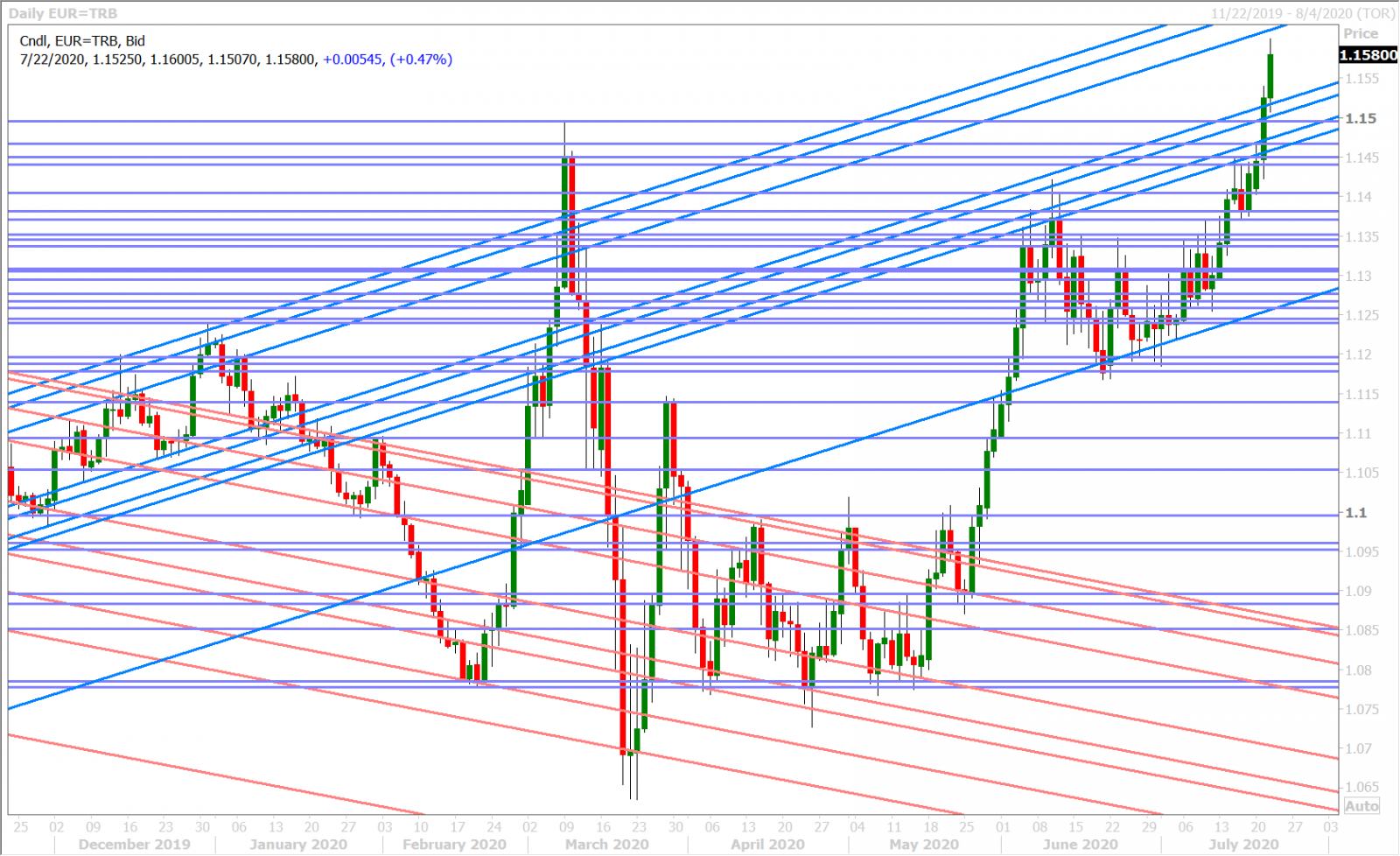

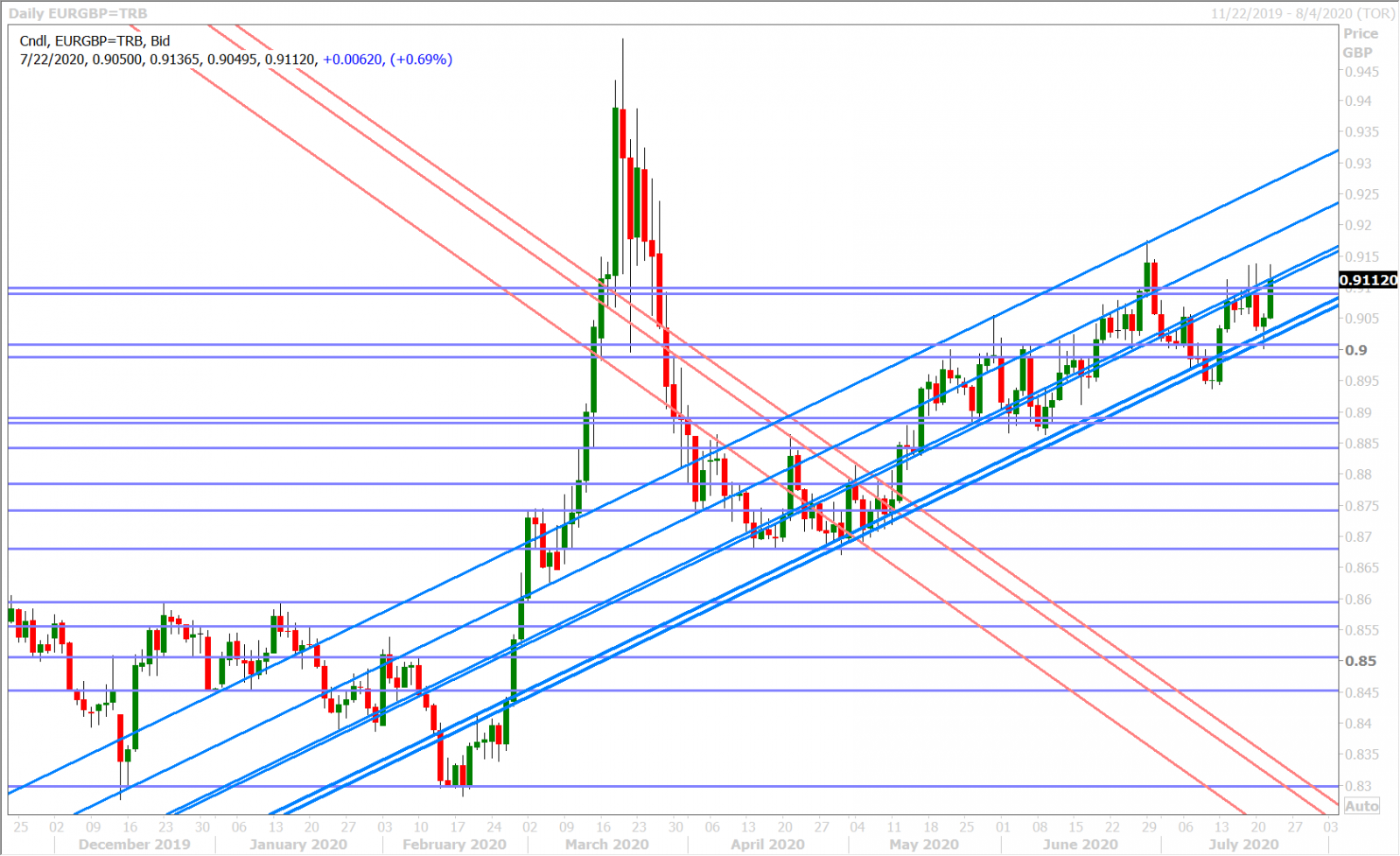

EURUSD

We’ve had to eat a bit of humble pie on our post-EU Summit bearish Euro view over the last 24hrs after yesterday’s explosive silver rally sparked a EURUSD surge past chart resistance in the 1.1450-70s and then the 1.1490-1.1520s. The latter resistance level morphed into support and provided an anchor for buyers during this morning’s US/China-tension driven dip, and we feel as if all eyes are now on silver prices at the moment…which continues fade their early NY +8% session highs. The next major EURUSD chart resistance level lies in the 1.1610-20s.

EURUSD DAILY

EURUSD HOURLY

SPOT SILVER DAILY

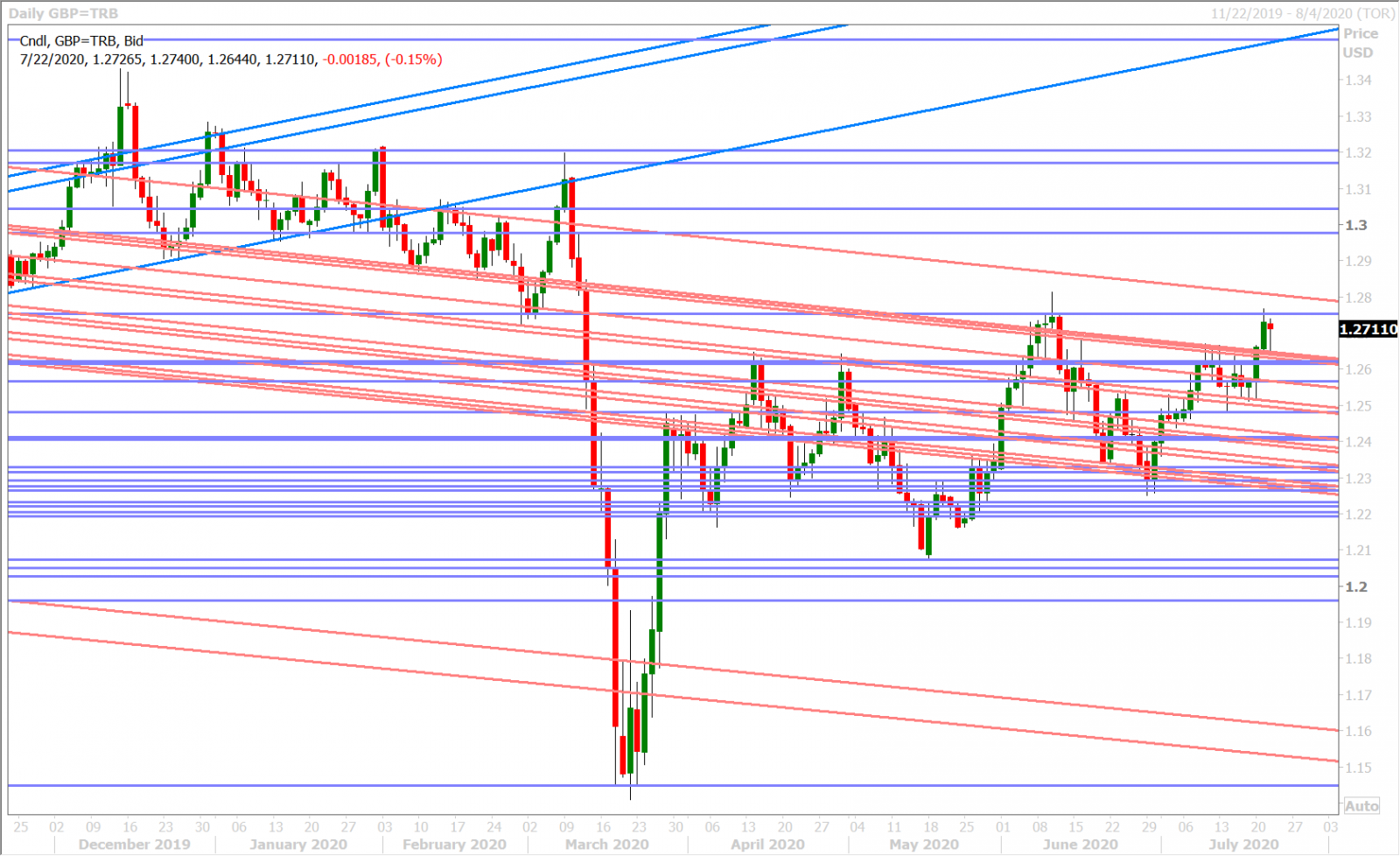

GBPUSD

Sterling continued its rally in NY trade yesterday after silver prices exploded higher during the 9amET hour. Chart resistance in the 1.2750s and a rough final hour of trade for the S&Ps capped GBPUSD into the NY close and, while this morning’s shut down of China’s Houston consulate spurred a mild risk-off move that saw the market give up yesterday’s gains, chart support in the 1.2640s and another silver rally towards today’s NY open has helped sterling recover somewhat. On any other day, the sudden reversal higher for the EURGBP over the last 24hrs would normally have us on the lookout for negative Brexit headlines, but this move feels completely EUR/silver driven.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

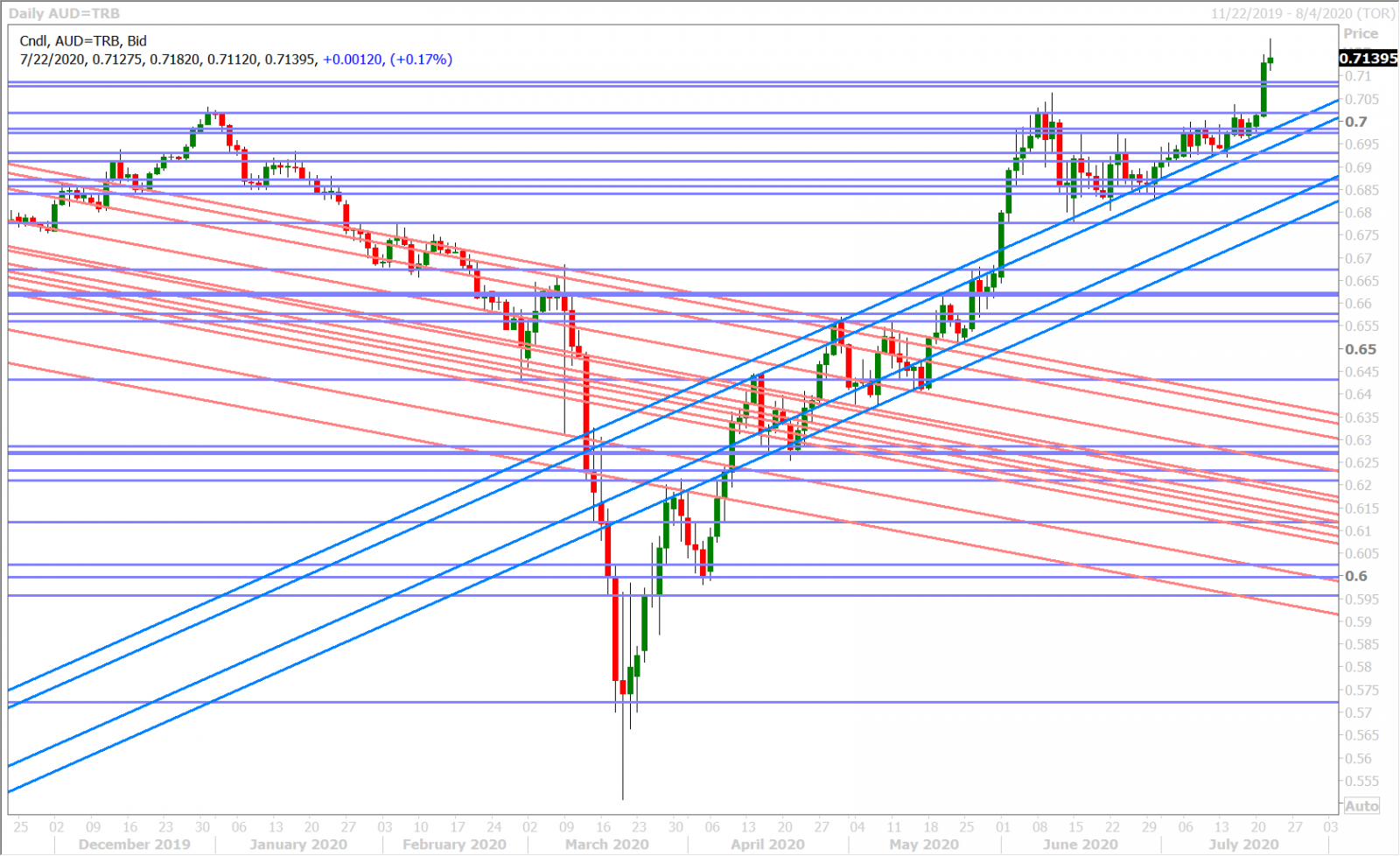

AUDUSD

The Australian dollar didn’t benefit as much from yesterday’s silver surge, but AUDUSD achieved another important technical achievement by closing NY trade well above chart resistance in the 0.7080-90s. Yesterday’s S&P dump into the cash close, this morning’s risk-off move following US/China escalations, and some post-NY open sales in silver have seen a few AUDUSD selling waves come in over the last 24hrs, but the market continues to hold the bulk of its recent gains.

This morning’s decision by the US to shut China’s Houston consulate over spying concerns had a pronouncedly negative effect on the Chinese yuan. Off-shore dollar/yuan vaulted 400pts to the 7.01 handle, but chart resistance around the 7.0140s and silver-led USD selling since the 5amET hour has seen USDCNH settle down a bit. More here from the Financial Times.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

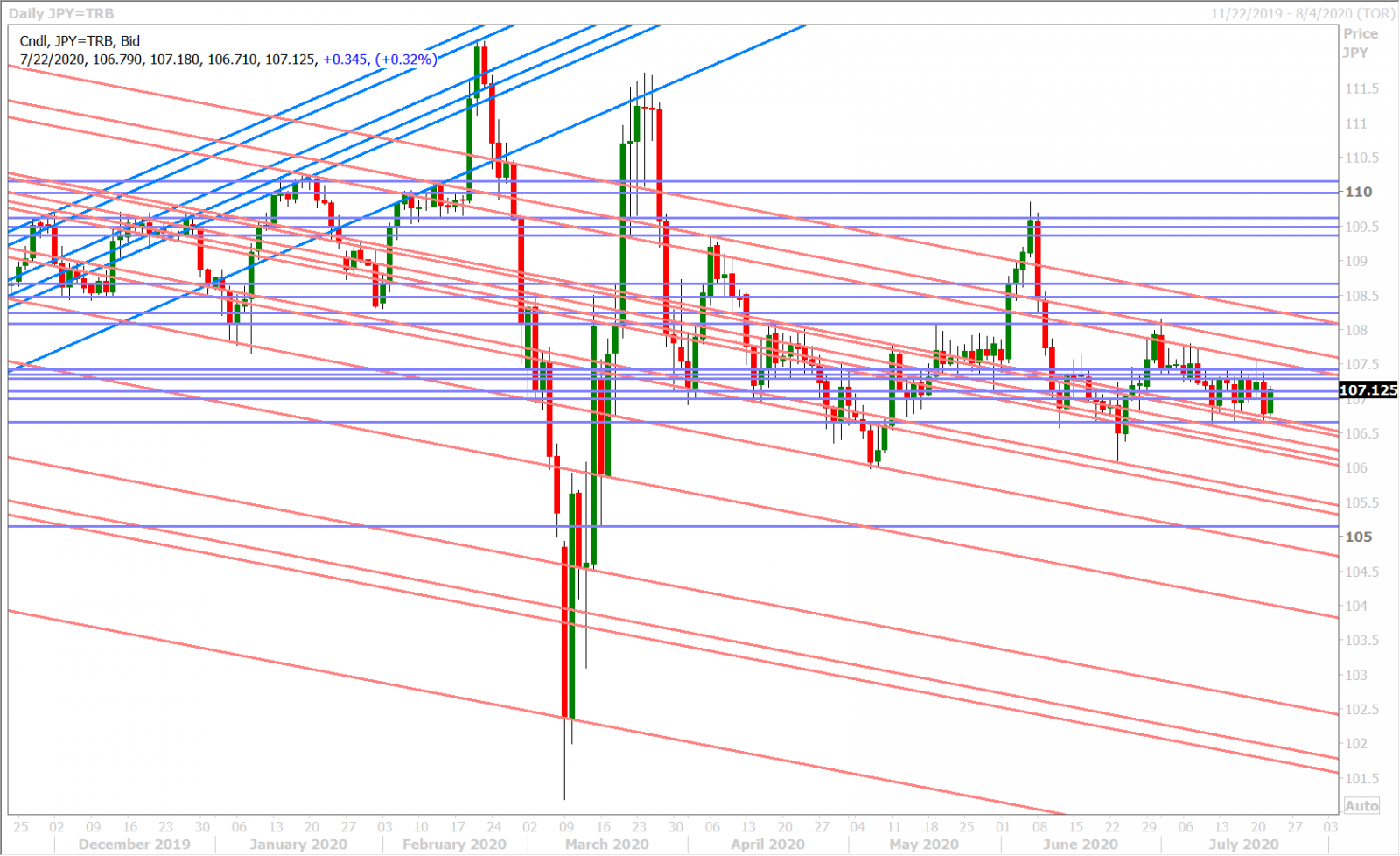

USDJPY

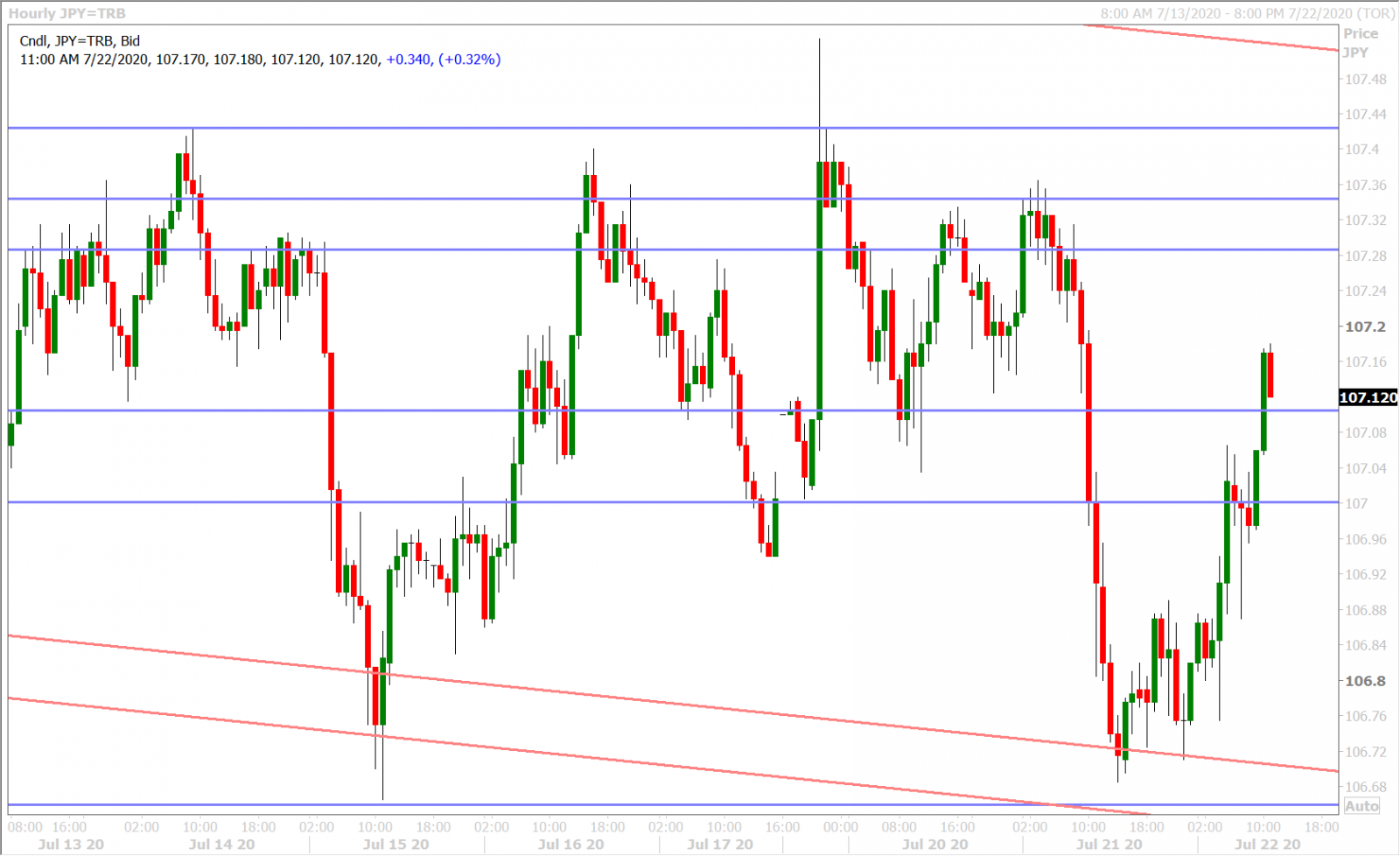

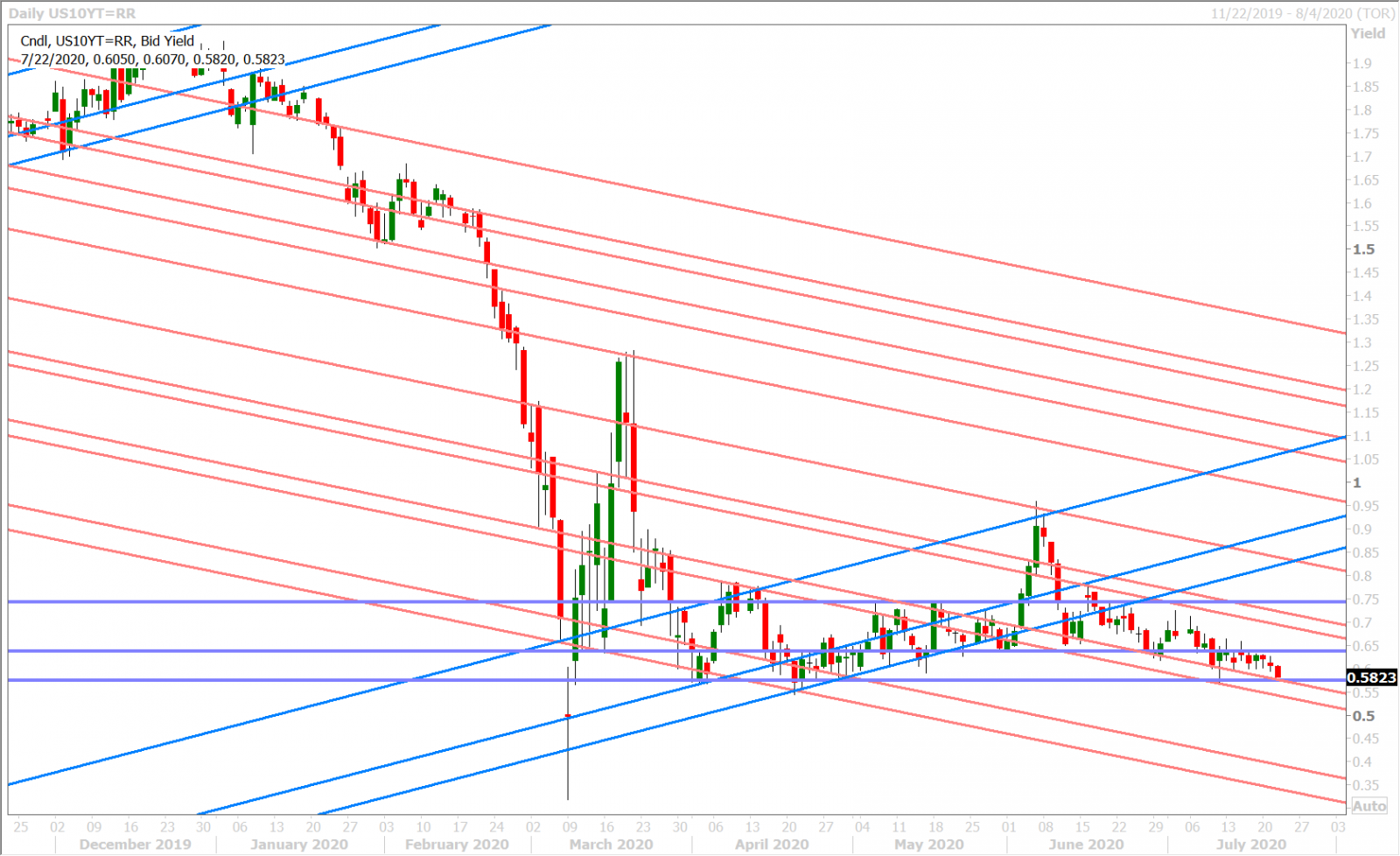

Dollar/yen got dragged lower with broad, silver-led, USD selling yesterday, but today’s bounce back above the 107 handle has been challenging to explain in light of continued USD pressure and the familiar downbeat tone to US yields. Perhaps we could be seeing a bit of a “sell-Japan” trade remerge here as Japan reported a record 747 new coronavirus cases this morning?

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com