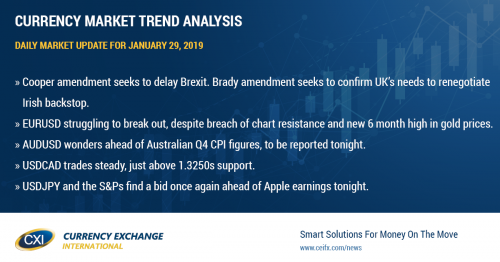

Brexit in focus once again today. UK Parliament to vote on key amendments at 2pmET.

Summary

-

USDCAD: Dollar/CAD is not doing much of anything this morning as the broader USD trades quietly. Yesterday’s extended bounce higher, on the back of falling crude oil prices, got capped out at chart resistance near 1.3290, and we’ve since been gyrating between two trend-lines (1.3250s and 1.3270s). Today’s calendar is going to be light once again, which will leave traders focused on oil prices and the broader USD once again. March crude is regaining half of yesterday’s losses this morning (+1%) after the US slapped a de facto ban on Venezuelan oil yesterday. We think USDCAD could drift back up to yesterday’s highs again should the 1.3250s hold; otherwise expect another retreat into the low 1.32s should the support level give way.

-

EURUSD: Euro/dollar broke above trend-line resistance in the 1.1420s yesterday, but we didn’t get the follow-through burst of buying that one might expect when a key upside level gives way. European traders tried again to push higher this morning when gold prices broke out to new 6 month highs, but we’re still not seeing the kind of positive momentum that would encourage EUR buyers to chase. One could make the argument that the market has already priced in a dovish FOMC meeting for tomorrow, and so the USD bears may not want to get ahead of themselves here. We think EURUSD risks pulling back here. USDCNH is trading steady, just shy of chart resistance in the 6.7550s. A break back above would be EURUSD negative.

-

GBPUSD: Sterling will be the center of attention for FX traders today as the UK parliament votes on a series of amendments to Theresa May’s statement on the defeat of her Brexit bill. More here. The latest headlines suggest that the Labor Party is pushing for the Cooper amendment, which if passed will force the government to extend Article 50 (delay Brexit), whereas Theresa May is pushing for the Brady amendment, which she’s hoping will give her some bargaining power when she re-engages Brussels on the Irish backstop. Voting is expected to commence around 2pmET. GBPUSD continues to coast around yesterday’s familiar levels. Support 1.3140-50. Resistance 1.3170s. We think the Cooper amendment (should it pass) will be more positive for GBPUSD in the near term.

-

AUDUSD: The Aussie is wondering around this morning after a slight decline in prices following last night’s disappointing Australian NAB survey was cancelled out by some upbeat talk from the RBA’s Harper. More here. Support in the 0.7150s held prices after the NAB’s December “business condition” sub-index came in at just +2 vs +11 in the prior month. March copper prices are bouncing +0.9% higher this morning, which ought to help AUD but trend-line resistance in the 0.7170s is capping right now for AUDUSD. We think the market will follow EURUSD here, at least until tonight’s data. Australia reports its Q4 2018 CPI figures tonight at 7:30pmET, with traders expecting +0.4% QoQ and +1.7% YoY.

-

USDJPY: Dollar/yen is trying to regain its composure this morning after yesterday’s swift US stock market selloff pulled the market below chart support in the 109.40s. It’s all about the earnings season right now for US stocks, and yesterday’s news from Nvidia and Caterpillar about a slowdown in China is what ruined the mood initially. The S&Ps have since inched back above their NY close at the 2640 level, which is helping USDJPY regain the 109.40-109.70 range, but traders will have the Apple earnings release to brace for after the bell today. The decision by the US to formally charge Huawei yesterday with bank fraud is quite remarkable considering the resumption of trade talks with China tomorrow, but US equity traders appear to be shrugging this news off.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

March Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

March S&P 500 Daily

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com