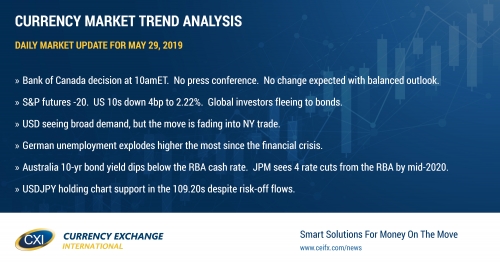

Bank of Canada rate decision in focus for USDCAD traders, with risk aversion flows supporting

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

USDCAD

Dollar/CAD traders are teasing the upper bounds of the May price range this morning (1.3500) as another bout of risk aversion hits the S&P futures and oil prices ahead of the latest Bank of Canada rate decision at 10amET. We continue to believe that the central bank will happily reference the recent improvement in Canadian data but they’ll be forced to acknowledge that global trade uncertainty and oil prices (two things they said they were openly looking at) have deteriorated since the last meeting. The chart structure for the market remains positive in our opinion so long as USDCAD stays above 1.3460, and so we think any cautious/patient tilt to the tone of the press release could see traders chase the market higher. Note there won’t be a press conference this time around where Stephen Poloz typically clarify things and answers questions. The first Bank of Canada speaker that we’ll hear from this week will be deputy governor Wilkins, when she speaks before the Calgary Chamber of Commerce on Thursday.

USDCAD DAILY

USDCAD HOURLY

JUN CRUDE OIL DAILY

EURUSD

Euro/dollar is trading on the backfoot this morning after the market closed below trend-line support in the 1.1170s yesterday. Today’s broad risk-off tone to markets doesn’t appear to be helping either, as European equity traders fret about a US/China trade war that could now Chinese involve rare earth minerals, growing tension between Italy and the EU, an inverted yield curve in Australia, and the German employment report for May (which saw the unemployment rate tick up for the first time since Nov 2013 and unemployment explode higher by 60k). USDCNH tried to rally and hold gains above the 6.9300 level earlier today (which is EURUSD negative), but this move appears to be petering out heading into NY trade. Italian BTP yields have calmed down so far today (which is EURUSD supportive). We think some EURUSD shorts might cover here at trend-line support in the 1.1150s should they not see follow-through to the downside. We’re also watching gold prices as well to see if any further selling below 2781 in the S&Ps sparks demand for precious metals and the EUR.

EURUSD DAILY

EURUSD HOURLY

USDCNH DAILY

GBPUSD

The British pound is leaking lower this morning as yesterday’s NY close was lackluster. Traders extended the market further south to chart support in the 1.2620-30s overnight, and we’ve since seen some buying come in at that level. The EURGBP cross is trading steady this morning, but continues to hold chart support at 0.8800. We think GBPUSD could see some short covering here as well, should EURUSD bounce.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

There’s a whole lot of nothing going on with the Aussie so far today, as price remains largely confined to yesterday's 0.6915-0.6935 range. Traders appear to be shaking off headlines that Australia’s 10yr yield has dropped below the RBA cash rate, as well as JP Morgan’s bold call for four 25bp rate cuts from the RBA by mid-2020. July copper is back in sell mode today, following the risk-off trade lower to the tune of 1%. We think the market’s ability to hold up despite the negative headlines is quite impressive, and we think the entrenched AUDUSD fund short position (which has grown steadily over the last 5 weeks) may have to re-evaluate should we see a move above the 0.6930s.

AUDUSD DAILY

AUDUSD HOURLY

JUL COPPER DAILY

USDJPY

Dollar/yen is holding chart support in the 109.20 quite well this morning, despite a late day plunge in the S&P futures below the 2806 level yesterday and continued selling overnight. The US 10yr yield is trading at a new 2-year low this morning as global investors flee into bonds across the board. Germany’s bund now yields -0.167%, Japan’s JGBs are flirting with a new 3-year around -0.10%. The value of negative yielding debt globally is now approaching 11 trillion dollars, according to Bloomberg. We think USDJPY’s ability to hold chart support here is quite impressive as well, but we wouldn’t get too excited about it until the global risk aversion wave abates. For the time being though, we think the risk for USDJPY remains to the downside. The BOJ's Kuroda spoke last night, but didn't say anything notable on the monetary policy front.

USDJPY DAILY

USDJPY HOURLY

S&P 500 DAILY

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com