Case Study: Enhance your foreign check clearing operations and see rapid results when you switch over to CXI

This case study is part of our case studies and resources series. For more insights from CXI visit our resources and news page. Contact us now to partner with CXI.

Customer

Country Club Bank (CCB) is a privately held, FDIC registered federal savings community bank located in the Midwest with over $2 billion in assets and approximately 25 full-service locations. Their primary focus is to create homegrown solutions that are tailored to meet the local needs of each of their customers.

Challenge

CCB was experiencing a labor-intensive manual processing environment along with lengthy processing times to clear foreign check items for their customers. CCB identified the foreign check clearing service as an opportunity to better service its clients’ needs with increased clearing speed and security while enhancing its operational efficiency and increasing fee income. This prompted CCB to seek a partner that could enhance the foreign check clearing process while increasing their revenue.

Solution

CCB partnered with CXI, an experienced provider that has an extensive track record in clearing foreign checks. CXI provided a streamlined platform with remote deposit integrations, robust compliance and reporting functionality, and smart bulk upload check identification tools. CXI’s onboarding team guided CCB through process design and system implementation to simplify their operations while growing their foreign exchange business safely and securely. With CXI, CCB receives comprehensive foreign exchange solutions with one provider, one platform. This gives CCB the ability to provide a high-quality service with an enhanced customer service experience for their clients.

Solution Specifics

Country Club Bank chose to partner with CXI, which is now their sole provider for clearing foreign checks. To start, CXI held discovery sessions with CCB to understand the bank’s existing challenges and future goals. CCB then leveraged CXI’s specialized foreign exchange experience and system capabilities to design a workflow that simplified their foreign check clearing process by reducing manual work, increasing information security, and speeding up clearing time. Upon implementation, CXI provided the CCB with its online platform, CXIFX, allowing the bank to easily scan or manually enter checks on cash letter or collections.

CXI quickly set up the online foreign exchange platform within three weeks and customized the system to match the workflow designed to achieve CCB’s goals. After launch, customer activity improved and feedback from both clients and staff was exceptional.

CCB personnel confirmed that the check clearing process with CXI’s platform was very simple and took minimal time to complete transactions. These are the solution specifics that were implemented for the customer:

1. Complete access to CXI’s online platform (CXIFX) to enter checks drawn on foreign banks:

- Enter checks through an automated platform to be sent to CXI for same day credit

- Scan checks to be processed by CXI saving on shipping costs and wait times

- Smart check identification rules for cash letter and collection routing

- Robust reporting capabilities for easy account management

- Numerous compliance components built-in for back office OFAC clearing

- Access to exchange rates to quote their customers daily

2. Added service for customers and new revenue stream:

- Ability to offer foreign check clearing to customers in a safe and secure environment

- Quicker access to funds being available

- Dedicated customer support team and account manager for continued success

- In a revenue share arrangement, the bank successfully captured additional revenue while offering their clients competitive pricing

?

Results

By partnering with CXI, the CCB is now scanning foreign checks directly into the CXIFX portal with increased efficiency to clear the items timely for their customers. By utilizing the scanning platform, employees’ processing time and overall shipping costs have been reduced. This, along with the fast turnaround time, has been noticed by clients who have provided very positive feedback about the full experience.

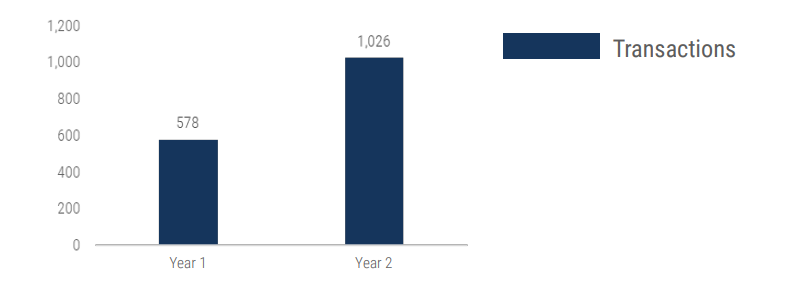

1,000+

CCB now exceeds 1,000+

foreign check clearing transactions annually

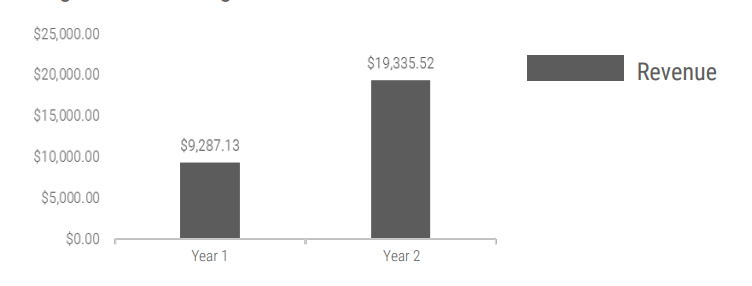

2x

Foreign check clearing revenue doubled in the first year of switching over to CXI’s services

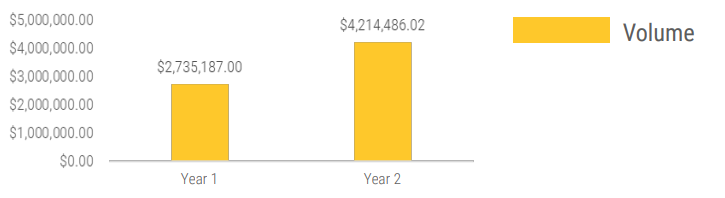

4.2mm+

Total volume of $4,214,486

annually processed in foreign check

clearing services

78%

Increase in total processed

Canadian checks

Customer Testimonial

“Country Club Bank moved to the CXI for our foreign and Canadian check processing. We learned about CXI when we were searching for a new foreign currency provider. After choosing CXI for that service, we learned they offered an imaging solution for our foreign check processing needs. Prior to this we sent these items to Atlanta via FedEx, a process that was far more time consuming.

Our implementation was simple; the team at CXI walked us through every step of the set-up and ensured all questions were answered and we were processing correctly. In our first full year with CXI, we processed 1,041 Canadian checks and we couldn’t imagine doing it the old way. This process is fast and easy.

The reports are readily available and easy to understand. There have rarely been issues arise but when they do, the team at CXI is very responsive. They have been so easy to work with and are 100% customer satisfaction driven.”

- CCB Deposit operations team

Foreign Check Clearing Transactions Year Over Year

Foreign Check Clearing Volume Year Over Year

Foreign Check Clearing Revenue Year Over Year

Foreign Check Clearing System Highlights

Smart Check Identification

An exclusive feature designed to automatically detect if a check should be processed on Collection or as a Cash Letter based on the financial institution's predetermined thresholds. This removes the user's need to identify the classification of the foreign checks.

Remote Capture

Start clearing US and Canadian dollar checks drawn on Canadian accounts digitally. Remote capture technology makes clearing these checks quicker, safer, and more secure. Reduce potential delays, errors, and shipping costs for the most common foreign checks financial institutions process in the US.

Compliance Verification System

Built into the core of the CXIFX system, the CVS enables the screening of specified fields against watch lists in all transaction types.

Live Rates

Receive a live rate for specific currency pairs during transactions and transfers.See our resources page >

Subscribe to currency insider >

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com

Streamline your Financial Institution's Foreign Check Clearing Process.

Streamline your Financial Institution's Foreign Check Clearing Process.