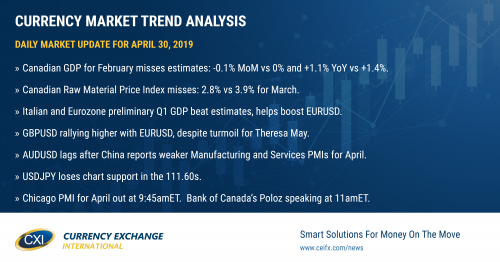

Canadian GDP contracts 0.1% MoM in February. Data helps to stem USDCAD selling

Summary

-

USDCAD: Dollar/CAD has gone offered this morning as EURUSD shoots higher during early European trade. We got some preliminary Q1 GDP figures out of Europe today and while the numbers weren’t stellar, they we’re bad either (+0.1% YoY growth vs -0.1% for Italy, and +1.2% YoY growth vs +1.1% for the Eurozone). If we combine this cautious optimism about Europe with yesterday’s weaker than expected read on personal consumption expenditures out of the US (+1.6% YoY vs +1.7%) and Friday’s softer inflation data in the Q1 US GDP report, we think we’re seeing USD longs take some chips off the table here ahead of the Fed. While we confess this EURUSD short covering is happening a little earlier than we expected this week, it’s hard to ignore the extent of broad USD long positioning here ahead of a Federal Reserve meeting tomorrow where hawkish monetary policy guidance is not anticipated. China reported weaker than expected PMI data for the month of April last night (50.1 vs 50.5 for Manufacturing and 54.3 vs 54.5 for Services) but the broader markets, with the exception of the Australian dollar, largely shrugged this off. June crude oil prices are bouncing 1.7% higher this morning after Saudi Arabia hinted that its oil output will be significantly lower than 10mln bpd until the end of May. Canada has just reported its GDP figures for the month of February and the numbers missed expectations (-0.1% MoM vs 0% and +1.1% YoY vs +1.4%). The Canadian Raw Material Price Index also missed estimates, coming in at 2.8% vs 3.9% for March. We think this negative data set from Canada may now finally give buyers some confidence to re-enter here, but we suspect they’ll want to see today’s broad USD selling abate a little bit first. Today’s chart support is 1.3430-40. The Chicago PMI numbers for April come out next at 9:45amET. The Bank of Canada’s Stephen Poloz will be speaking before the House of Commons Standing Committee on Finance at 11amET this morning.

-

EURUSD: The Euro is galloping higher this morning as traders appear to be breathing a sigh of relief when it comes to European data. Reuters is also reporting that today’s 10-yr BTP bond auction in Italy went well, allowing the nation to pay the lowest amount of interest in over a year. EURUSD is now testing chart resistance at the 1.1220s as NY trading gets underway today. We think we could see a quick move to the 1.1250-60s should this level give way. Today’s scheduled SOMA operations from the Fed (normally a EURUSD negative because of the USD liquidity being withdrawn from the credit markets) appears to be having no effect this time around. We think EURUSD cools off a tad here should the Chicago PMI not disappoint.

-

GBPUSD: The pound is going along for the ride today; rallying higher with EURUSD since the start of European trade. Nothing positive has crossed the wires today in terms of Brexit news. In fact, it’s been quite the opposite as Theresa May is now reportedly about to face an unprecedented challenge to her leadership from activists within the Tory party. More here. GBPUSD traders appear unwilling to fight the broad USD weakness this morning though, and have shot the market higher into chart resistance around the 1.2980s to 1.3010s. We think the market may now dial back some of overnight move higher.

-

AUDUSD: The Australian dollar was the only major currency that showed a sizable reaction to the weak Chinese PMI data out last night. After testing chart resistance in the 0.7060s, AUDUSD fell a quick 30pts following the release. The market has rallied half way back though since the start of European trade, as EURUSD marched higher, and we now sit waffling around a trend-line level in the 0.7050s.

-

USDJPY: Dollar/yen has broken down today, and the catalyst was the weak Chinese data overnight because the lower bound of chart support in the 111.60-80s gave way in the process. This has since seen sellers re-enter in USDJPY, which now continues the move lower following last Thursday’s bearish reversal on the charts. Support today lies in the 111.10-20s. We think the extended fund long position in USDJPY looks vulnerable here ahead of the Fed tomorrow as recent longs are now underwater (losing money).

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

June Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

May Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com