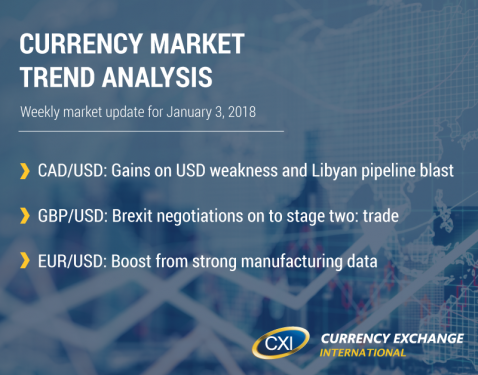

Currency Market Trend Analysis: January 3, 2018

Looking For International Payments Solutions?

Get access to our free whitepaper and unlock everything you're missing.

Learn More

By The Numbers: Your FX Week In Review

Currency Calendar

| Date | Releases / Holiday | |

|---|---|---|

| January 1, 2018 | New Year’s Day | Many |

| January 2, 2018 | Markit Manufacturing PMI’s | Many |

| January 3, 2018 | Unemployment Rate (Dec) | Germany |

| January 3, 2018 | Construction PMI (Dec) | UK |

| January 3, 2018 | ISM Manufacturing PMI (Dec) | USA |

| January 3, 2018 | FOMC Minutes | USA |

| January 4, 2018 | Markit Services PMI (Dec) | USA, EMU, UK |

| January 4, 2018 | Consumer Credit | UK |

| January 4, 2018 | Jobless Claims | USA |

| January 5, 2018 | Retail Sales (Nov) | Germany |

| January 5, 2018 | CPI (Dec)/PPI (Nov) | EMU |

| January 5, 2018 | Unemployment Rate (Dec) | USA/Canada |

| January 5, 2018 | Ivey Purchasing Managers Index (Dec) | Canada |

Upcoming bank holidays and impactful report releases for select countries.

Market Analysis

CAD/USD - Canadian Dollar

CAD/USD opened last week at 0.7863 and closed at 0.7953 – appreciating by 1.15% as WTI broke above $60 and US data disappointed.

This was a relatively quiet week for the CAD due to the holiday season, leaving market impetus to external factors. The CAD was underpinned early in the week by reports that Libya lost around 90,000 barrels per day of crude production due to a blast on a pipeline. Riding this news, WTI broke $60, boosting the commodity-linked CAD.

Further support was found in broad-based USD weakness. A variety of US data missed the mark this past week, including: goods trade deficit, weekly jobless claims, consumer confidence, durable goods, core PCE price index, and the Richmond Fed manufacturing index. These data were partially balanced by pending home sales, which rose 0.2% against an expectation of a 0.5% contraction. Year over year, the dollar index has lost over 9.0%, marking the first decline since 2012.

1. New Year’s Day: Monday, January 1st

2. Markit Manufacturing PMI’s: Tuesday, January 2nd

3. Unemployment Rate (Dec): Friday, January 5th

4. Ivey Purchasing Managers Index (Dec): Friday, January 5th

Forex Charts powered by Investing.com

Forex Charts powered by Investing.com

GBP/USD - British Pound

GBP/USD opened last week at 1.3362 and closed at 1.3503 – appreciating by 1.06% as the EU27 approved the transition to stage two of Brexit negotiations (trade).

After a very bumpy road, rife with delays, Brexit negotiations have moved on to stage two - trade. The next round of negotiations may be even more contentious than the first, but this marks an important step forward for Brexit, and for confidence in the Sterling/May’s government. Stage two of negotiations will likely begin with a focus on the transitional period, to take place immediately after Brexit initiates in March 2019.

1. New Year’s Day: Monday, January 1st

2. Markit Manufacturing PMI’s: Tuesday, January 2nd

3. Markit Services PMI (Dec): Thursday, January 4th

Forex Charts powered by Investing.com

Forex Charts powered by Investing.com

EUR/USD - European Central Bank Euro

EUR/USD opened last week at 1.1863 and closed at 1.1999 – appreciating by 1.15% on strong EZ Markit Manufacturing PMIs.

The Eurozone ended the year strong, with Markit Manufacturing PMIs hitting the highest level since 1997 (and Germany’s PMI setting a record). Going into 2018, the two biggest questions are will QE come to a close after the 9 month tapered extension resolves, and subsequently, when will the ECB hike rates. Markets currently price in a 50% chance of a rate hike in 2018. The Euro is currently under-valued by measure of purchasing power parity (1.20 vs. PPP of 1.30). Although the ECB seems keen to underplay the Euro and avoid further appreciation, PPP and strong growth indicate the Euro may continue to appreciate throughout 2018.

1. New Year’s Day: Monday, January 1st

2. Markit Manufacturing PMI’s: Tuesday, January 2nd

3. Unemployment Rate (Dec, Germany): Wednesday, January 3rd

4. Markit Services PMI (Dec, EMU): Thursday, January 4th

5. Retail Sales (Nov): Friday, January 5th

6. CPI (EMU, Dec): Friday, January 5th

7. PPI (EMU, Nov): Friday, January 5th

Forex Charts powered by Investing.com

Forex Charts powered by Investing.com

Get more Currency Market Trend Analysis >>

FX Market Pro

Corporations & Financial Institutions: Want to get ahead of the curve for the upcoming week? Get CXI's currency market trend analysis sent directly to your inbox weekly.

Sign Up

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com