Could US/China Trade War 2.0 + another period of USD funding stress be upon us?

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.gvf

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- President Trump threatens new tariffs on China over handling of coronavirus.

- China releases animated propaganda video, mocking US’ coronavirus response.

- Chinese yuan selloff leads overnight risk-off move. AUDUSD punished.

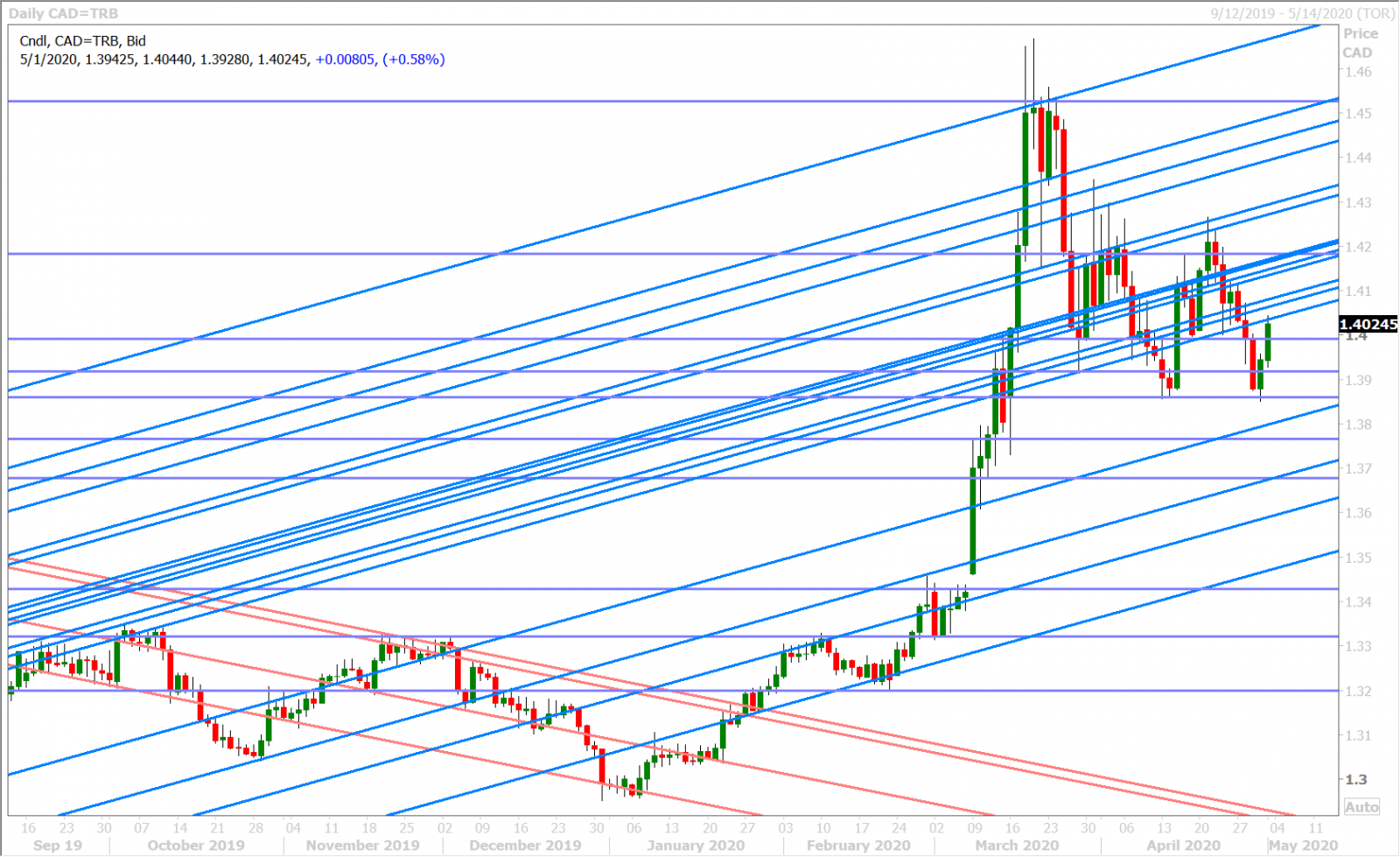

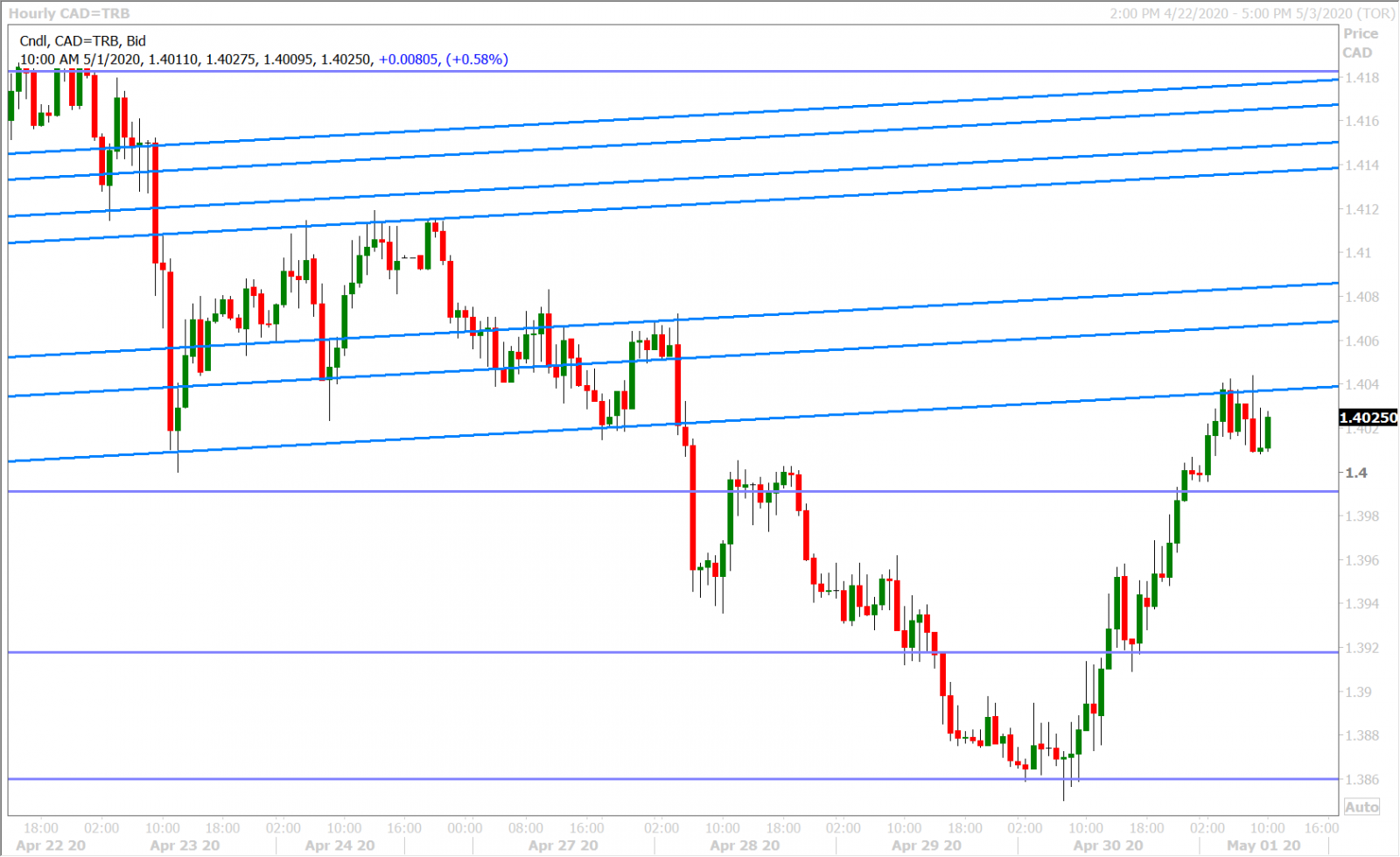

- USDCAD continues bounce off range lows after 1.3920s regain into NY close.

- Funding currencies (EUR & JPY) outperforming. Signs of US dollar funding stress returning.

- BREAKING: US April ISM Manufacturing PMI beats expectations, 41.5 vs 36.9

ANALYSIS

USDCAD

Is it time to start preparing for round two of the famed US/China trade war from last year? Global market participants certainly appear to be doing so given the rhetoric out of President Trump over the last 36hrs. We’ve gone from Trump thinking about retaliation against China for their mishandling of the coronavirus, to rumors from WAPO that the US could strip China of its sovereign immunity or void US debt obligations to China, to the President threatening new tariffs all over again. Asked whether he would consider having the United States stop payment of its debt obligations as a way to punish Beijing, Trump said: "Well, I can do it differently. I can do the same thing, but even for more money, just by putting on tariffs. So, I don't have to do that." (Reuters). Just wait until Trump sees this animated propaganda video from China’s official Xinhua news agency, released overnight, mocking the US’ coronavirus response. See here from ABC News.

Today was supposed to be a relatively quieter day in global financial markets because of the May Day holiday across Europe and Asia (ex. New Zealand, Australia and Japan), but instead we saw risk off flows pick up steam overnight. A spike higher in USDCNH and CNH option volatility led the move, which then added insult to injury for the China-sensitive AUDUSD after it lost chart support at 0.6500. USDCAD continued higher after yesterday’s WAPO article inspired a confident bounce off its range lows in the 1.3850s and a NY close back above the 1.3920 level. GBPUSD has now almost completely given up yesterday’s gains and positive NY close above the 1.2500 mark, as sterling once again shows its higher beta sensitivity to risk. USDJPY is trading lower as the market flips back to its old positive correlation with risk sentiment. EURUSD is oddly bid (perhaps because of its status as a funding currency?), but we’d note a much more positive chart structure as being supportive here as well.

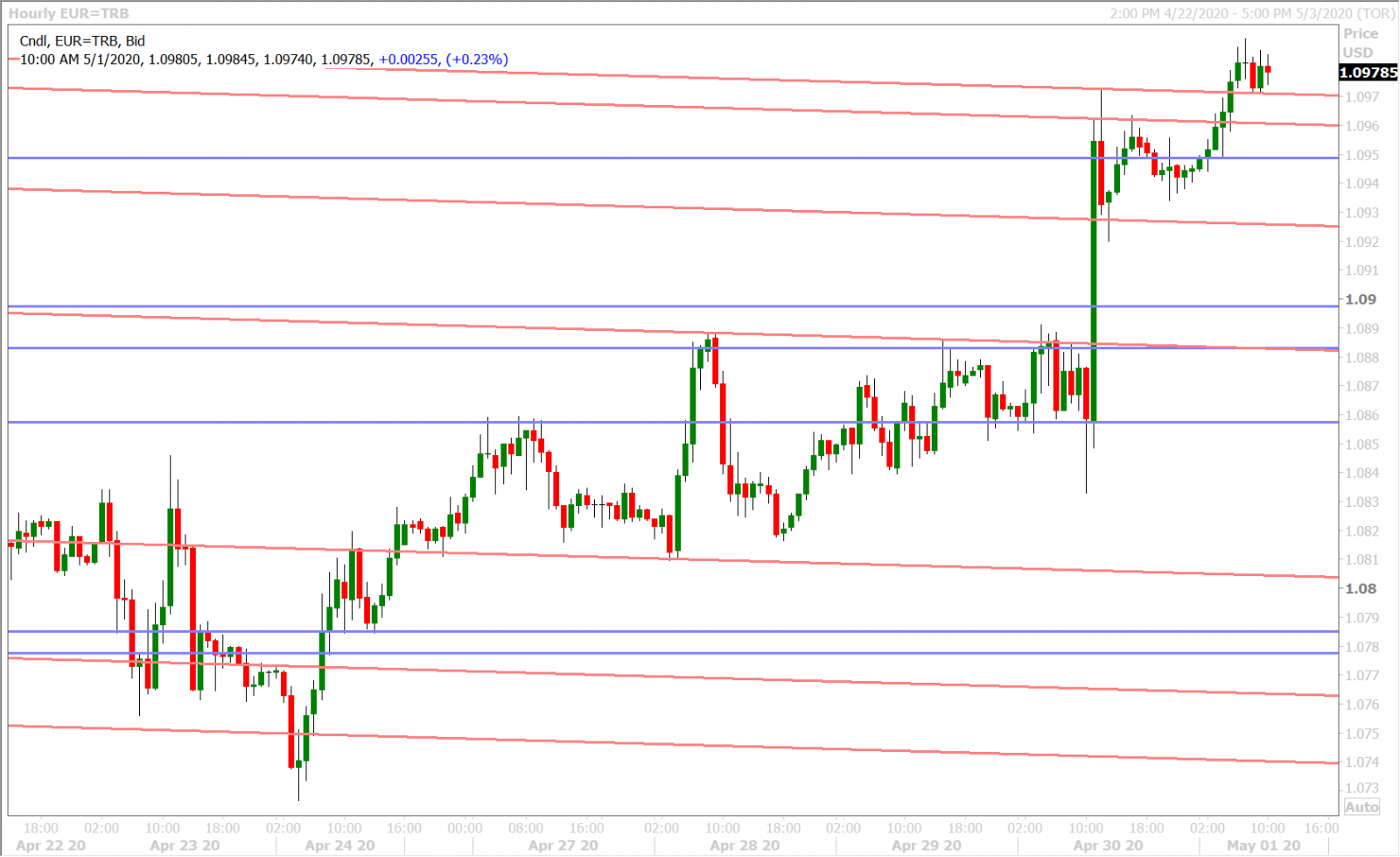

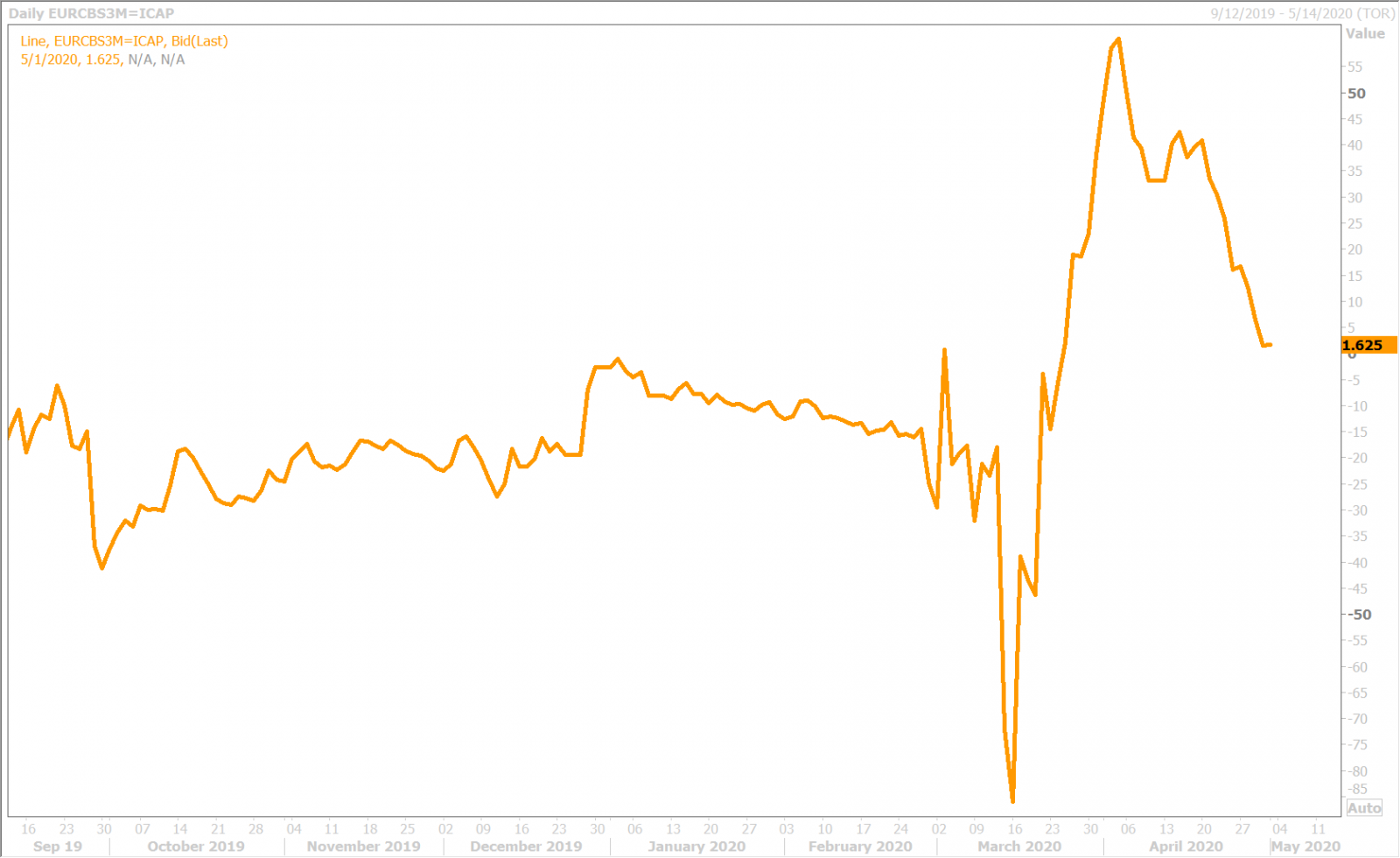

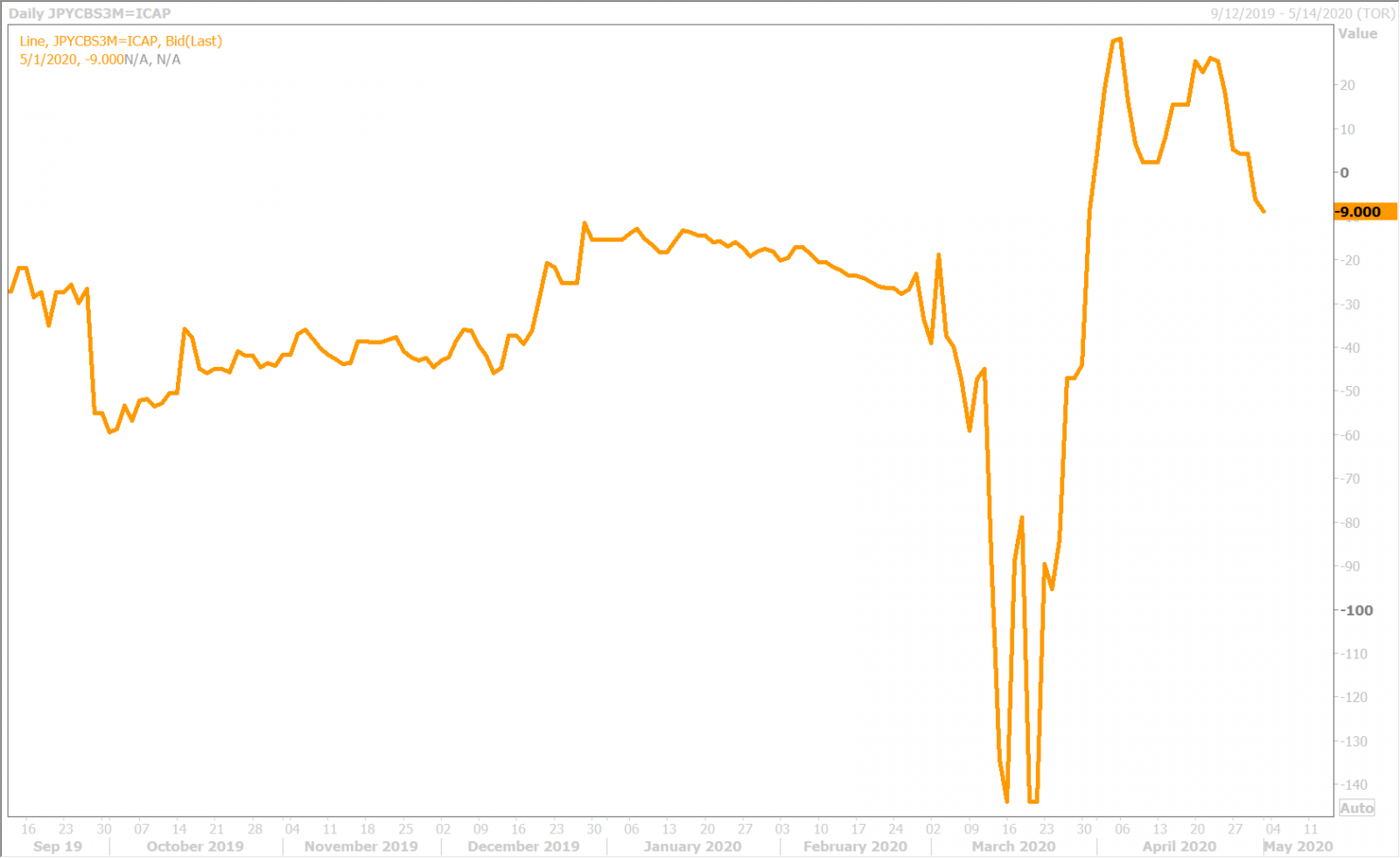

We’re also watching the continued widening of the major USD cross currency basis swaps (CCBS) this morning. The price for the 3-month EURUSD CCBS continues to trend back towards zero, after hitting highs of +60bp in early April. The Japanese version has gone back below zero (now -9bp) after hitting highs of +30bp in early April as well. The selling in spot gold markets yesterday reeked of collateral margin calls to us. These are all signs, in our opinion, of US dollar funding stress potentially returning. Notice how emerging market FX currencies are getting clobbered today.

We were asked by Reuters yesterday why we thought this was happening despite the flood of liquidity put into the markets by the Fed in March, to which we said “because there’s no irrefutable evidence to prove that what centrals banks do actually works. They “tell” us that their monetary policy actions are stimulative and that it all increases liquidity, but what if none of it is actually true? They can attempt to “price fix” local money markets like repo/T-bills, but they have absolutely no control over how the offshore global banking system creates (lends) and destroys (curtails) the “real money” that makes the world go around, ie. Eurodollars.”

We think something is changing before our eyes to start the month of May, and while we cannot pin point it just yet, we believe that traders need to be prepared for a return of the “US/China-trade-war” type of risk-off flows we saw last year.

USDCAD DAILY

USDCAD HOURLY

JUNE CRUDE OIL DAILY

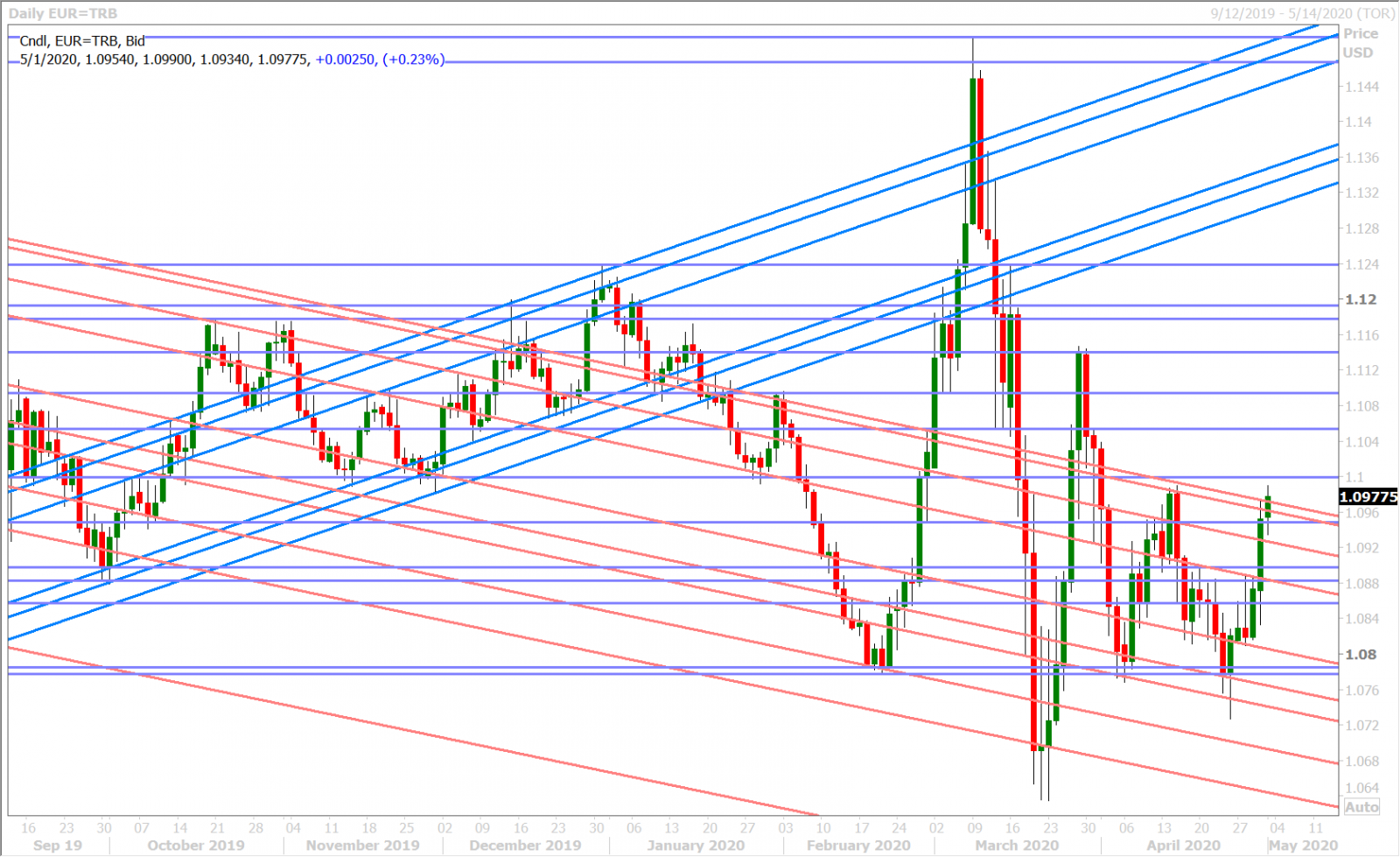

EURUSD

Euro/dollar is displaying an odd bid this morning; effectively de-coupling from its positive correlation with the broader risk tone of late. We’ve noticed the same thing in dollar/yen today too. Both the EUR and the JPY are negative yielders (funding currencies), and so we wonder if global FX markets are beginning to re-position for Round 2 of the US/China trade war. Such a scenario would bring back risk-off flows obviously but, if we look at the playbook from Round 1 over 2018/2019, increased US/China trade tensions didn’t lead to broad USD buying. Commodity currencies like the AUD and CAD underperformed, but the EUR and JPY held up relatively well because of their 2nd tier safe-haven statuses. We acknowledge that 24-48hrs of new developments does not make a new trend here, but we’re paying very close attention.

EURUSD DAILY

EURUSD HOURLY

EURUSD 3-MONTH CROSS CURRENCY BASIS SWAP DAILY

GBPUSD

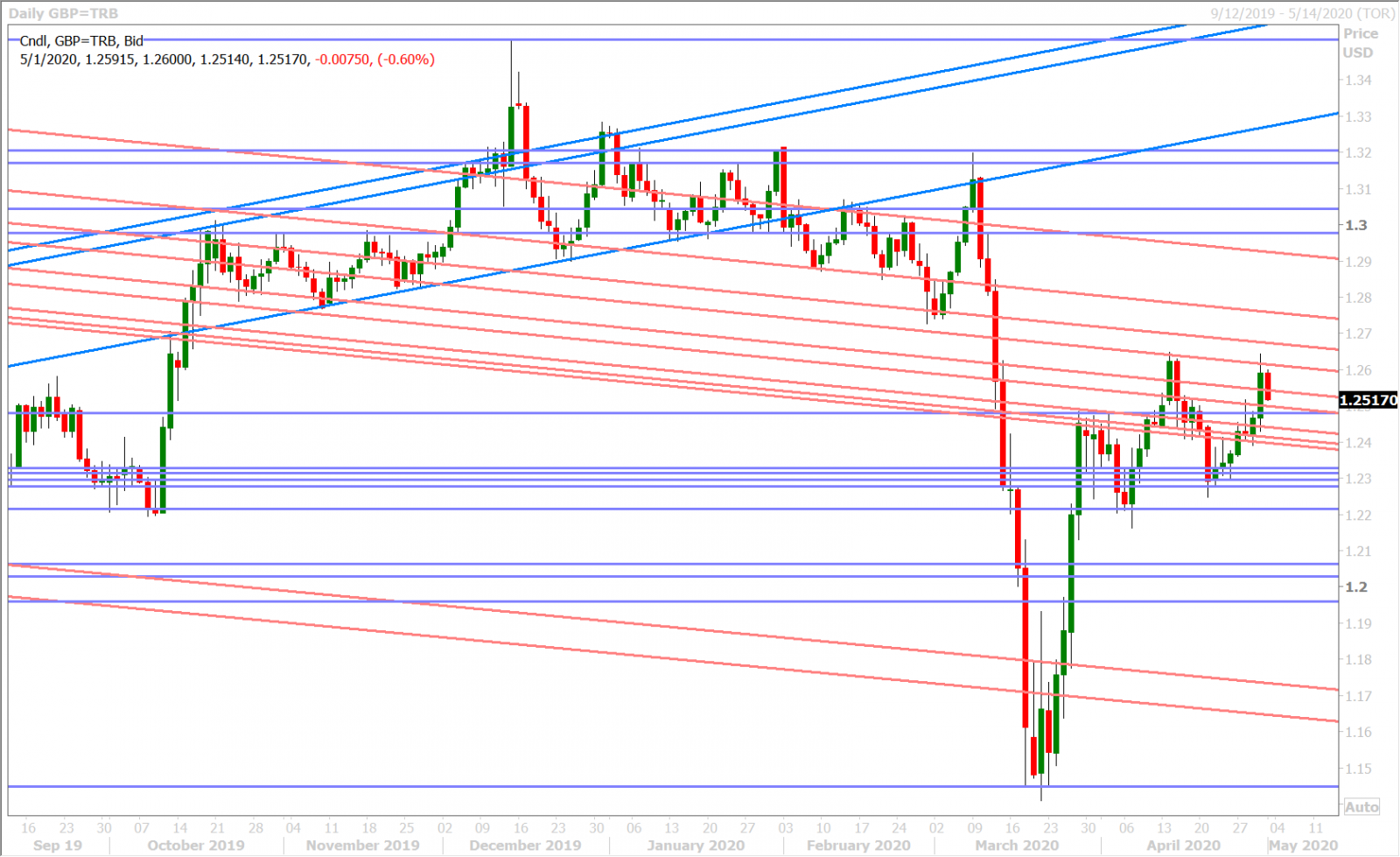

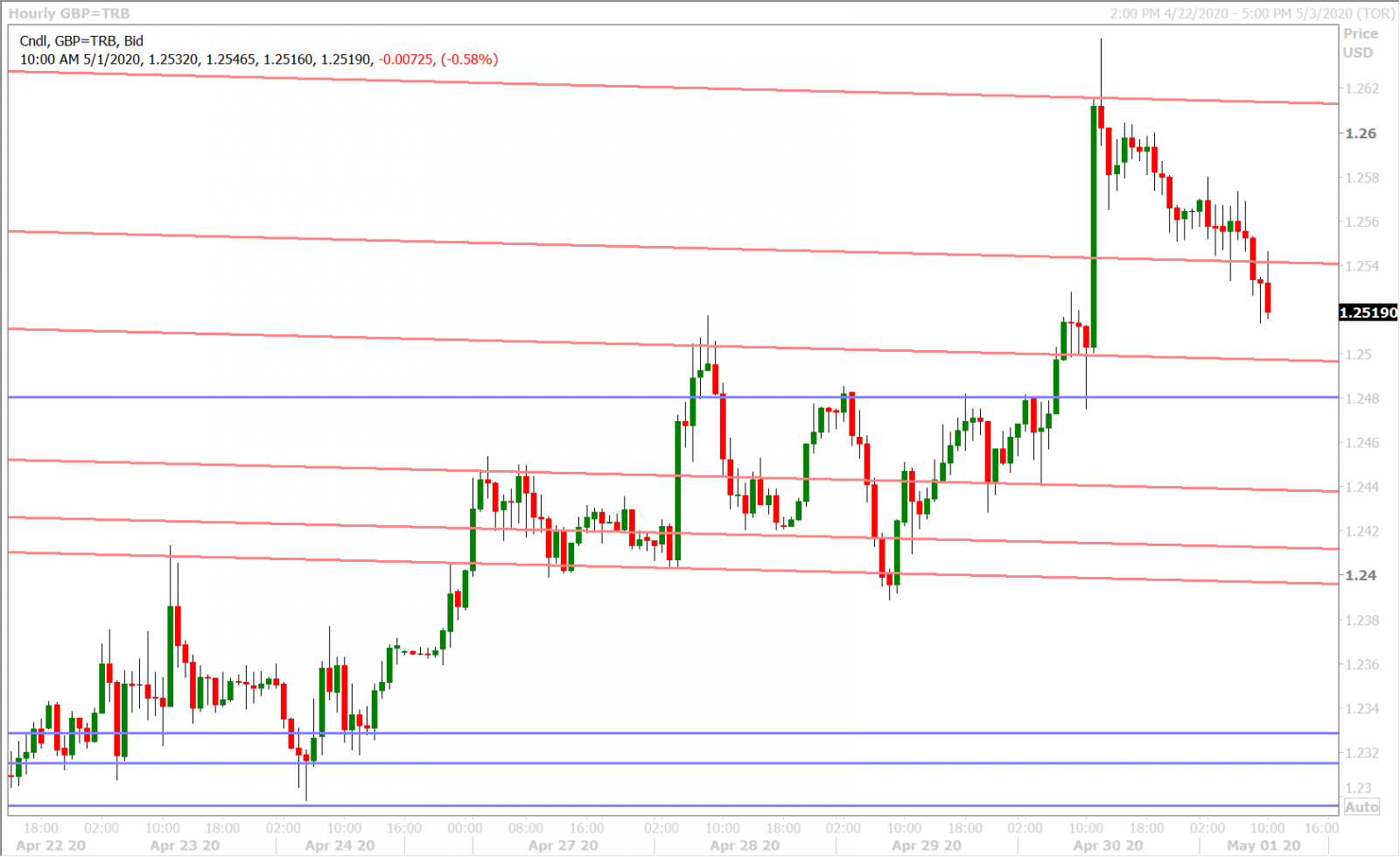

Sterling bulls ought to be disappointed this morning after GBPUSD has given up most of its gains from yesterday. We felt that yesterday’s rally was instigated by the Fed’s “expanded scope” to its Main Street Lending Program, but all that “feel good feeling” (that would make one want to sell USD) has been forgotten today. A resurgence of the US/China trade war seems to be the new narrative, and it has done some damage to the technicals on the daily GBPUSD chart.

The day is young though, as we like to say, and we think the market still has legs so long as chart support holds in the 1.2480-1.2500 area. The UK reported its final April Manufacturing PMI slightly below expectations this morning, 32.6 vs 32.8, which was a non-event in our opinion.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

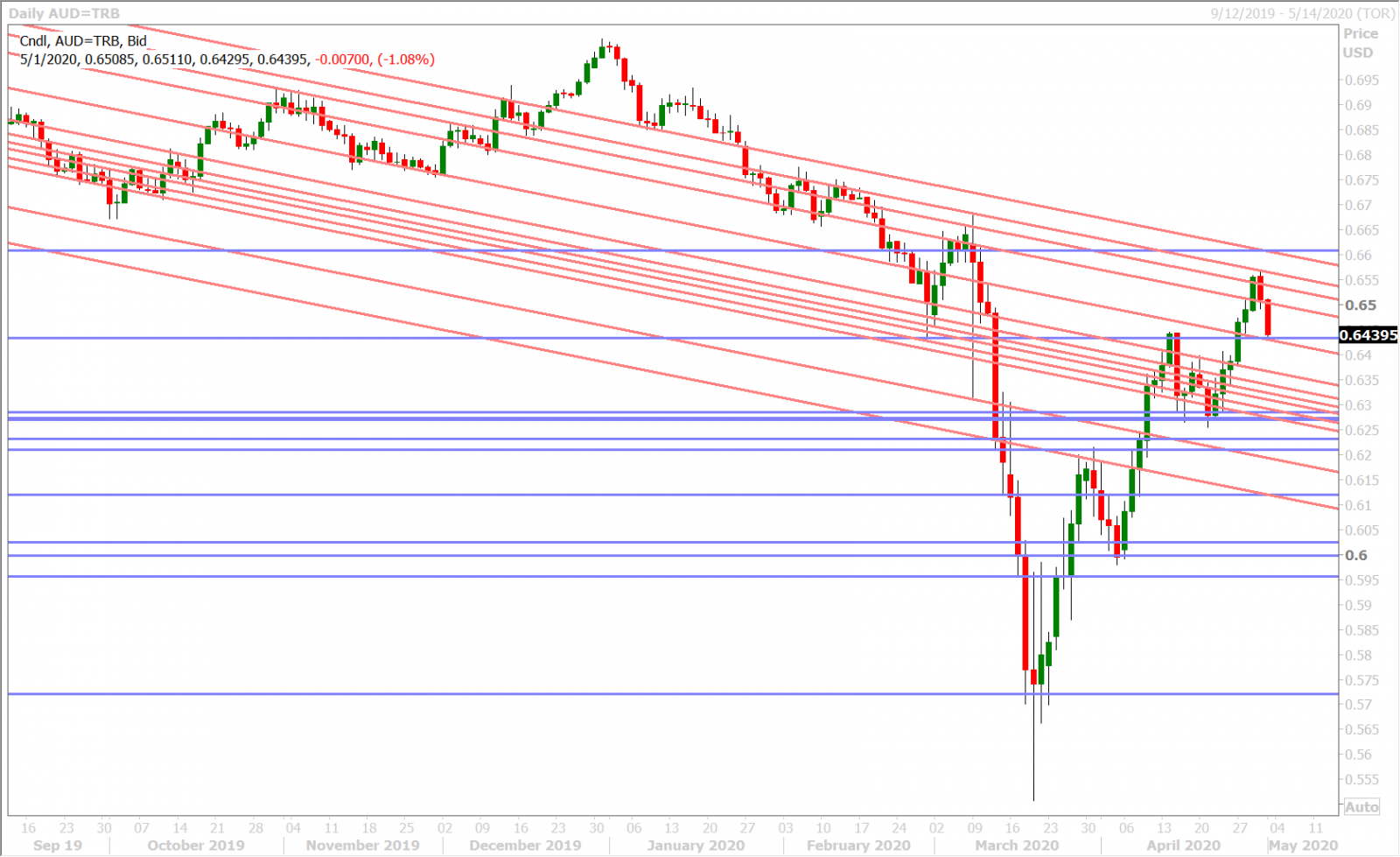

AUDUSD

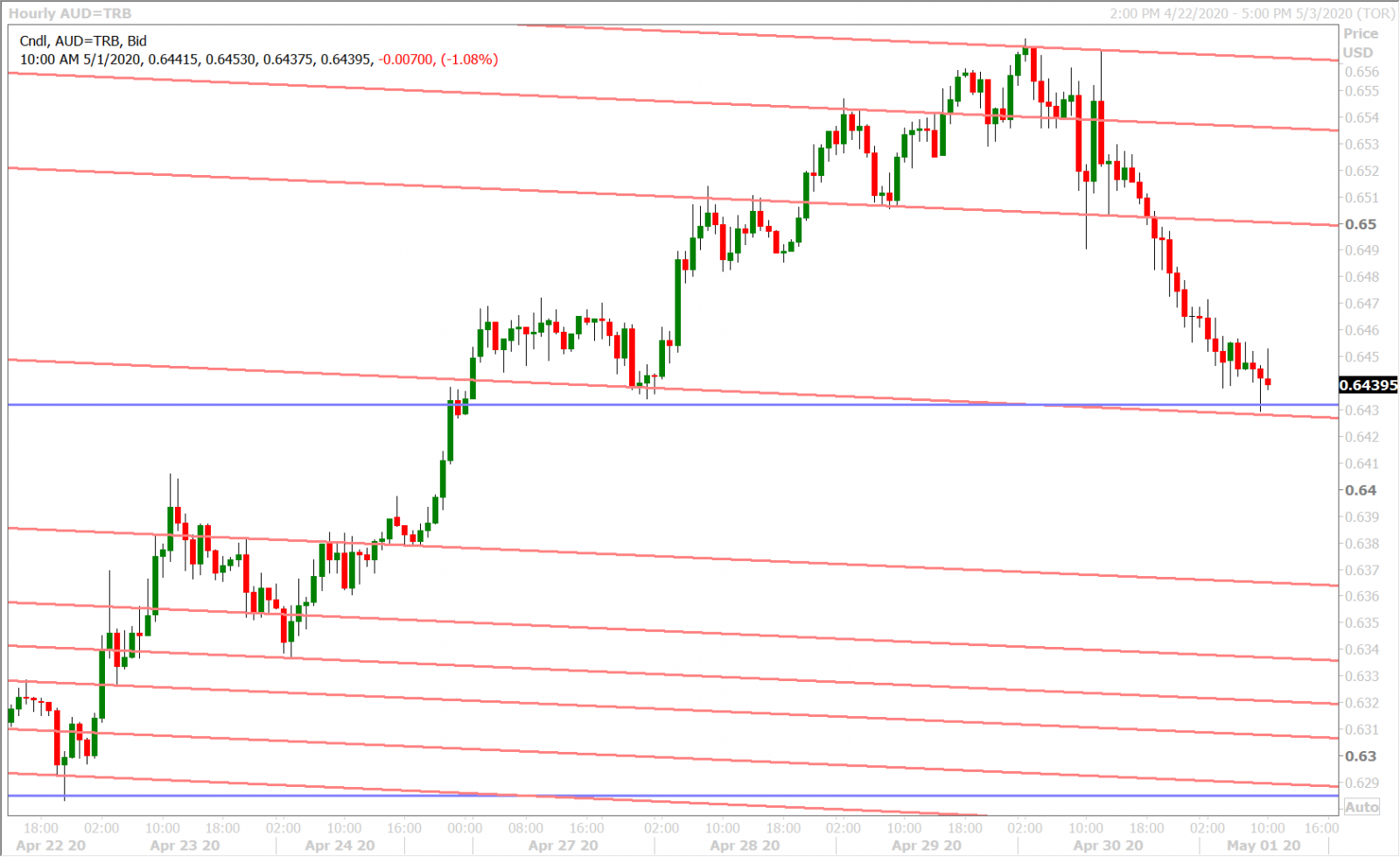

The Australian dollar is feeling the brunt of the marketplace’s renewed focus on US/China trade relations. The daily chart technicals for AUDUSD were looking a little worrisome following yesterday’s NY close, which was well off session highs in the 0.6560s, and we found it notable how the market’s interest in AUDUSD upside completely disappeared after yesterday’s 2.7blnAUD option expiry had passed at 10amET.

Some negative corporate earnings reports from Apple and Amazon didn’t help the broader risk tone at the start of quiet Asian trade last night, but it was really President Trump’s tariff threat against China that got the ball rolling to the downside for AUDUSD. The Chinese yuan sold off sharply, option traders reported a spike in volatility (cost) for protection against declines in CNH and AUD, and AUDUSD lost the key 0.6500 level (which has been a pivotal level for the market this week).

US White House economic advisor Larry Kudlow is attempting some damage control this morning by talking to CNBC, which we think could help explain the mild bounce in risk sentiment we’ve seen since the start of NY trade.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

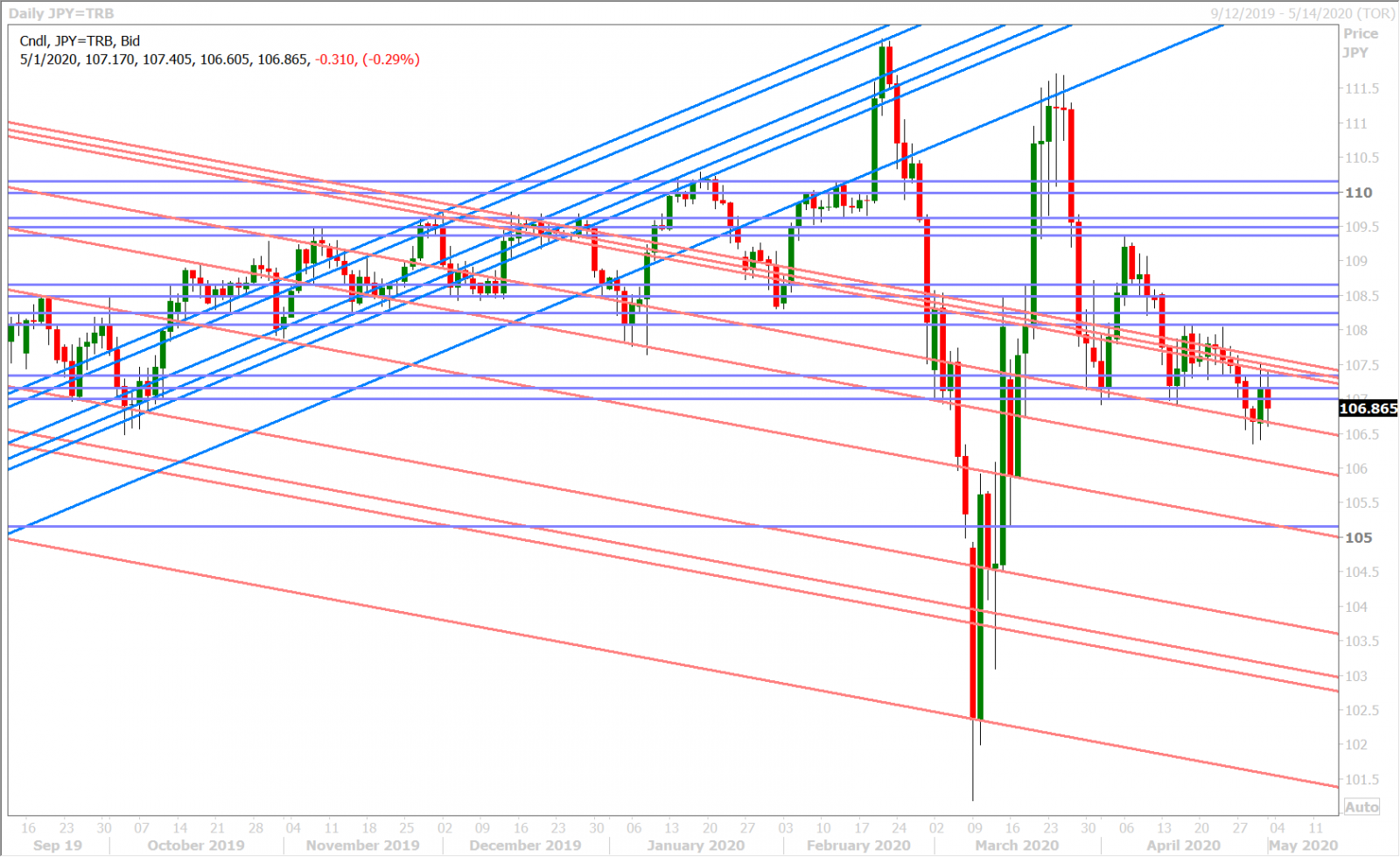

USDJPY

The yen is winning the battle of the safe havens this morning as the FX market shows signs of beginning to price in a different sort of risk-off scenario for the month of May. Global markets may be starting to look past the near term economic affects from the coronavirus lockdowns, but it may have US/China Trade War 2.0 to worry about now.

Everybody is looking towards China to lead the global economy towards the “V-shaped” recovery that Wall Street is so desperately clinging to, but an escalation in trade tensions could very well be the nail in the coffin for that thesis, which already has too much wishful thinking in it to begin with.

Japanese markets will be closed on Monday through Wednesday next week for the remainder of the Golden Week holidays.

USDJPY DAILY

USDJPY HOURLY

USDJPY 3-MONTH CROSS CURRENCY BASIS SWAP DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com