Chinese stock market surge fuels risk taking

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- China state media says fostering bull market now more important than ever.

- Shanghai Composite explodes 5.7% higher, taking Chinese yuan with it.

- USD sold broadly overnight, despite another bad weekend of US COVID news.

- US June ISM Non-Manufacturing PMI on deck at 10amET, 50.1 expected.

- Bank of Canada’s Q2 Business Outlook Survey out at 10:30amET.

- RBA meets at 12:30amET tonight. Will recent Australian COVID spike feature?

ANALYSIS

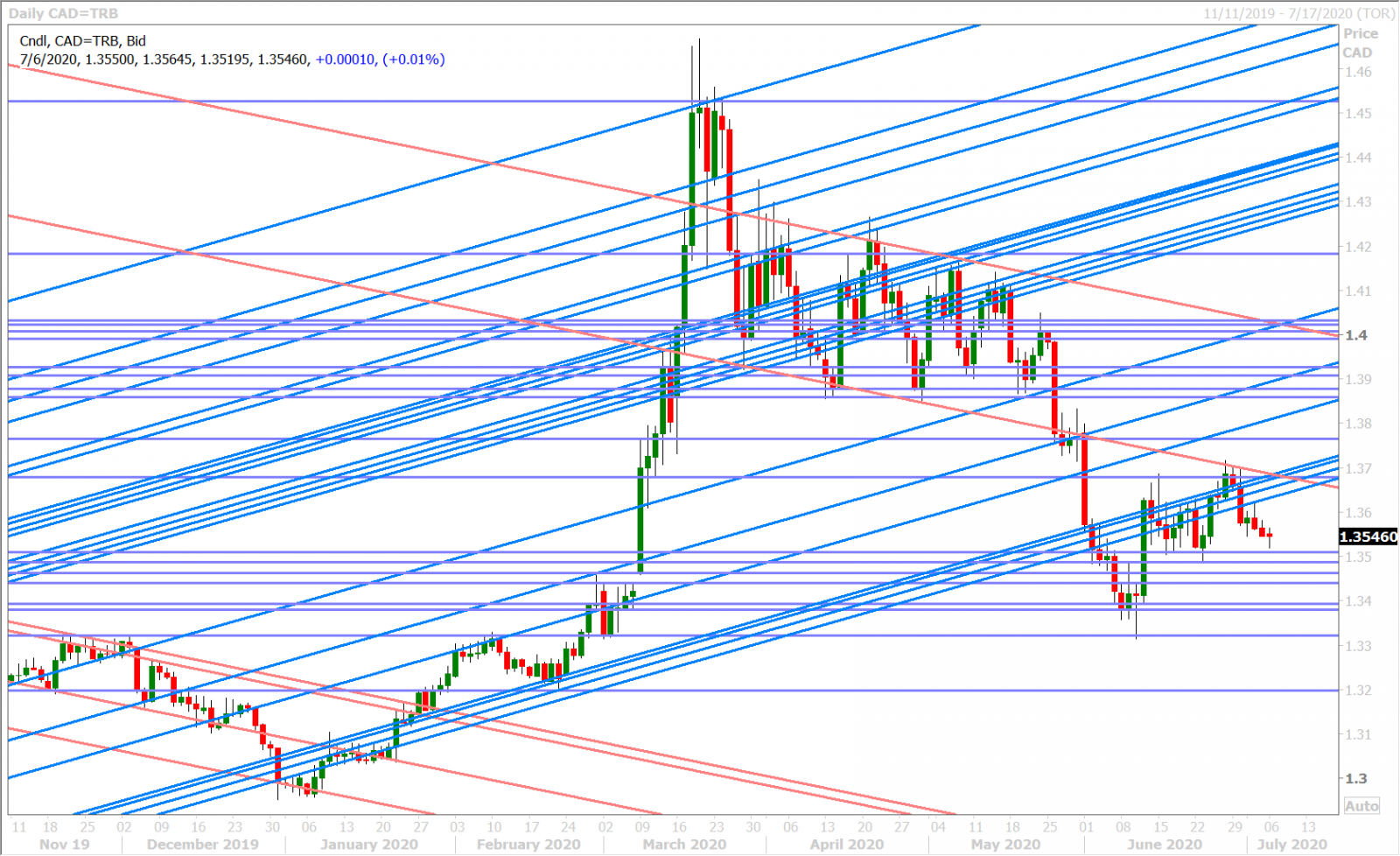

USDCAD

A euphoric 5.7% rise in China’s Shanghai Stock Index and an explosive move higher in the Chinese yuan last night are being cited by traders as the major reasons behind this morning’s upbeat tone to risk sentiment. A front-page editorial in China’s Securities Times said that fostering a “healthy” bull market after the pandemic is now more important than ever, which in turn led to “2015-style” fear-of-missing-out surge from retail investors to open stock accounts and bid up share prices overnight. This speculative tide has now lifted all global stock markets 1-2% this morning and it has also caused broad downside pressure on the US dollar to start the week…all in the face of more negative COVID headlines out of the US this past holiday weekend.

Dollar/CAD slipped down to chart support in the 1.3510s amid the overnight “risk-on” move, but traders appears to be lightening up now ahead of this morning’s key event risks: June ISM Non-Manufacturing PMI at 10amET (50.1 expected) and the Bank of Canada’s Q2 Business Outlook Survey at 10:30amET (covering sentiment from mid-May to mid-June).

USDCAD DAILY

USDCAD HOURLY

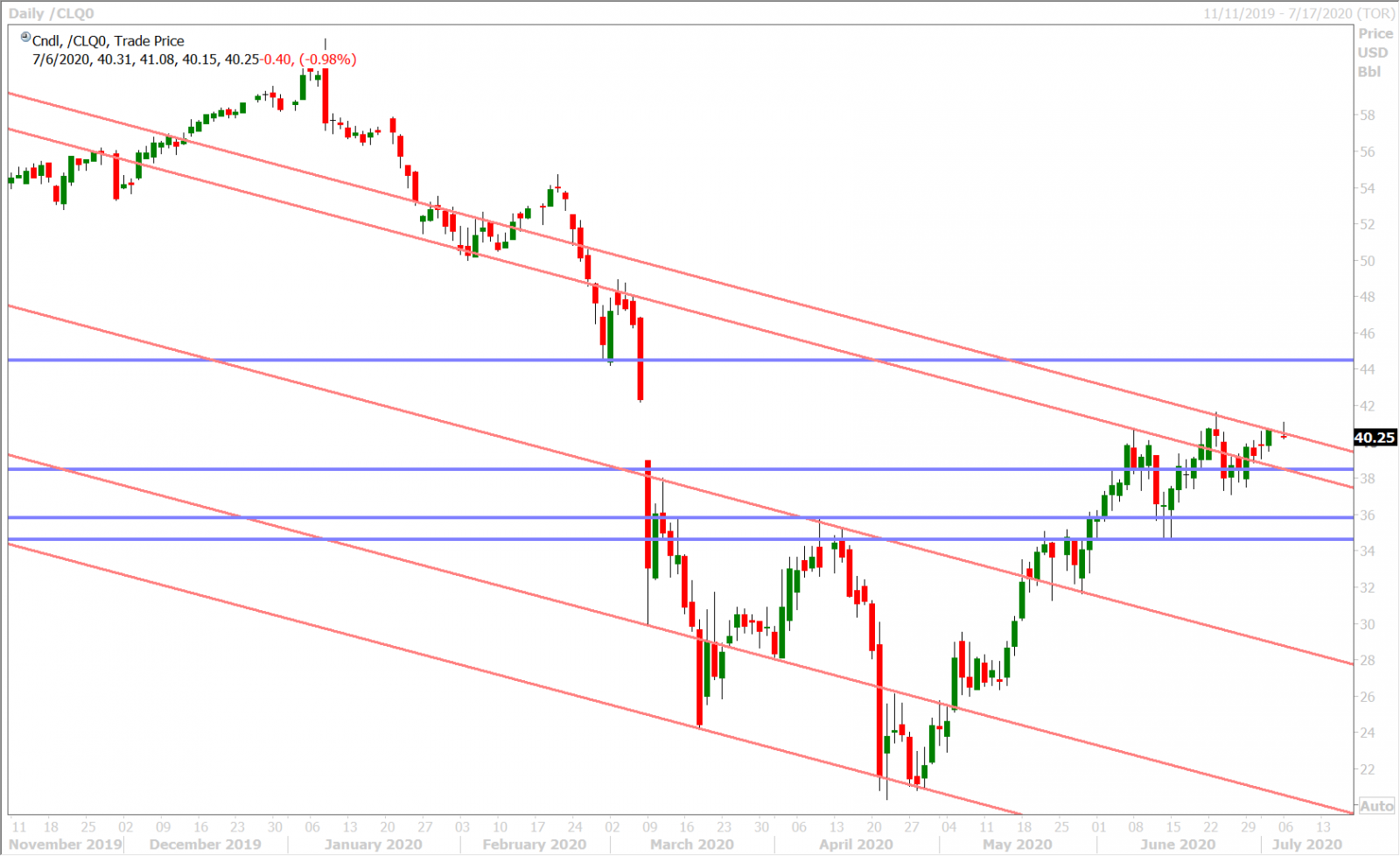

AUGUST CRUDE OIL DAILY

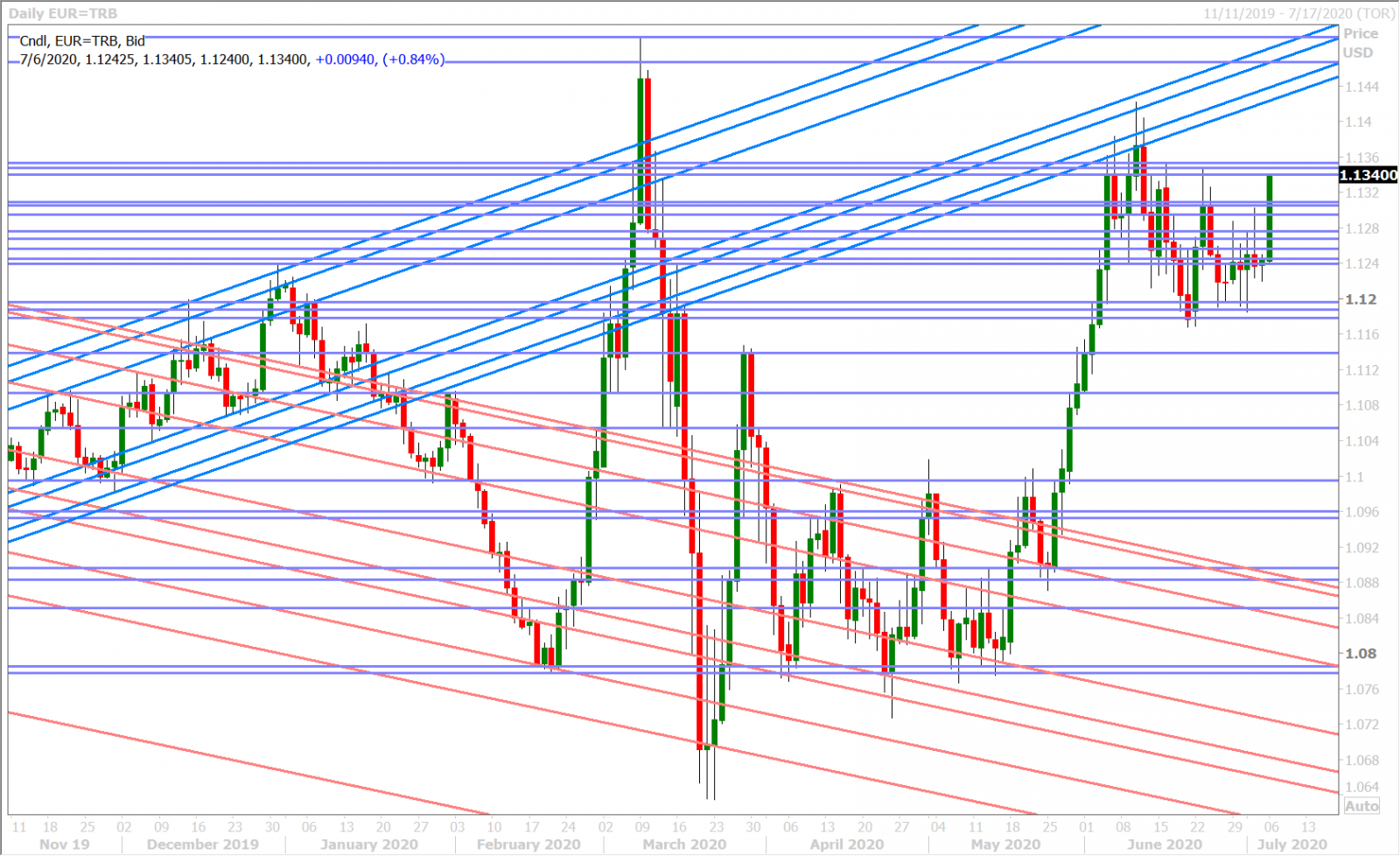

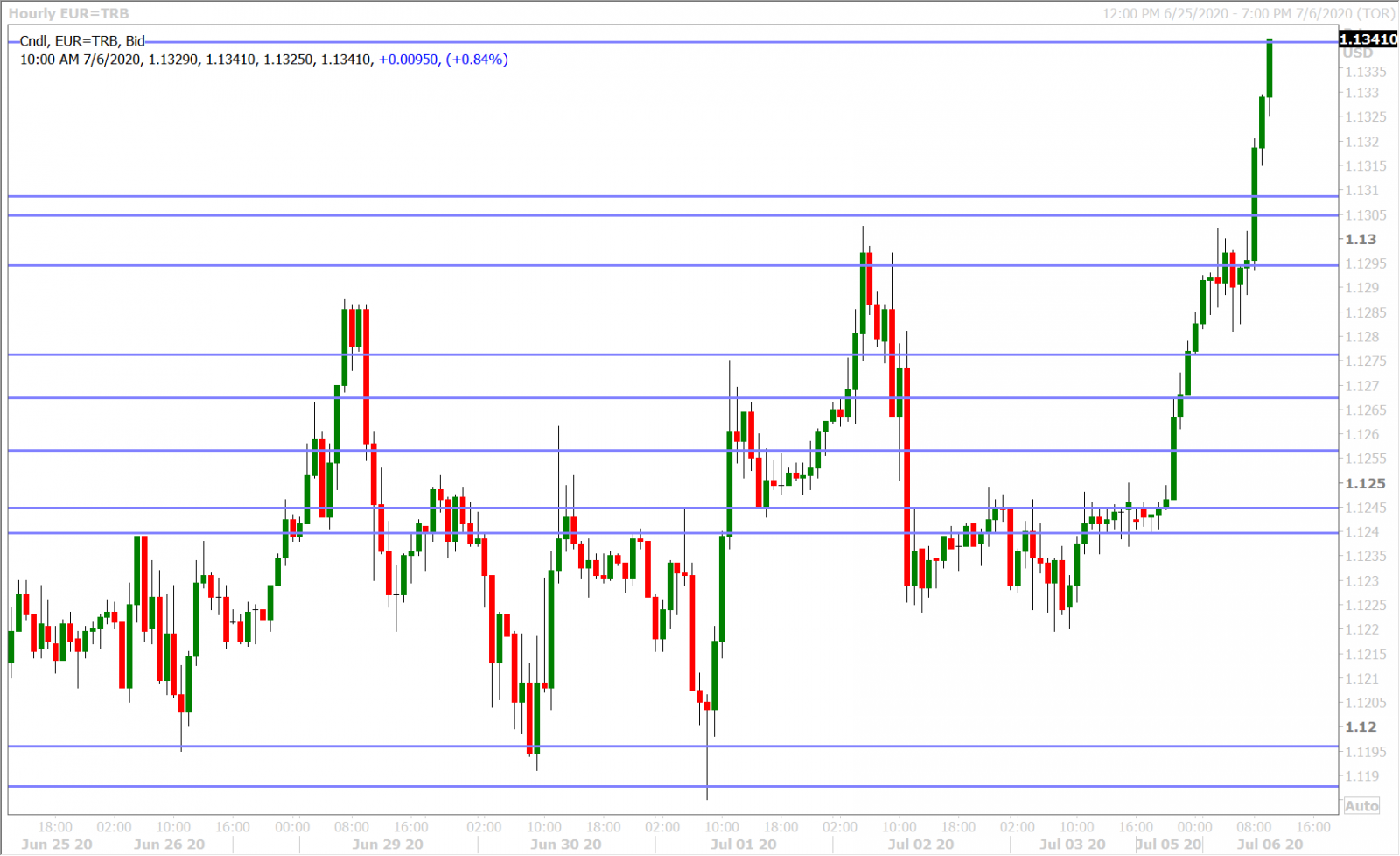

EURUSD

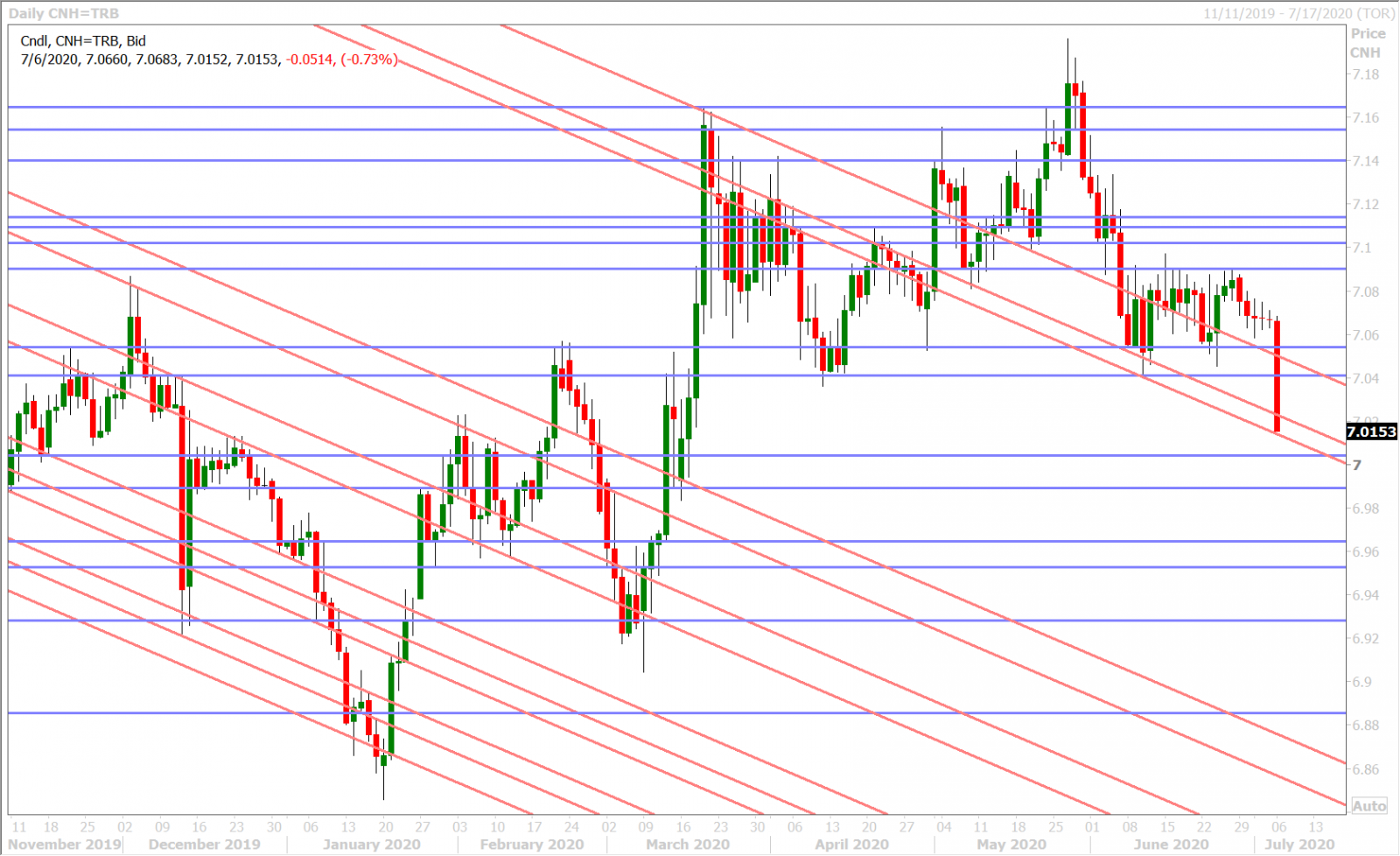

Euro/dollar has galloped almost a full figure higher this morning and, while “risk-on” flows are definitely helping to push the market higher, the Euro does not normally lead “risk” in one way or the other and so we think we’re once again seeing the magnetizing effect of large topside option expiries…of which there are many this week. Almost 1.2blnEUR will be coming off the board at the 1.1345 strike tomorrow, another 1blnEUR at 1.1300 on Wednesday, and over 1.5blnEUR feature between 1.1275 and 1.1300 for Thursday. This almost paints a perfect picture of where EURUSD traders will want to pin the market this week, provided USDCNH doesn’t fall apart below the 7.00 mark. This morning’s weaker than expected, albeit dated, German Industrial Orders for May (+10.4% vs +15.0%) was ignored by market participants.

EURUSD DAILY

EURUSD HOURLY

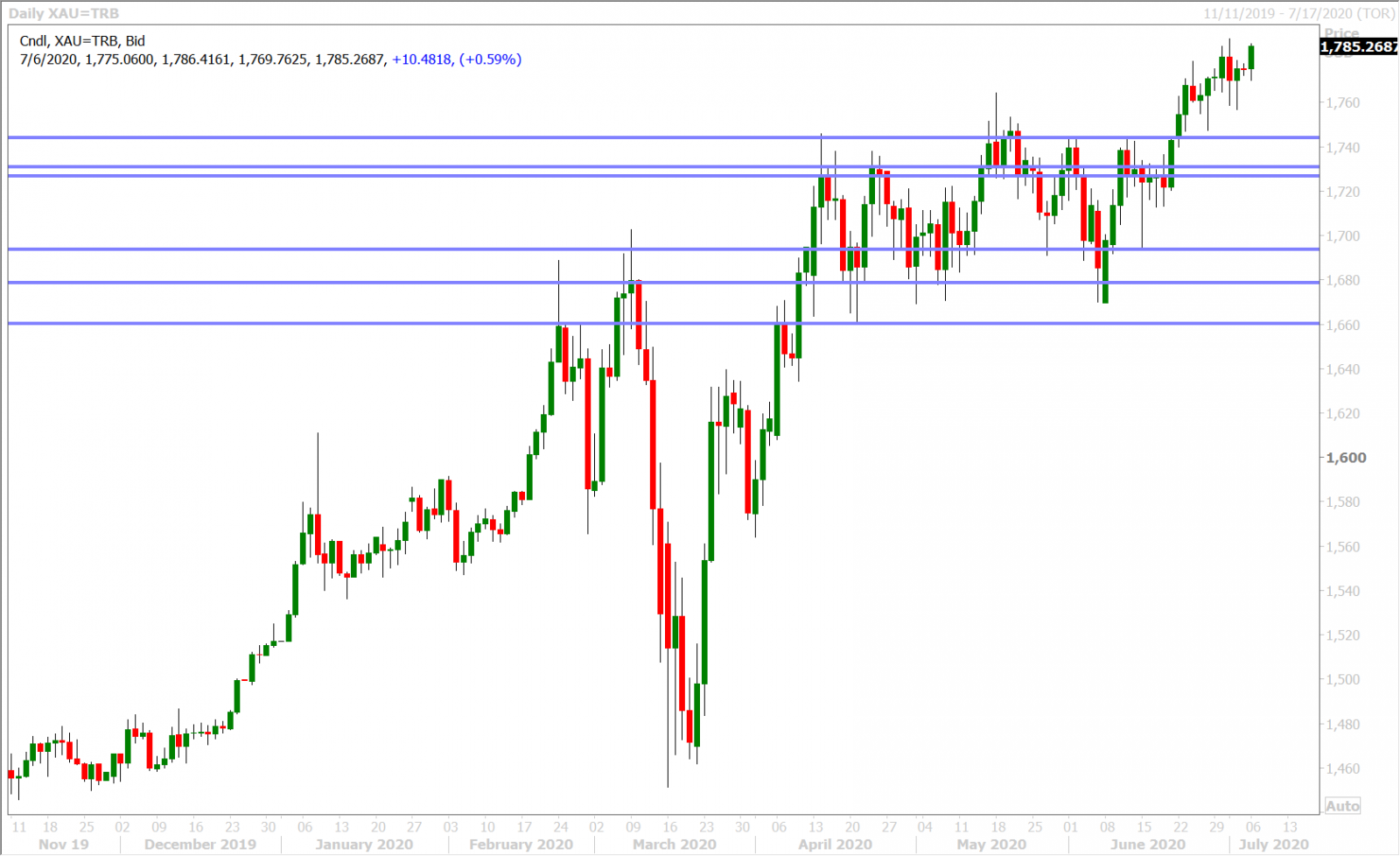

SPOT GOLD DAILY

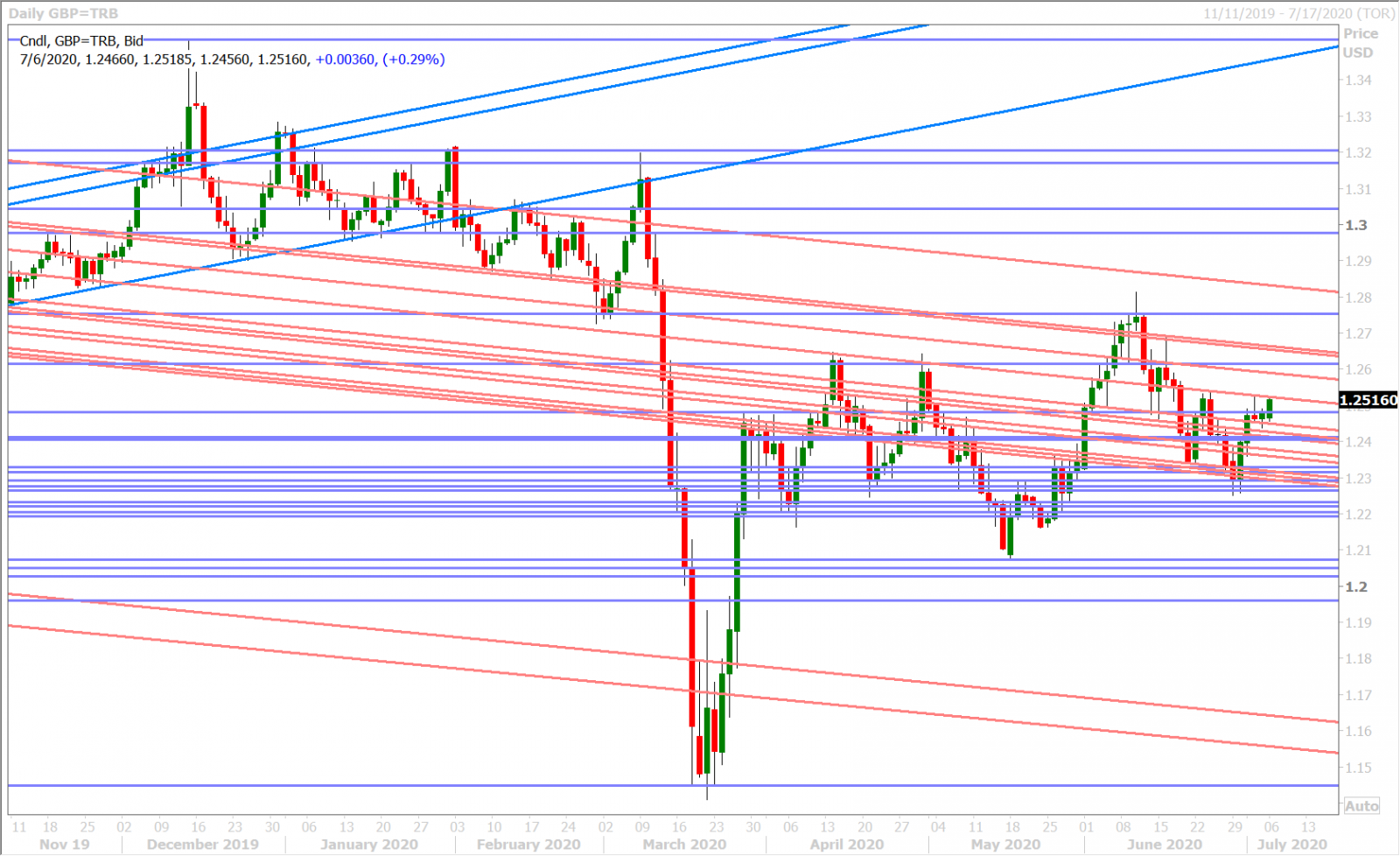

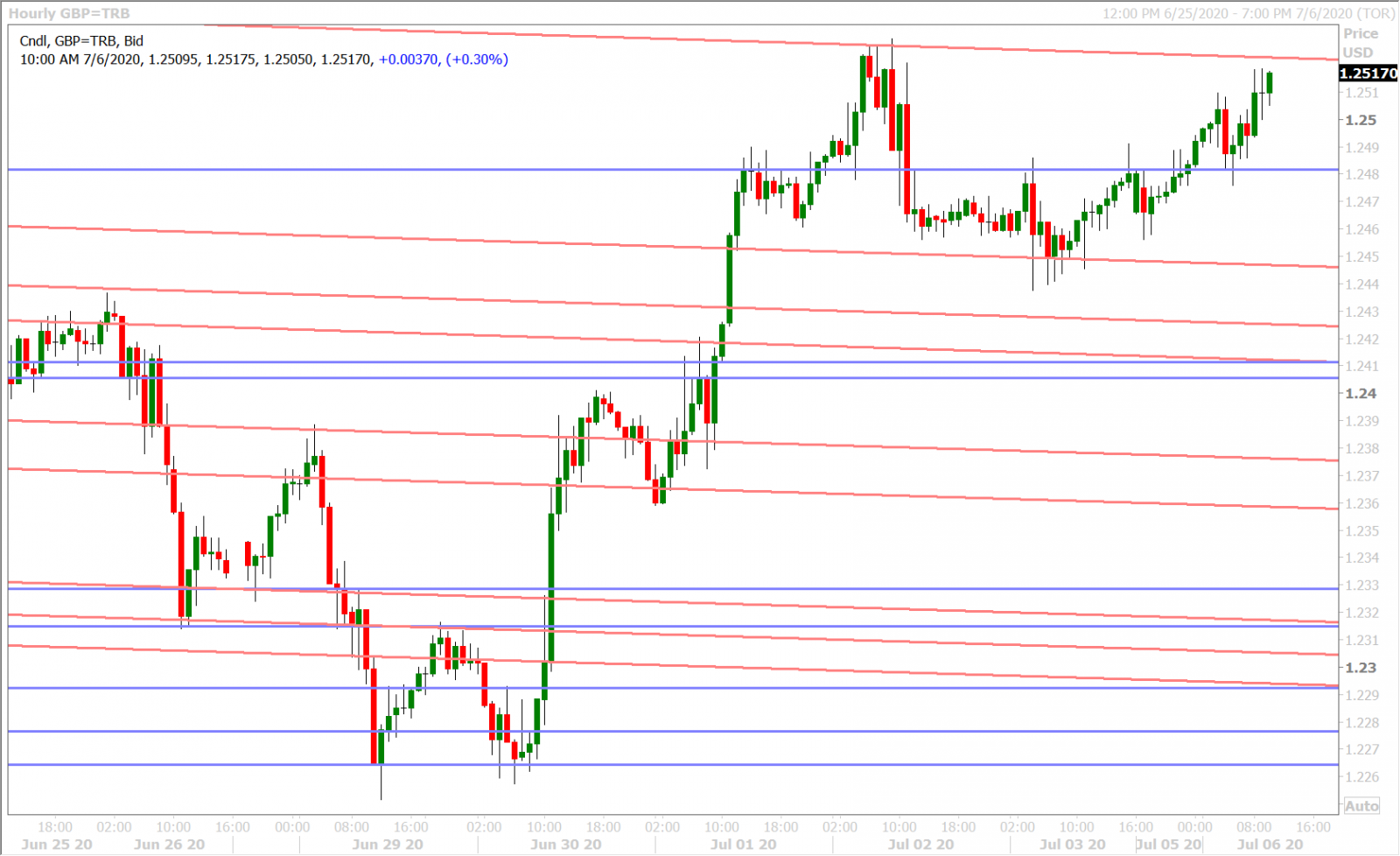

GBPUSD

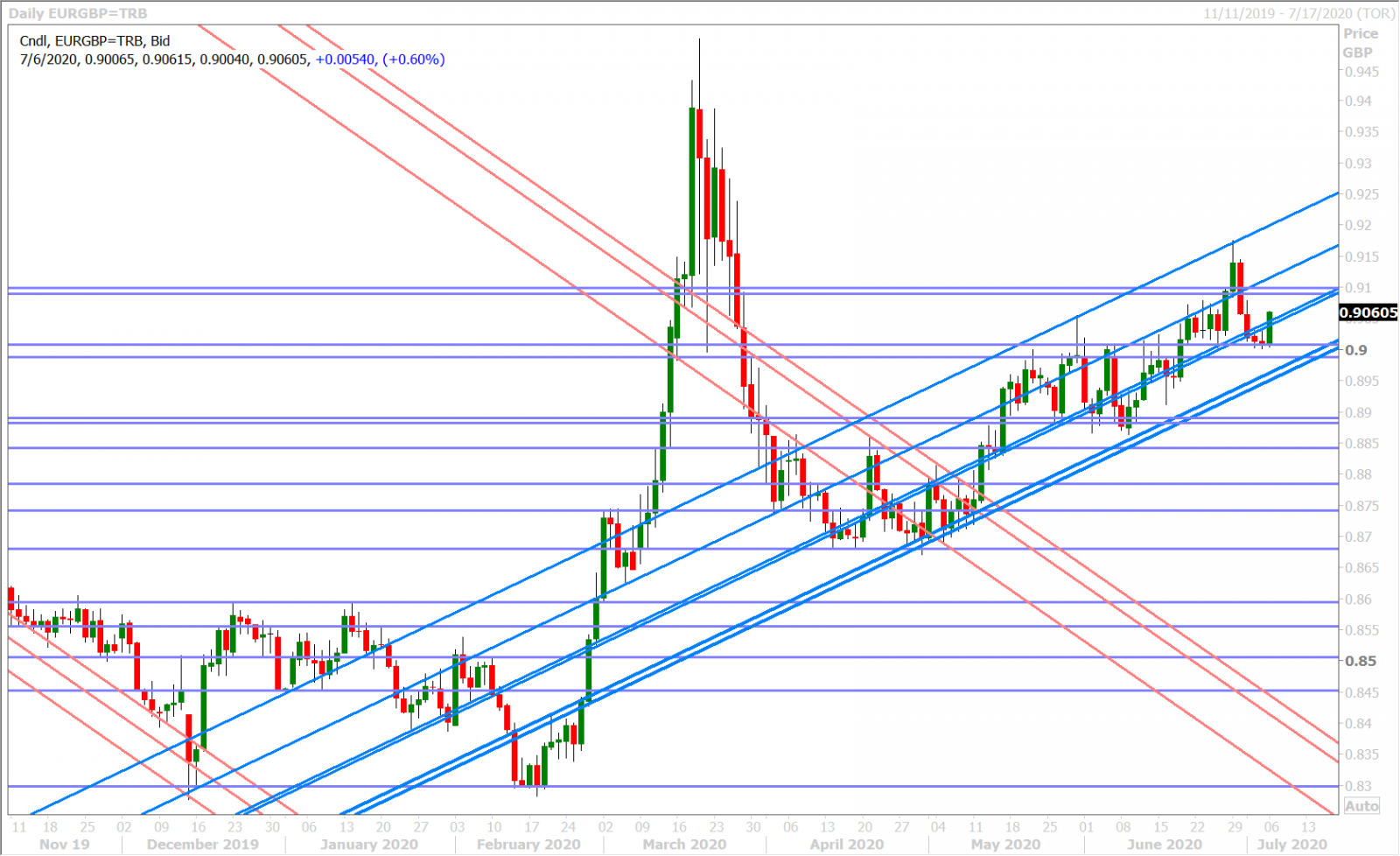

Today’s “risk-on” tide is lifting sterling as well but the gains appear are far more muted. One could make the argument that GBP traders are keeping their powder dry here ahead of this week’s expected Brexit/Sunik headlines, but we think this morning’s uninspiring GBPUSD price action could simply be a reflection of EURGBP’s rise in the wake of broad EUR strength. The Euro, for better or worse, has more reasons to rally vis a vis the pound this morning and is therefore stealing the limelight.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

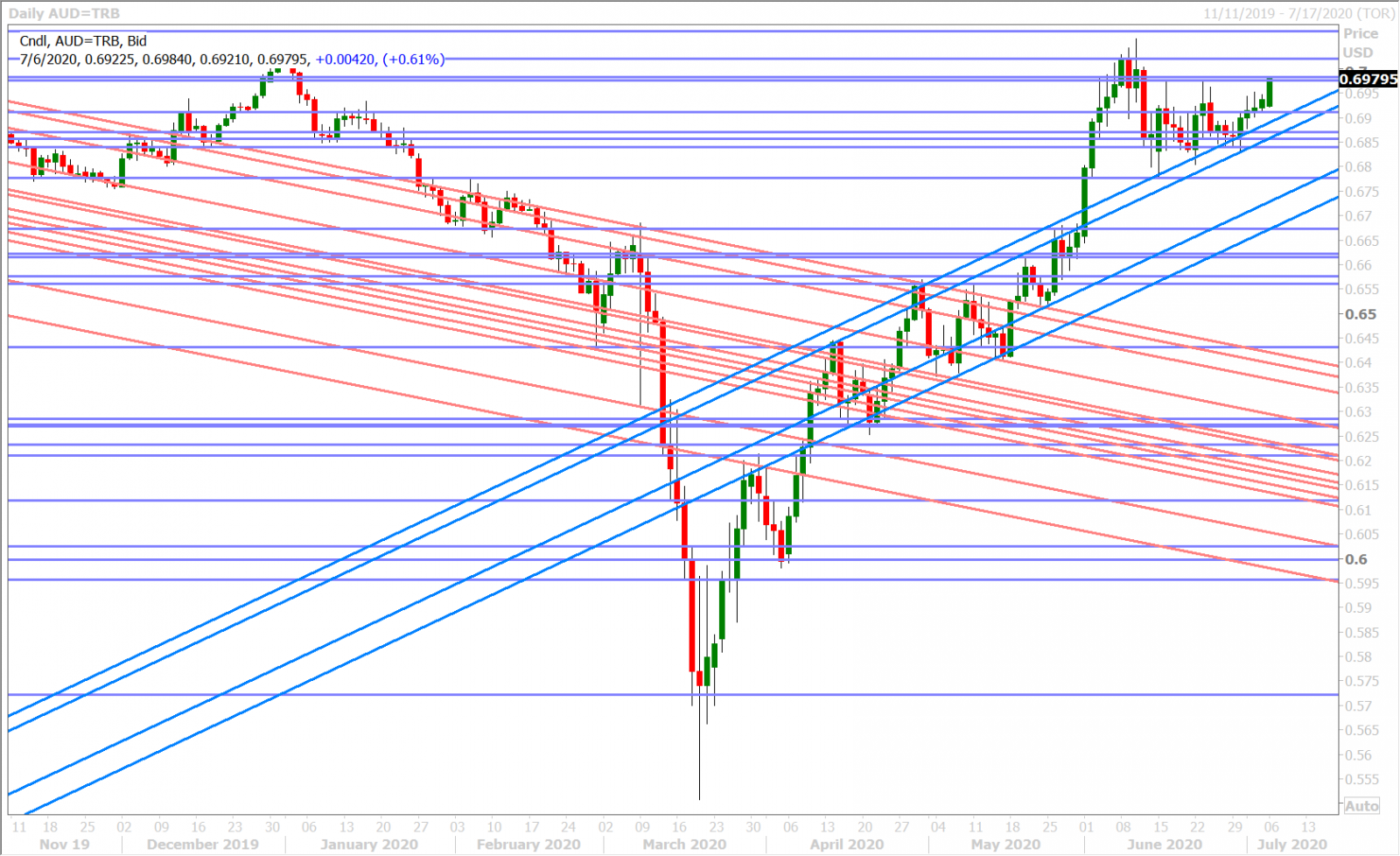

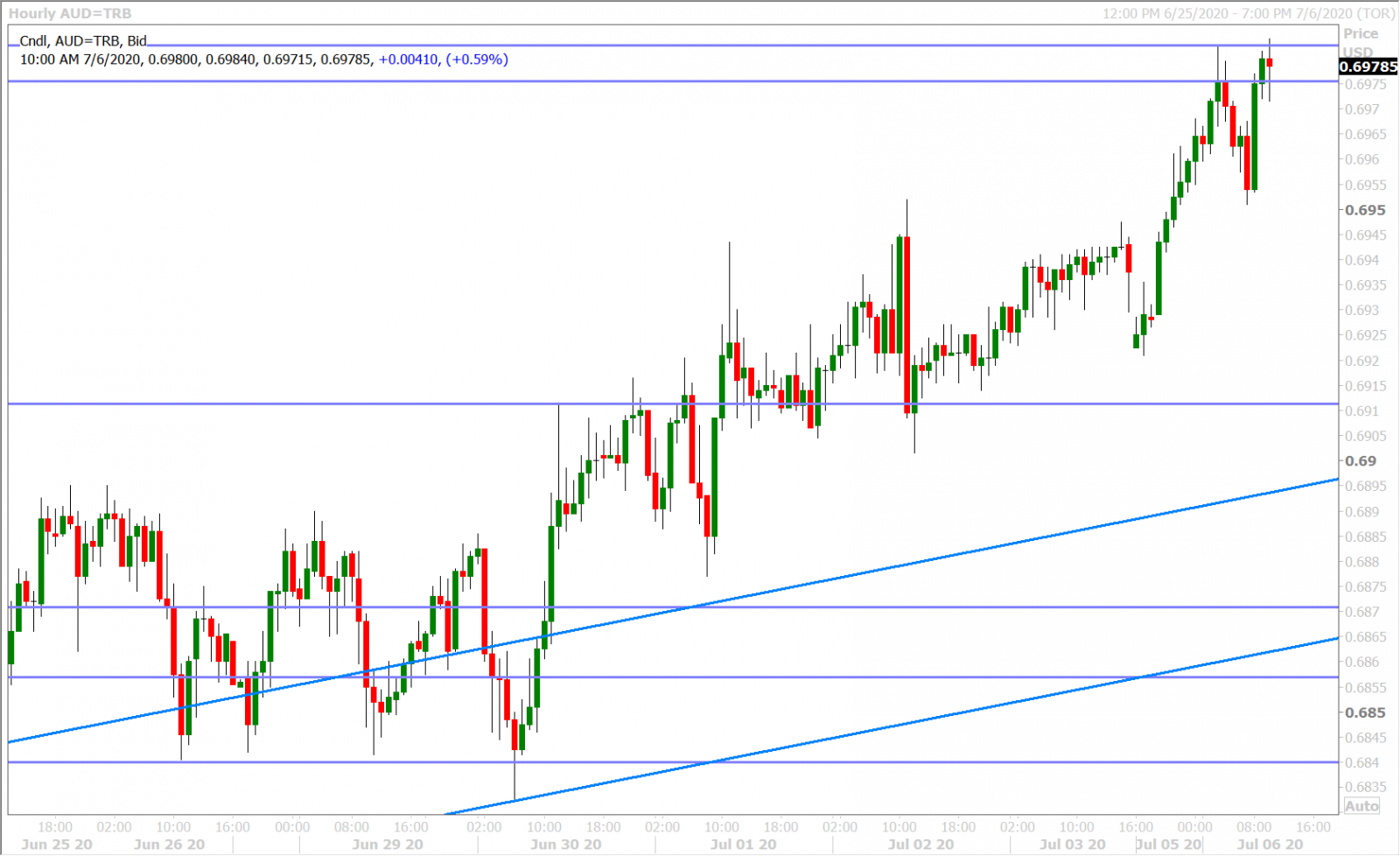

AUDUSD

The Australian dollar bulls have used China’s stock market surge today to quickly build upon the market’s technical strength we outlined late last week. Chart resistance in the 0.6980s, and then the 0.7020s, should now become the focus for AUDUSD traders as they get ready for the US ISM Non-Manufacturing PMI at 10amET and the tonight’s RBA decision at 12:30amET. The Reserve Bank of Australia is expected to keep interest rates and its 3yr bond yield target on hold, along with its more confident-sounding outlook…which we think will instead leave traders focused on how they respond to recent negatives (renewed lock-downs in Melbourne, closure of Victoria-New South Wales border after recent COVID case spike).

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

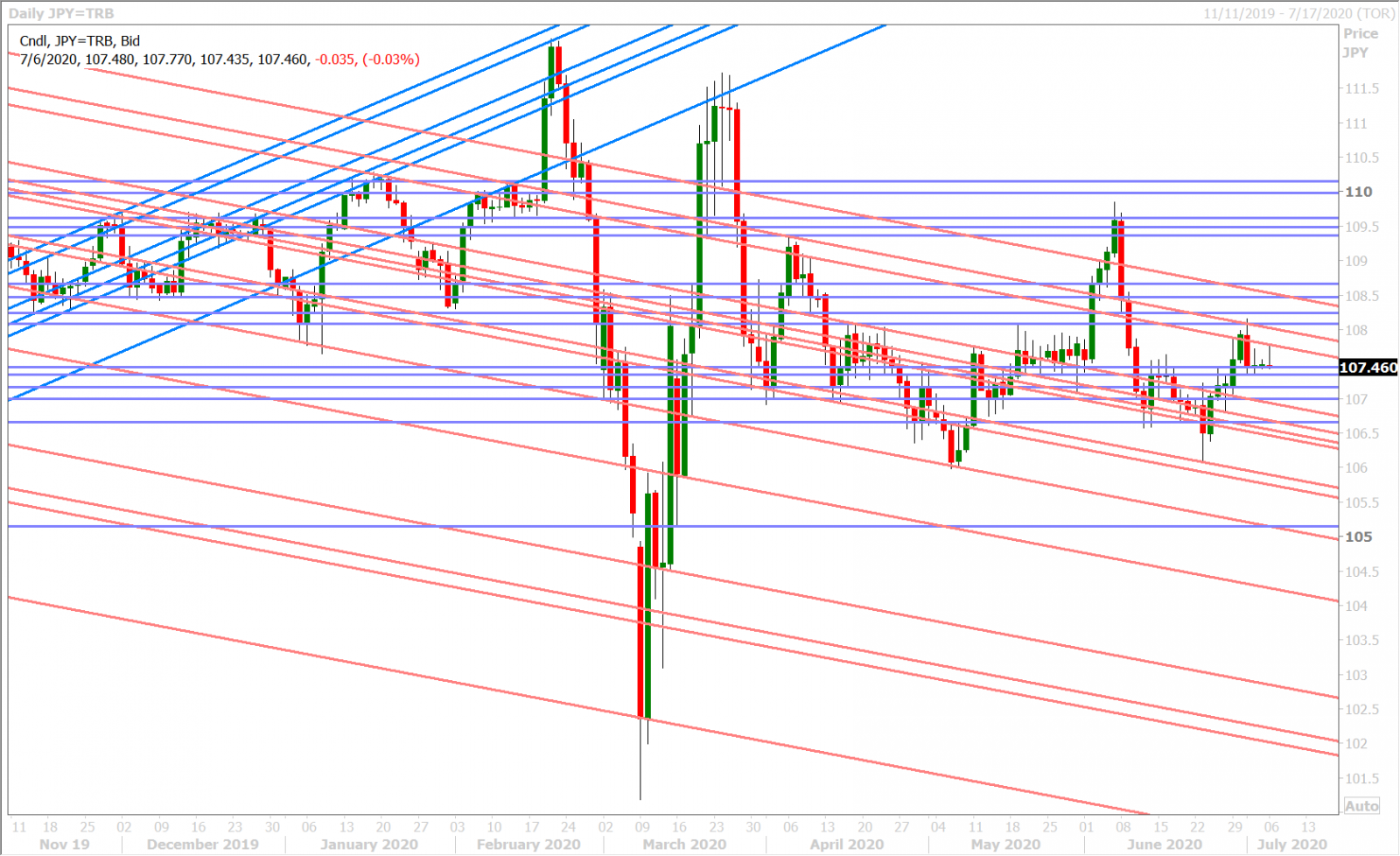

USDJPY

Dollar/yen bounced as US yields crept higher with last night’s Chinese stock market surge, but global bond markets seem less convinced with today’s “risk-rally” ever since the European open. USDJPY has slipped back down to familiar chart support in the 107.40s after grazing trend-line chart resistance in the 107.70s in late Asian trade. Recall that over $2blnUSD in options will be rolling off at the 107.50 strike this Wednesday/Thursday, which could likely anchor the market to current levels this week.

USDJPY DAILY

USDJPY HOURLY

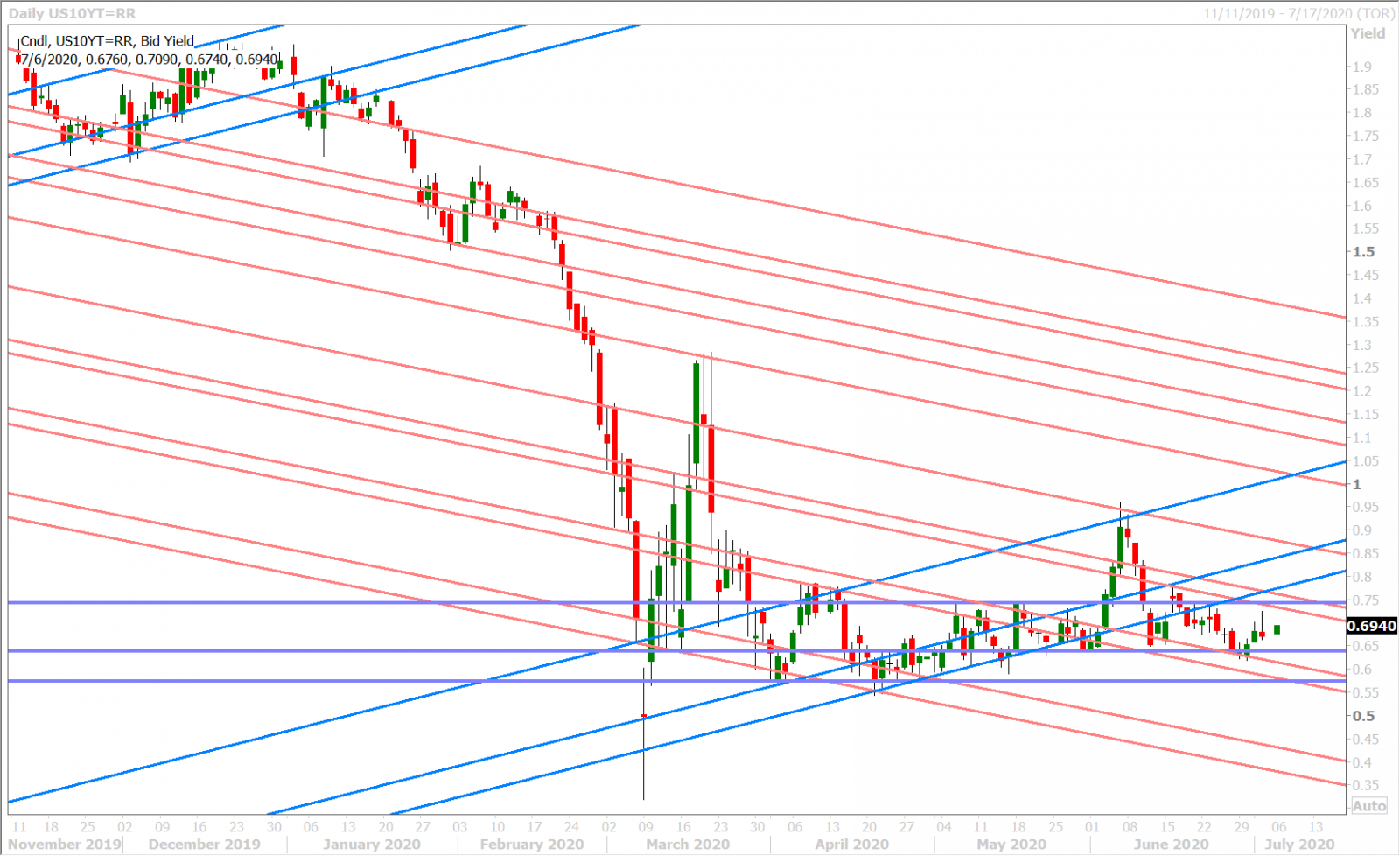

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com