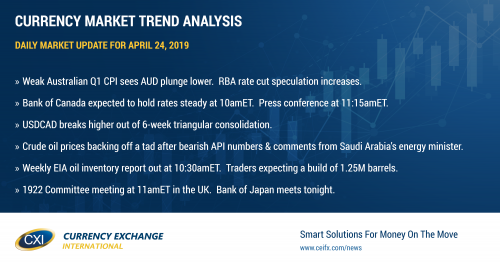

Australian CPI disappoints. Bank of Canada rate announcement up next at 10amET.

Summary

-

USDCAD: Dollar/CAD is trading with a bid tone this morning as the Australian dollar suffers and crude oil prices pull back a tad. Australia reported weaker than expected CPI figures for Q1 2019 overnight and this led broad USD buying in Asia overnight. June crude oil prices are pulling back 0.5% so far today after last night’s API report showed a larger than expected build in weekly oil inventories and after Saudi Arabia’s energy minister Khalid al-Falih said he sees no need to raise oil output immediately after the US ends waivers granted to buyers of Iranian crude (prefers to wait and see as global inventories continue to rise). It’s Bank of Canada Day today for USDCAD traders, with the Canadian central bank set to announce its latest hold on interest rates at 10amET, followed by a press conference at 11:15amET. We continue to believe there’s a risk that Stephen Poloz sounds more dovish than expected. We expect the governor to acknowledge recent improvements in oil prices, core CPI, retail sales, and employment, but we suspect that we’ll also get soundbites about the most recent weak Business Outlook Survey and decelerating global growth (which he acknowledged in early April as starting to affect Canada). From a technical perspective, the USDCAD market has broken out to the upside after yesterday’s break above 1.3410 and a 6-week triangular consolidation of prices. Since this breakout has occurred a little earlier than we expected, we would not be surprised to see the market toy with recent fund longs when the announcement comes out (perhaps a spike lower to the 1.3390-1.3400s initially to see how strong their conviction really is). After that though, we think we’ll need to see a headline that is fundamentally more cautious than expected in order to drive the market to new highs for the month here. There is not much in terms of major resistance on the daily USDCAD chart above the 1.3450-60s right now, and so that would suggest an easy path higher for the market should the Bank of Canada deliver dovish soundbites.

-

EURUSD: Euro/dollar had a very choppy overnight session today; trading above chart support in the 1.1220s into early Asia, spiking lower after the weak German IFO survey, rallying back above the 1.1220s shortly thereafter, and now receding once again as NY trading gets underway. Germany reported its April IFO survey below expectations on all three metrics (Business Climate, Current Assessment and Expectations). Dollar/yuan is struggling with the 6.73 level today, which we didn’t think would be a roadblock (but indeed it seems to be). The US economic/central bank speak calendar is going to be light again today and so we think EURUSD may very well chop around current levels today. We think the fund short position will continue to feel comfortable so long as prices stay below the 1.1250s.

-

GBPUSD: Sterling is bouncing again this morning, but from much lower levels after yesterday's broad chase for dollars (on China stimulus concerns) saw the market plunge lower. Trend-line support in the 1.2920s has proven to be strong line in the sand so far today. The 1922 Committee is set to meet today at 11amET, and the speculation is that they will try to find a way to change Tory party rules to allow for a 2nd no-confidence motion against Theresa May. More here from the Guardian.

-

AUDUSD: The Australian dollar is getting pummeled today and it’s all happening because Australia reported weaker than expected CPI figures for the Q1 2019 overnight. The QoQ numbers came in at flat vs +0.2% expected, and the YoY numbers came in at +1.3% vs +1.5% expected. This has now ratcheted up speculation that the Reserve Bank of Australia may cut interest rates (50% odds now) at it’s next meeting on May 7. Odds of a July interest rate cut have shot up to 80%. The market has sliced through yesterday’s chart support in the 0.7080s, and has quickly made a bee line for the next major support level in the 0.7020s. Given the considerably negative technical developments that have occurred on the AUDUSD so far this week, we think the leveraged fund net short position will feel increasingly comfortable here. Australian markets will be closed tonight in observance of ANZAC Day.

-

USDJPY: Dollar/yen has been struggling immensely in the past 24hrs. A surge in the US stock market yesterday to new 2019 highs (on the back of good corporate earnings results) did absolutely nothing for USDJPY. Perhaps there’s some angst in the marketplace or a desire not to add to position length ahead of the Bank of Japan policy announcement, which is scheduled for later in the Asian trading session tonight. We think the BOJ keeps its dovish monetary policy measures in place as usual and doesn’t rock the boat with regard to its cautious economic outlook for Japan.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

June Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

May Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com