Broader USD bid ahead of US/China talks and Brexit extension decision from the EU.

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

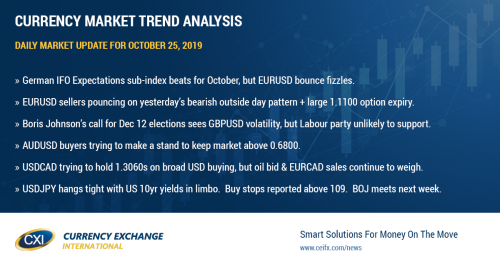

- German IFO Expectations sub-index beats for October, but EURUSD bounce fizzles.

- EURUSD sellers pouncing on yesterday’s bearish outside day pattern + large 1.1100 option expiry.

- Boris Johnson’s call for Dec 12 elections sees GBPUSD volatility, but Labour party unlikely to support.

- AUDUSD buyers trying to make a stand to keep market above 0.6800.

- USDCAD trying to hold 1.3060s on broad USD buying, but oil bid & EURCAD sales continue to weigh.

- USDJPY hangs tight with US 10yr yields in limbo. Buy stops reported above 109. BOJ meets next week.

ANALYSIS

USDCAD

Dollar/CAD is barely hanging on to trend-line support in the 1.3060s this morning and we think this is solely because the post ECB, IFO-driven, bounce in EURUSD has fizzled out. The persistent bid to December crude oil prices and continued EURCAD sales are not helping however. There’s nothing notable on the economic calendar today, and so expect traders to focus on today’s US/China trade talks surrounding the planned purchases of US agricultural products, Brexit headlines and market chatter surrounding the upcoming FOMC meeting next week. The October Fed fund futures are now pricing in a 90% chance the FOMC cuts rates by 25bp on Wednesday. The NYFed supplied 77.34blnUSD in additional liquidity to US primary dealers during this morning’s overnight repo operation.

USDCAD DAILY

USDCAD HOURLY

DEC CRUDE OIL DAILY

EURUSD

Traders bid farewell to Mario Draghi yesterday, but not without smacking EURUSD lower first. The ECB President defended last month’s decision to re-start quantitative easing and keep interest rates where they are for “as long as necessary”, and then went on defending his 8-year legacy of doing his best to fulfill the central bank’s mandates. The problem is that none of what the ECB has done has worked to spur inflation and growth in the Eurozone and we think the negative market chatter about Draghi’s legacy that followed the press conference reminded traders of just how bad things are in Europe right now. To claim that quantitative easing has been effective, to say negative interest rates have been a success, and to give Christine Lagarde the message of “never give up” is simply embarrassing and irresponsible in our opinion. Mario Draghi touched on the topic of issuer limits yesterday as well, but played it coy by saying there is “quite a bit of time” before QE limits become a problem and that it also depends on fiscal policy. The WSJ reported later in the day that the ECB will run out of Eurozone bonds to buy around the end of next year.

Today’s early morning bounce in EURUSD appeared to be driven by the better than expected reading for this month’s German IFO Expectations sub-index. While the German sentiment survey’s Current Conditions sub-index marginally missed expectations (97.8 vs 98.0), the forward looking component beat (91.5 vs 91.0). All this is unravelling now though as traders are talking about a 1.3blnEUR option expiry at the 1.1100 strike for 10amET. We think yesterday’s bearish outside day chart pattern is also a negative technical development for the market and should keep the sellers in charge heading into next week.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Sterling saw a bit of volatility in early afternoon trade yesterday after UK PM Boris Johnson said it’s now impossible to deliver legislation in parliament and that the time has come to call for a national election on December 12. This saw GBPUSD fall quickly below the 1.2800 level and the logic here is that an early election adds more uncertainty and will take the focus off fully passing Boris Johnson’s Withdrawal Agreement Bill, which parliament approved in theory (just not the details). The market quickly recovered however when Labour party sources suggested they wouldn’t vote for the election motion (which Johnson wants to table for Monday). The overnight headlines have also been focused on the EU, which has now agreed to a Brexit extension “in principle”, but not in terms of the duration. Bloomberg is reporting that EU diplomats will decide on the length of the Brexit delay by Tuesday next week. France is now said to only favor an extension to November 30. GBPUSD appears to be following EURUSD lower once again as we head into NY trade today. We think the sellers have the advantage here as well considering yesterday’s bearish outside day pattern, the fall below the 1.2870s, and negative momentum in EUR.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

It appears buyers are trying to make a stand here today in AUDUSD. The market managed to regain the 0.6810s support level in late Asian trade and while it got some help from EURUSD buying leading up to the German IFO release, it continues to hold half of its morning rally despite EURUSD giving up all of its gains. A softer USDCNH exchange rate seems to be helping a little bit today. Perhaps chalk this up to mild optimism ahead of today’s US/China trade talks where the Chinese will ask the US to remove further tariffs in exchange for 40-50bln/year of US agricultural purchases they agreed to verbally. We think the upside momentum from last week’s break above the 0.6800 hinges upon buyers making a stand here, and we think a NY close back above the 0.6830 level will do much to support that.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen is not doing much today, and we think this is largely a reflection of US 10yr yields which continue to stagnate just shy of the 1.77% chart resistance level. Reuters is reporting market chatter about sizable buy stop orders in USDJPY above 109.00-109.10 (which is logical given a move to that level would coincide with a break of topside chart resistance in the 108.80s). The Bank of Japan meets next Wednesday night/early Thursday morning (right after the Fed meeting). This week’s Bloomberg/WSJ stories about the BOJ possibly sounding more dovish, yet standing pat on policy changes, are get recycled a little bit today.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com