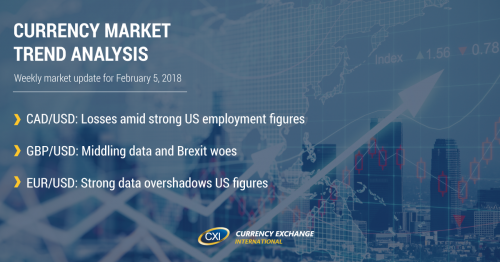

Currency Market Trend Analysis: February 5, 2018

By The Numbers: Your FX Week In Review

Currency Calendar

| Date | Releases / Holiday | |

|---|---|---|

| February 5, 2018 | Market Services PMI (Jan) | EMU/USA |

| February 5, 2018 | ECB President Draghi’s Speech | EMU |

| February 6, 2018 | BRC Like-For-Like Retail Sales (Jan) | UK |

| February 6, 2018 | German Buba President Weidmann speech | Germany |

| February 6, 2018 | Trade Balance (Dec) | USA |

| February 6, 2018 | International Merchandise Trade (Dec) | Canada |

| February 6, 2018 | Ivey Purchasing Managers Index (Jan) | Canada |

| February 7, 2018 | Non-monetary policy’s ECB meeting | EMU |

| February 7, 2018 | Consumer Credit Change (Dec) | USA |

| February 8, 2018 | RICS Housing Price Balance (Jan) | UK |

| February 8, 2018 | Imports/Exports (Dec) | Germany |

| February 8, 2018 | Economic Bulletin | EMU |

| February 8, 2018 | BoE Interest Rate Decision | UK |

| February 8, 2018 | Monetary Policy Summary | UK |

| February 8, 2018 | Housing Starts (Jan) | Canada |

| February 9, 2018 | Industrial/Manufacturing Production | UK |

| February 9, 2018 | Baker Hughes US Oil Rig Count | USA |

| February 9, 2018 | Unemployment Rate (Jan) | Canada |

Upcoming bank holidays and impactful report releases for select countries.

Market Analysis

CAD/USD - Canadian Dollar

CAD/USD opened last week at 0.8124 and closed at 0.8049 – depreciating by 0.92% as Canadian CPI inflation slowed down, crude prices faltered, and US employment figures bettered expectations.

The CAD was under pressure this last week, following a slowdown in Canadian headline CPI inflation from 2.1% to 1.9% YoY. These data were partially balanced by a respectable monthly GDP growth of 0.4% - in-line with market expectations. The commodity-sensitive Loonie was weighed down further by sliding oil prices triggered by an announced expansion in Iraqi oil production, and fears that US shale will pick up in H2 2018.

The USD was underpinned by rising treasury yields and a stellar jobs report – 200,000 new jobs in January against a 180,000 expectation. These strong figures compounded the Loonie’s commodity and domestic data-inspired losses.

It is of note that the CAD is currently overvalued in terms of interest rate differentials, a measurement often used as a short-term predictor of currency exchange movements.

1. International Merchandise Trade (Dec): Tuesday, February 6th

2. Ivey Purchasing Managers Index (Jan): Tuesday, February 6th

3. Housing Starts (Jan): Thursday, February 8th

4. Unemployment Rate (Jan): Friday, February 9th

Forex Charts powered by Investing.com

Forex Charts powered by Investing.com

GBP/USD - British Pound

GBP/USD opened last week at 1.4157 and closed at 1.4122 – depreciating by 0.25% as US jobs reports bettered expectations, UK manufacturing and Markit PMI’s missed the mark, and a leaked Brexit report created jitters.

UK data was tilted to the downside this past week. Markit’s services PMI fell to 53.0 from 54.2 in December, while the Manufacturing Purchasing Mangers’ Index fell from 56.2 to 55.3. Additionally, the Manufacturing sector reported slowed growth and rising prices. The effects of these poor data were compounded by strong US figures.

Politics continues to weigh on the Sterling. A leaked Brexit reports suggest that all forms of Brexit will damage the UK economy, in particular raising the possibility of energy supply shortages and corresponding price increases. Questions over Prime Minster May’s leadership cropped up again this week, with MP’s worrying about upcoming local elections in light of faltering popularity.

The BoE’s Governor Carney lent some support to the GBP, acknowledging that the Sterling has exceeded the inflation target, but that deviations were due to the GBP’s depreciation. He went on to say that as slack is removed from the UK economy, the focus of the BoE will turn more to correcting inflation.

This week markets will likely look to the retail sales and manufacturing production data for impetus. Though the BoE does have an interest rate decision, is it unlikely that rates will change, and market reactions will likely be muted.

1. BRC Like-For-Like Retail Sales (Jan): Tuesday, February 6th

2. RICS Housing Price Balance (Jan): Thursday, February 8th

3. BoE Interest Rate Decision: Thursday, February 8th

4. Monetary Policy Summary: Thursday, February 8th

5. Industrial/Manufacturing Production: Friday, February 9th

Forex Charts powered by Investing.com

Forex Charts powered by Investing.com

EUR/USD - European Central Bank Euro

EUR/USD opened last week at 1.246 and closed at 1.2459 – appreciating by 0.26% despite strong US data, as Eurozone CPI bettered expectations and Q4 GDP came it at a robust 2.7% YoY.

The common currency appreciated against the USD this past week, as Eurozone (EZ) data continued to come in strong. The annual EZ CPI came in at 1.4%, surprising to the up-side. This was partially balanced by core figures which dropped to 0.9% against a 1.0% expectation. GDP figures came in strong, following Q3’s 2.8% YoY rise with 2.7% for Q4. The EUR was also underpinned by German unemployment, which hit a record low of 5.5%.

This will be a relatively data-light week for the common currency, with US politics and Markit Services PMI likely being key determinants.

1. Markit Services PMI (Jan, EMU): Monday, February 5th

2. ECB President Draghi’s Speech: Monday, February 5th

3. German Buba President Weidmann speech (Germany): Tuesday, February 6th

4. Non-monetary policy’s ECB meeting (EMU): Wednesday, February 7th

5. Imports/Exports (Dec, Germany): Thursday, February 8th

6. Economic Bulletin (EMU): Thursday, February 8th

Forex Charts powered by Investing.com

Forex Charts powered by Investing.com

Get more Currency Market Trend Analysis >>

Sign up to get CXI's Currency Market Trend Analysis sent to your inbox weekly >>

FX Market Pro

Corporations & Financial Institutions: Want to get ahead of the curve for the upcoming week? Get CXI's currency market trend analysis sent directly to your inbox weekly.

Sign Up

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com