Boris Johnson asks the Queen to formally UK prorogue parliament

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

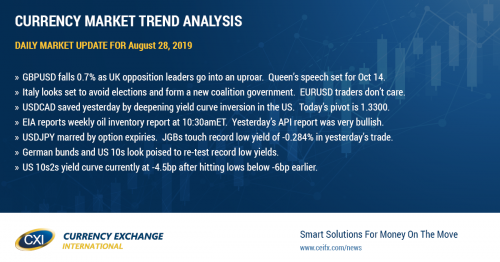

USDCAD

A deepening of the US 10s2s yield curve inversion saved USDCAD yesterday, and the move higher continues this morning as the widely followed recession indicator inverted as much as 6bp at one point in European trade. Trend-line chart resistance at the 1.3300 level has now become support, and while one could make the argument that yesterday’s move back above the 1.3260-70s technically puts the market back into a range-trade, buyers appear to have some momentum here heading into the US GDP report tomorrow and the Canadian GDP report on Friday. Yesterday’s “risk-off” tone to markets also saved EURCAD, with the popular CAD cross rate bouncing off trend-line support in the 1.4680s. Canadian dollar traders appear to be ignoring a late day rally to October oil prices yesterday for the time being, which seemed to be spurred by a combination of Hurricane Dorian angst and a very bullish oil inventory report from the API (-11.1mln barrels vs -2.1mln expected). The EIA will release its weekly oil inventory report at 10:30amET, but market expectations for a draw have now been ratcheted up to 8.5mln barrels after yesterday’s API report. We think the 1.3300 level will be today’s pivot for price action. Stay above and yesterday's buyers remain in charge, but creep back below and they’ll have an excuse to sell.

USDCAD DAILY

USDCAD HOURLY

OCT CRUDE OIL DAILY

EURUSD

Euro/dollar traders in a bad mood this morning. The Italian bond market is celebrating an agreement by the Democratic Party and the Five Star Movement to form a new coalition government (BTP/Bunds down to +170bp and the BTP yield itself now below 1.00% for the first time ever!), but the EURUSD market has seen no meaningful bid come in. Instead, traders are keeping the market confined to a narrow, trend-line support zone in the 1.1080-90s. This just goes to show, in our opinion, how weak European sentiment is right now. We think EURUSD could spill all the way back down to the 1.1050s should the 1.1080s give way.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Brexit headlines are stealing the limelight yet again this morning, but this time they’re negative and sterling is taking it on the chin as a result. UK Boris Johnson has formally asked the Queen to prorogue parliament from the second week of September (possibly Sep 10th) to October 14th (which he’d now like to set as the date for the Queen’s speech and the launch of what he calls his “very exciting agenda”). UK opposition leaders are in an uproar this morning as they claim this would give them less time to debate Brexit and stop a “no-deal” outcome if push comes to shove, and the media is having a hay day with these headlines. We would remind readers though that the UK parliament normally takes a recess around this time of year anyways so that MPs can attend their annual party conferences (see here) and so Boris Johnson is really just talking about a few more days off on either end of the pre-scheduled Sep 14 – Oct 9 recess. The UK PM said that lawmakers will have “ample time” to debate Brexit and that they’ll be able to vote on the new government’s overall program on Oct 21/22. Boris Johnson is staunchly defending his attackers this morning, who are now threatening a vote of no-confidence against the government next week, saying that it is “completely untrue” that he’s trying to suspend parliament because of Brexit. GBPUSD fell all the way back down to chart support in the 1.2160s after these headlines came out but it has since bounced higher to test yesterday’s trend-line support (now resistance) just above the 1.2200 level. We’re not so sure what the fuss is all about regarding today’s headlines, but this does technically raise “no-deal” Brexit risks a little bit. We think it’s time for more positive comments from Germany’s Angela Merkel, don’t you?

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

So the Aussie never made it above the 0.6780s yesterday; in fact it couldn’t even get back into the 0.6770s for any meaningful length of time. Yesterday’s deepening US yield curve inversion spooked global markets once again, and with that we saw the broad demand for USD which we normally see. Some buyers have emerged in European trade today, but they haven’t been able to make much headway. We think there’s still a chance AUDUSD follows through with Monday’s bullish outside day pattern, but we think EURUSD needs to bounce strongly back above the 1.1080s here in order for that to happen.

AUDUSD DAILY

AUDUSD HOURLY

SEP COPPER DAILY

USDJPY

Dollar/yen is trading very quietly so far today, with the market not really doing anything since yesterday’s option expiry at the 106.00 strike. An $1bln USD option expiry at 105.80 will likely kill volatility again this morning. The US 10yr note yield looks poised to test Monday’s lows below 1.45% this morning as the German bund yield revisits its depths below -0.70%. We think USDJPY can coast side-ways here so long as US treasuries and bunds can hold their recent lows. The JGB yield is bouncing slightly today after re-testing its record low -0.284% yield in yesterday’s trade. We still haven’t heard anything from the BOJ with regard to JGB yields trading below the central banks yield curve control threshold of -0.20%. This is more "proof is in the pudding" in our opinion that central bankers worldwide are deathly afraid of going up against their respective bond markets right now.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD VS US 2YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com