China talks up further stimulus & US/China trade progress, but risk-on bid from Yuan strength now evaporating

Summary

-

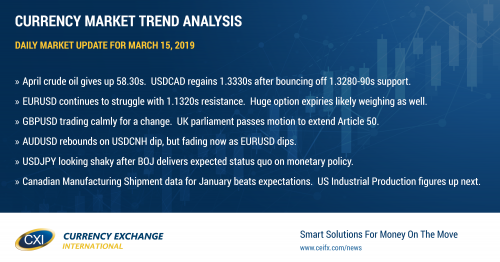

USDCAD: Dollar/CAD struggled to regain the 1.3330s yesterday amid a persistent bid to oil prices. This negative technical structure held into the NY close, which in turn invited some follow-through selling in Asian and early European trade today. Buyers have stepped up to the plate again however at yesterday’s trend-line support level in the 1.3280-90s and we’re now re-approaching the 1.3330s, but with more upward momentum. Canadian Manufacturing Shipments data for January showed a gain of 1.0% MoM vs expectations of +0.4%. Next up are the US Industrial Production figures for February at 9:15amET, where traders are expecting a read of +0.4% MoM. We’ll get an update on the net long USDCAD fund position at CME (as of March 12th) later today. The Bank of Canada’s Wilkins didn’t say anything new for markets in her speech last night (expects Canadian GDP to rise later this year, but still concerned about high level of Canadian household debt). With April crude oil prices now giving up near term support in the 58.30s and USDCAD now quickly regaining the 1.3330s, we think the market could easily continue its rally here today. Expect some hesitation at Fibo chart resistance in the 1.3370s.

-

EURUSD: Euro/dollar seems to be following the Chinese yuan again today, and the direction is slightly higher after Chinese officials talked up the “substantive” progress of US/China trade negotiations and announced more stimulus measures for the economy overnight (cut to the value-added tax on April 1st and increased infrastructure spending). This pulled USDCNH back below 6.7200, or the level the market broke above yesterday and appears to be leading to a better “risk-on” tone to markets this morning (S&Ps, copper, and AUD all up). EURUSD is still struggling with overhead chart resistance in the 1.1320s this morning however, and today’s sizable option expiries are not helping in our opinion (4.5blnEUR+ rolling off between the 1.1300 and 1.1325 strikes at 10amET). We think EURUSD probes the downside in search of buyers yet again today. We’ll get an updated read on the net short EURUSD fund position at CME (as of March 12th) later today.

-

GBPUSD: Sterling is doing a whole lot of nothing today, as traders appear fatigued with this week’s extreme market volatility. Yesterday’s motion to extend Article 50 (Brexit) for three months passed in the UK House of Commons, but this was expected by market participants. We’re now reading reports that Theresa May has scheduled yet another meaningful vote on her Brexit plan before parliament next Tuesday (this will be her 3rd attempt to get her deal passed). We don’t know honestly what positive changes can be achieved before then, considering the UK and EU are not talking. In our opinion, this feels more like another ploy to scare EU leaders into reconsider renegotiating better terms for the UK when the meet at next week’s EU summit in Brussels. Chart support today lies at 1.3210, then 1.3160-70. Resistance today is 1.3265, and then 1.3285.

-

AUDUSD: So it turns out yesterday’s upside breakout in USDCNH wasn’t for real, and therefore Aussie traders are buying the market back today. Chart resistance at the 0.7080s gave way in late Asian/early European trade today, but the market is giving this level up now as EURUSD recedes into NY trade. We think the market will continue to chop around current levels heading into the weekend.

-

USDJPY: Dollar/yen extended gains toward the 112 level leading into the Bank of Japan meeting last night, but then fell swiftly after the Japanese central bank kept all its dovish monetary policy measures in place as expected. Headlines about North Korea potentially suspending nuclear talks with the US added further pressure to the market, but buyers swooped in quickly to recover prices back above the 111.60 support level. We think USDJPY risks pulling back here should the 111.60s give way to the downside.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

April Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

May Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

June S&P 500 Daily

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com