Canadian core Retail Sales for March smash expectations (+1.7% MoM vs +0.9%)

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

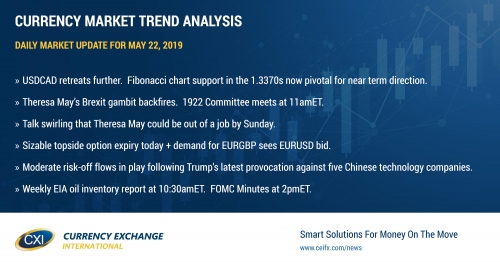

SUMMARY

- USDCAD retreats further. Fibonacci chart support in the 1.3370s now pivotal for near term direction.

- Theresa May’s Brexit gambit backfires. 1922 Committee meets at 11amET.

- Talk swirling that Theresa May could be out of a job by Sunday.

- Sizable topside option expiry today + demand for EURGBP sees EURUSD bid.

- Moderate risk-off flows in play following Trump’s latest provocation against five Chinese technology companies.

- Weekly EIA oil inventory report at 10:30amET. FOMC Minutes at 2pmET.

ANALYSIS

USDCAD

Dollar/CAD continues its decent lower this morning as the broader USD is being sold in Europe so far today. This comes despite some mild risk-off flows, which seemed to enter the fray after the US announced it would consider banning as many as five Chinese companies from working with American technology. The March Retail Sales figures for Canada were just released they smashed expectations on the core, ex-autos measure (+1.7% MoM vs +0.9%). The weekly EIA oil inventory report will be released today at 10:30amET as usual, and traders here are expecting a build of 8.2M barrels following last night’s 2.4M barrel build from the APIs. The Fed will be releasing the FOMC Minutes from its last policy meeting at 2pmET. We think this morning’s good Canadian data will keep the pressure on USDCAD, and we would not be surprised to see a move down to the 1.3330s should the 1.3370 not be reclaimed quickly.

USDCAD DAILY

USDCAD HOURLY

JUN CRUDE OIL DAILY

EURUSD

Euro/dollar has seen some buying in early European trade today despite a risk-off tone to equity and bond markets, and this appears to be flow related as over 1.5blnEUR in options expire at the 1.1180 strike this morning and demand continues for the EURGBP cross following Theresa May’s failed Brexit gambit yesterday. We think EURUSD could see some further buying here should chart support the 1.1160s hold today.

EURUSD DAILY

EURUSD HOURLY

USDCNH DAILY

GBPUSD

The pound continues to get pounded today as the political fall-out continues after Theresa May’s Brexit speech yesterday. While the trading algorithms initially liked the sound of a parliament vote on whether or not to hold a 2nd public referendum on Brexit, Theresa May said such a vote would still be dependent upon MPs accepting her Brexit plan. The Labour and DUP parties are fuming this morning, as are members of Theresa May’s cabinet (who were supposedly on side with her yesterday). The 1922 Committee is set to meet at 11amET and there is now rampant talk that these lawmakers will change parliamentary rules, which could allow for Theresa May to face another non-confidence vote as early as Sunday. GBPUSD has fallen swiftly off yesterday’s post speech highs around 1.2805-15 and has since plummeted all the way down to chart support in the 1.2630s. We’ve since seen some buying at that level, but we suspect these are shorts taking profits here more than anything else. The UK reported its April CPI figures this morning and they mildly missed expectations (+0.6% MoM vs +0.7%)

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Aussie is riding the coattails of EURUSD higher during early European trade this morning, but it’s nothing to write home about in our opinion. The lower bound of the Sunday opening gap (0.6860s) continues to hold, while chart resistance remains in the 0.6920s. We think AUDUSD likely consolidates with a bid tone here.

AUDUSD DAILY

AUDUSD HOURLY

JUL COPPER DAILY

USDJPY

Dollar/yen is pulling back moderately this morning as the S&P futures and global bond yields react to Trump’s latest provocation against five Chinese technology companies. Over 1blnUSD in options expire at the 110.25 strike this morning, which resides just below chart support in the 110.30s. While we’re not surprised to see USDJPY consolidate here, we think buyers will try to reemerge at some point and challenge the May 5th Sunday opening gap at 110.95-111.10.

USDJPY DAILY

USDJPY HOURLY

S&P 500 DAILY

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com