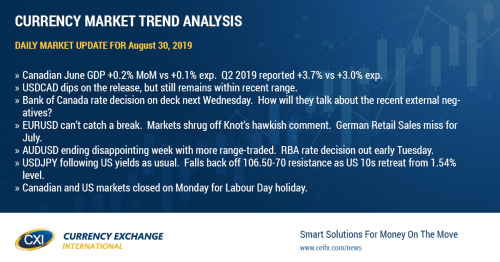

Canadian GDP for June beats expectations

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

USDCAD

Dollar/CAD has taken a leg lower here after Canada reported stronger than expected GDP growth for both June and Q2 2019. The figures came in at +0.2% MoM vs +0.1% expected, and +3.7% annualized for Q2 vs +3.0% expected. The market is now re-testing familiar chart support in the 1.3260s-70s, and we think the next stop could be 1.3230 should this level fail to hold. Odds are this doesn’t happen however as we think traders will be itching to leave early for the long weekend. Next week’s calendar will be eventful as we’ll get the RBA rate decision early Tuesday and then he first look at the state of US manufacturing for the month of August. The August employment reports for both the US and Canada will be announced on Friday. What is more, we’ll get the Bank of Canada’s latest decision on interest rates on Wednesday, which we think traders are eagerly anticipating because we haven’t heard anything out of the Canadian central bank for over six weeks now. So many negatives have occurred since July 10th (escalation of the US/China trade war, Fed rate cut, more yield curve inversions, increasingly depressing data out of Germany, etc). The Canadian 10s2s yield curve is also now more steeply inverted (-20bp) compared to where it was the last time they met (which is signaling recession). Therefore, we’re also very curious, and eager, to see how the Bank of Canada explains all this when talking about its forward outlook. We know they’re concerned about trade uncertainty (they’ve told us that already) and so we think the market’s reaction to Wednesday’s event will largely come down to how negative Stephen Poloz sounds. While we think he’ll be quick to point out the recent positives in the Canadian economy (on-trend CPI, steadier oil prices), we think there’s a good chance he will sound more negative (on balance) this time around when compared to July, and this tone could in turn sow the seeds for a “pre-emptive” rate cut on Oct 30th. We continue to believe that global central bankers are struggling to understand what’s going on in their respective bond/money markets and that’s because they’re not even considering, or can't see, the possibility that part of this rush into sovereigns may be coming from primary dealer banks (huge players in global bond markets) that may be hedging growing liquidity risks. Check out the Treasury TIC data. That being said, central banks never want to appear as if they’re “behind the curve” (especially now while they figure this out) and so we think the Bank of Canada might ultimately be forced down the same global rabbit hole of giving interest rate markets what they want for now (ie. insurance cuts). It looks like the OIS market will give the Bank of Canada a free pass next Wednesday (currently pricing just a 16% chance of a 25bp cut), but it still wants the Canadian central bank to cut at least once by year’s end.

USDCAD DAILY

USDCAD HOURLY

OCT CRUDE OIL DAILY

EURUSD

Euro/dollar just can’t catch a break. Some rather hawkish comments from ECB member Knot crossed the wires yesterday (MARKET EXPECTATIONS FOR ECB SEPT. DECISION ARE `OVERDONE) and while this caused a quick spike up in the market off its Christine Lagarde lows, traders were quick to hit the sell key again once EURUSD ran into familiar chart resistance at 1.1080-90. The market hugged trend-line support in the 1.1050s for the remainder of the day, and then slipped below the level in Asian trade last night. Some weak German Retail Sales data for the month of July (-2.2% MoM vs -1.0% exp) is now giving EURUSD another blow to the gut as we come to the end of a horrible week for the pair. We’ll get an updated read on how short EUR the leveraged funds are at 3:30pmET today when the CFTC releases its weekly Commitment of Traders Report. We think the funds have been late to adjust to the renewed downtrend in EURUSD ever since the market fell back below the 1.1300 level, and so we think they’re plenty of room for them to pile on new short positioning here (ie. catch up) without making their overall net short position look overextended.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

It’s been a sleepy month-end Friday for sterling this morning, with traders testing chart support in the 1.2160s and chart resistance in the 1.2190s. Expect volatility, and Brexit headlines, to pick up next Tuesday when the UK parliament returns from its summer recess.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The range-trade continues for the Australian dollar as traders wind up a disappointing week for the pair. Monday’s bullish outside day pattern (which stemmed from Lui He’s calming comments out of China) got us focused on a possible bottoming pattern for AUDUSD, but the market couldn’t get back above the 0.6780s by mid-week (important for confirming this pattern) and a slumping EURUSD has continued to been a negative drag on this market ever since. The Reserve Bank of Australia will announce its latest decision on interest rates early Tuesday, and while recent RBA member commentary has suggested that they stand ready to cut rates further “if needed”, the OIS market doesn’t think it needs to happen next week (odds of a 25bp cut to 0.75% sit at just 11%).

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

USDJPY DAILY

USDJPY HOURLY

US 10YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com